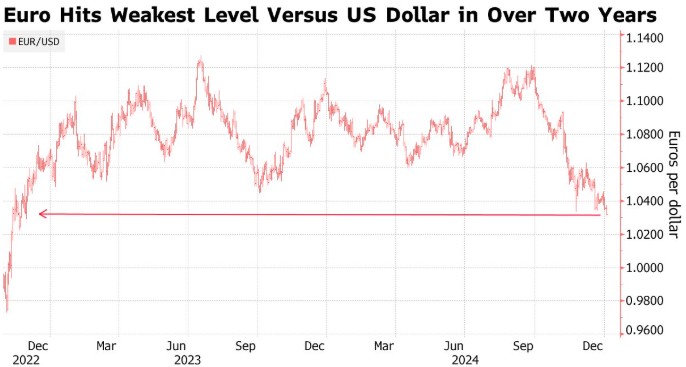

The divergence in economic and interest rate outlooks between Europe and the United States is widening, with the euro hitting a two-year low against the dollar

The euro to US dollar exchange rate has fallen to its lowest point since 2022, as the market is concerned about the divergence in the European economy and monetary policy. The euro dropped 0.4% to 1.0314, marking an 8% decline since the end of September. Analysts expect the euro may fall to parity in the second quarter, influenced by political instability in Germany and France and expectations of interest rate cuts by the European Central Bank. The British pound is also under pressure, falling to its lowest level since May

According to Zhitong Finance, the euro to US dollar exchange rate has fallen to its lowest level in over two years, as the market is concerned about the European economy and the divergence in monetary policy with the United States. As of the time of writing, the euro has dropped 0.4% against the dollar to 1.0314, the lowest level since November 2022, with a decline of about 8% since the end of September. The performance of the British pound has also lagged behind other major currencies, falling to its lowest level since May.

The euro has been declining due to concerns that the region's export-oriented economies will be hit by US trade tariffs, and that the European Central Bank's rate cuts will exceed expectations from the Federal Reserve. Political instability in Germany, the eurozone's largest economy, and France has also added pressure to the euro.

Jane Foley, head of foreign exchange strategy at Rabobank, stated, "For Germany and France, the weak growth outlook is intertwined with political uncertainty and expectations that the European Central Bank may announce more consecutive rate cuts in the spring." She expects the euro to fall to parity with the dollar in the second quarter.

Many strategists expect the euro to fall to parity with the dollar this year, or even lower. The last time it broke this key psychological barrier was in 2022, when the Russia-Ukraine war fully erupted, triggering an energy crisis in Europe and raising concerns about an economic recession.

On Thursday, the interruption of natural gas supplies from Russia to Europe via Ukraine reminded traders of the EU's previous energy dilemmas. This means that Central European countries will be forced to procure more expensive gas from elsewhere, increasing supply pressure as the region depletes its winter gas inventories at the fastest rate in years.

European Central Bank President Christine Lagarde stated in her New Year's address that the 2% inflation target remains in sight. Consumer price growth in the eurozone slowed last year, falling below the European Central Bank's target in September, although it has rebounded in recent months.

Due to concerns about the growth prospects of the UK economy, the pound also faced pressure on Thursday. The pound performed the worst among the G10 currencies, falling 0.7% against the dollar to 1.2435.

Foley from Rabobank stated, "Weak growth is a common issue for Germany, France, and the UK, and concerns about recession have intensified after the UK releases weak GDP data at the end of 2024."

The UK's GDP remained flat in the third quarter of 2024, and the Bank of England does not expect any growth in the fourth quarter of last year. This lackluster economic performance stands in stark contrast to the first half of last year, when the UK's economic growth rate was among the fastest in the G10