Korean stocks "collapse," a massive influx of South Korean retail investors rushes to U.S. stocks

截至 2024 年底,韩国投资者对美股的持有量达到了创纪录的 1121 亿美元,同比增长 65%。分析称,随着国内政治动荡加剧、特朗普的贸易威胁,韩国散户对美股的转向可能进一步加剧。

韩国散户投资者纷纷涌向美股市场,看好特朗普的第二个任期下的股市前景。

根据韩国证券存管数据,截至 2024 年底,韩国投资者对美股的持有量达到了创纪录的 1121 亿美元,同比增长 65%。

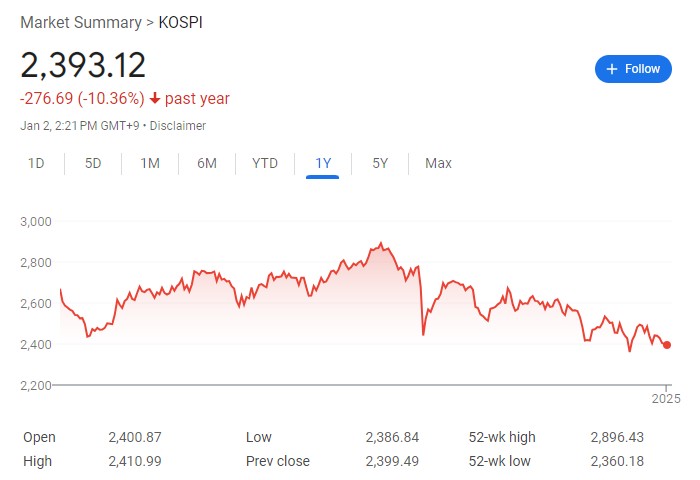

这一变化也反映出韩国投资者对本国股市长期低迷表现的失望。在韩股市场上,韩国投资者净卖出了 54 万亿韩元(约合 36 亿美元),导致韩国综合股价指数过去一年来累计下跌了约 10%。

公开数据显示,过去十年来,韩国股市的年化总股东回报仅为 5%,远低于日本的 10%和美国的 13%。并且,韩国上市公司中的破净比例相当高,达到约三分之二。面对这种情况,许多被称为 “蚂蚁” 的散户投资者(约 1400 万人)开始寻求更高的海外回报。

在韩国投资者的海外股票投资中,特斯拉成为了最受欢迎的股票。截至上个月,韩国散户持有的特斯拉股票价值达到 245 亿美元,紧随其后的是英伟达和苹果,持仓市值分别为 121 亿美元和 49 亿美元。

韩国企业治理论坛负责人 Namuh Rhee 表示:

“这一转变突显了投资者对本土股市糟糕回报的失望。”

“展望未来,除非发生重大变化,否则这种趋势可能还将持续。”

有分析称,随着国内政治动荡加剧,韩国散户对美股的转向可能进一步加剧。

上个月,韩国国会对总统尹锡悦进行了弹劾,增加了市场的不确定性;与此同时,特朗普当选美国总统,增加了对贸易关税提高和韩国电池生产商补贴减少的担忧,使得对本土市场的悲观情绪愈演愈烈。

为了提振疲软的股市,今年年初,韩国开始推动 “韩特估”,公布了类似日本的 “企业价值提升计划”,旨在通过包括税收优惠在内的激励措施支持股东回报。

然而,自 2 月份该计划推出以来,仅有 3.9%的上市公司表示将参与。许多投资者对该计划的有效性表示失望,认为缺乏强有力的措施使得其效果大打折扣。

分析人士认为,韩国股市估值低迷主要归咎于旨在保护大型家族企业的原始股东、牺牲少数股东利益的法律和监管框架。