Year-end review: Where is the 6.4% deficit rate in the United States heading?

In 2024, the U.S. fiscal deficit rate rises to 6.4%, with federal government spending reaching $6.8 trillion and revenue at $4.9 trillion, resulting in a deficit of $1.8 trillion. Government debt grows to $35.5 trillion, accounting for 120.7% of GDP. Major expenditures include Social Security, healthcare, and defense. Fiscal revenue increases by 10.8%, with both corporate income tax and personal income tax rising. Musk has pledged to cut the budget by $2 trillion, but achieving this is quite challenging

In 2024, the United States will have another year of expansive fiscal policy:

-

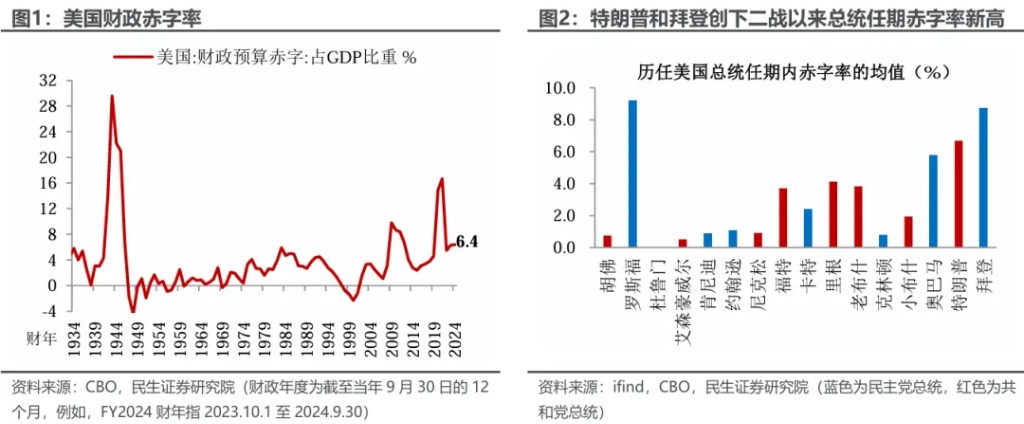

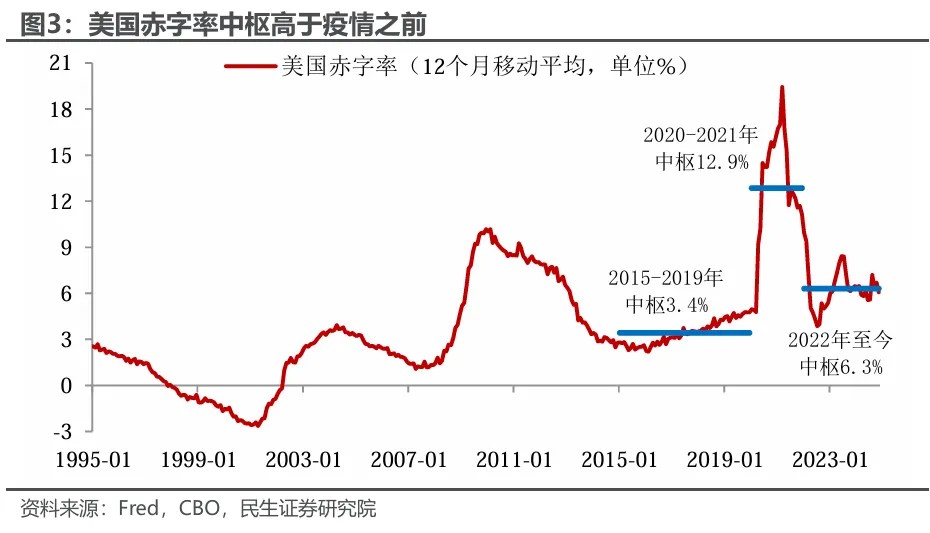

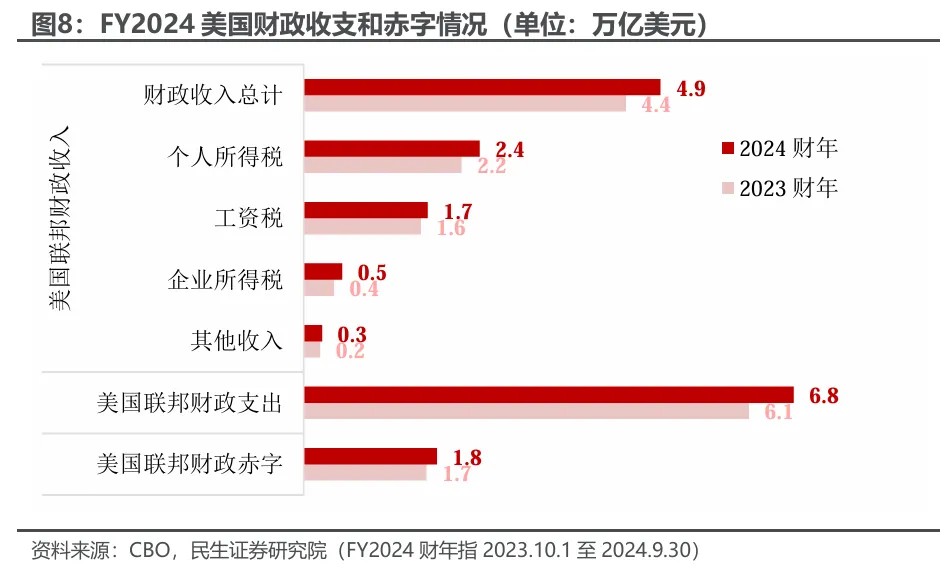

The deficit rate further rises to 6.4%. According to data released by the Congressional Budget Office (CBO) in November, for the fiscal year 2024 (from October 1, 2023, to September 30, 2024), federal government spending is $6.8 trillion, revenue is $4.9 trillion, and the fiscal deficit is $1.8 trillion, with the deficit rate further rising to 6.4%.

-

Government debt grows to $35.5 trillion. As of the end of September 2024, the total federal government debt is $35.5 trillion, accounting for 120.7% of GDP, an increase of 2.1 percentage points from the previous fiscal year. In just the fiscal year 2024, debt increased by $2.3 trillion (equivalent to the GDP of the 8th largest economy in the world).

As the economy that "spends" the most, will the U.S. continue to have high deficits in 2025, or will it shift towards tightening? We analyze the structure of U.S. fiscal spending to observe some clues.

Where is the U.S. government's money going in fiscal year 2024?

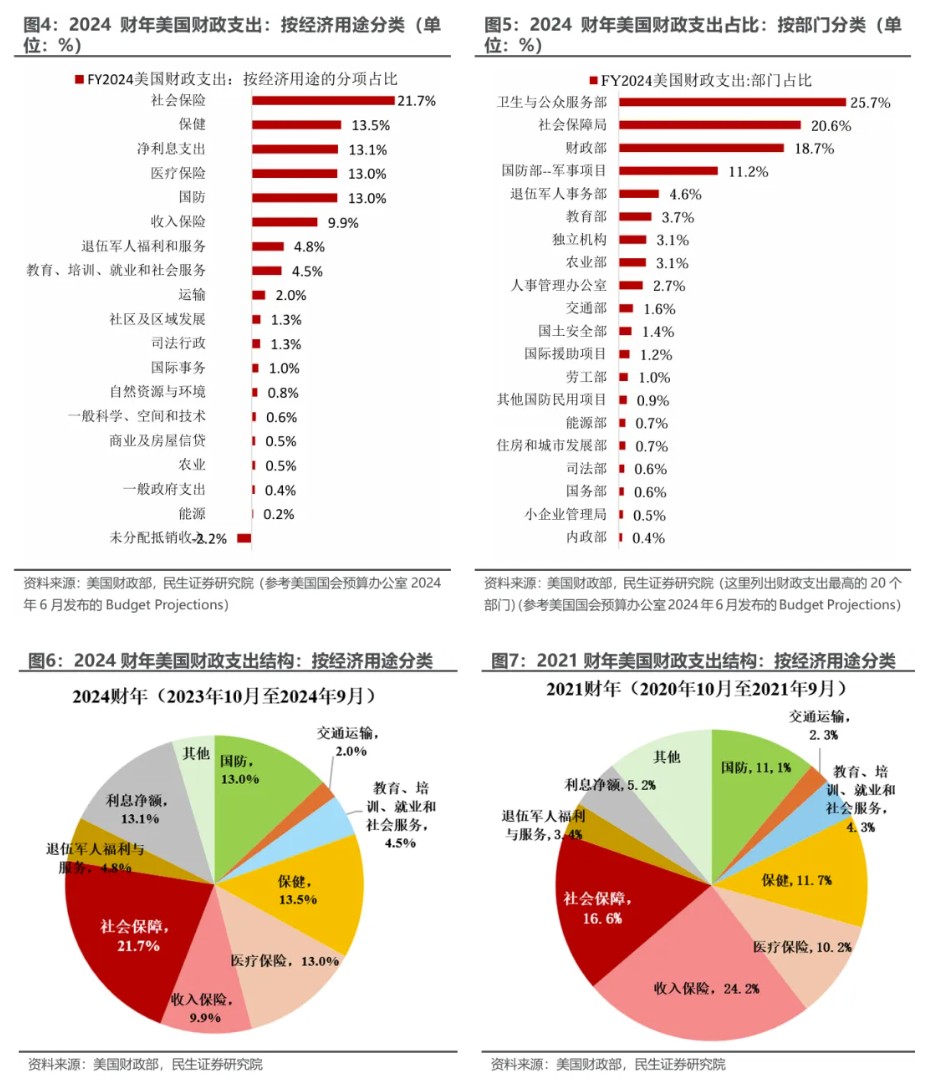

By economic purpose (Figure 4), Social Security remains the largest expenditure (21.6%), followed by healthcare, net interest payments, Medicare, and defense. Net interest payments have significantly increased by 33.7% compared to the previous fiscal year, squeezing other discretionary spending items. Compared to fiscal year 2021 during the pandemic (Figure 6), the job market is healthy, and current income insurance expenditures have significantly declined.

By government department (Figure 5), the Department of Health and Human Services, Social Security Administration, Department of the Treasury, Department of Defense, and Department of Veterans Affairs are the top spenders. The Treasury Department's spending increased by 18.3% year-on-year, mainly due to the substantial growth in net interest payments; the Department of Energy's spending surged by 31.6%, reflecting Biden's support for new energy projects.

How is the U.S. government's revenue in fiscal year 2024? The U.S. fiscal revenue for fiscal year 2024 is $4.92 trillion, an increase of 10.8% compared to FY2023. Corporate profits have risen, and corporate income tax revenue has increased significantly by 26.3%; individual income tax and payroll tax have increased by 11.5% and 5.9%, respectively

Is the “Department of Government Efficiency” goal of cutting $2 trillion in spending realistic?

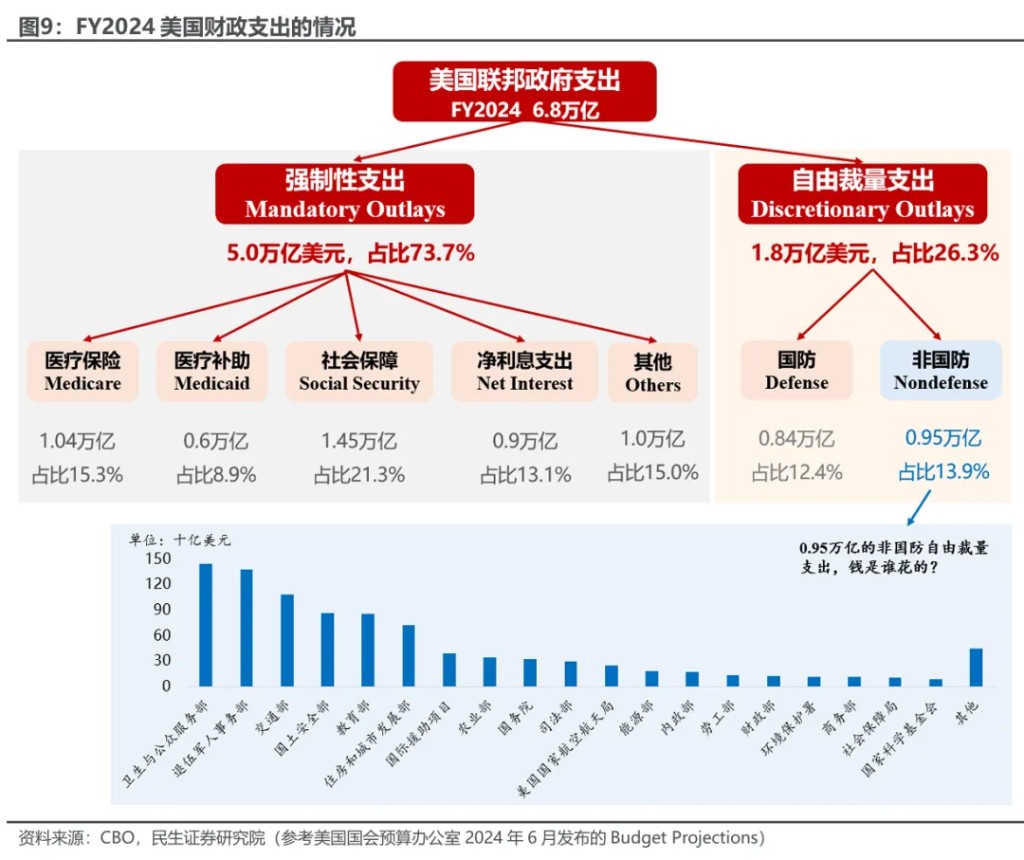

Elon Musk, head of the “Department of Government Efficiency (DOGE),” has promised to cut the budget by $2 trillion (nearly 30% of the $6.8 trillion in spending). Analyzing from the two major categories of fiscal spending (Figure 9), saving $2 trillion is quite challenging.

The first category is mandatory spending, which accounts for about 74% of federal government spending.

Mandatory spending includes Medicare, Medicaid, Social Security, net interest payments, retirement benefits for veterans, and federal employee salaries. As the population ages, the proportion of healthcare and social security spending is expected to rise; cutting healthcare spending is also quite difficult. Musk has also proposed reducing the number of government agencies by 75%. While layoffs can reduce employee salary expenditures, this is only a small part of mandatory spending.

The second category is discretionary spending, which accounts for about 26% of federal government spending.

Discretionary spending is divided into defense and non-defense categories, accounting for approximately 47% and 53%, respectively. The targeted cuts are expected to focus on non-defense discretionary spending, such as natural resources and environmental spending, education and training spending, and community development spending.

What to expect for the U.S. deficit rate in 2025?

Negotiations on the debt ceiling will restart in 2025. On December 27, Yellen stated that “the debt ceiling could be reached as early as between January 14 and 23, 2025, triggering ‘extraordinary measures.’” The debt ceiling issue may constrain fiscal spending in the first half of the year; once a new debt ceiling agreement is reached, fiscal space will open up.

Despite the incoming Treasury Secretary Bessent's commitment to significantly reduce the deficit, we still expect the deficit rate in 2025 to be difficult to cut, likely around 6.2%-6.5%; the proportion of net interest payments in the fiscal spending structure will further increase, continuing to squeeze discretionary spending.

Author of this article: Pei Mingnan S0100524080002, Tao Chuan, Source: Chuan Yue Global Macro, Original Title: “Year-End Review: Where is the 6.4% Deficit Rate in the U.S. Heading?” (Minsheng Macro Pei Mingnan)

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investing based on this is at your own risk