Using history as a mirror, January will "determine" the trend of the US stock market this year

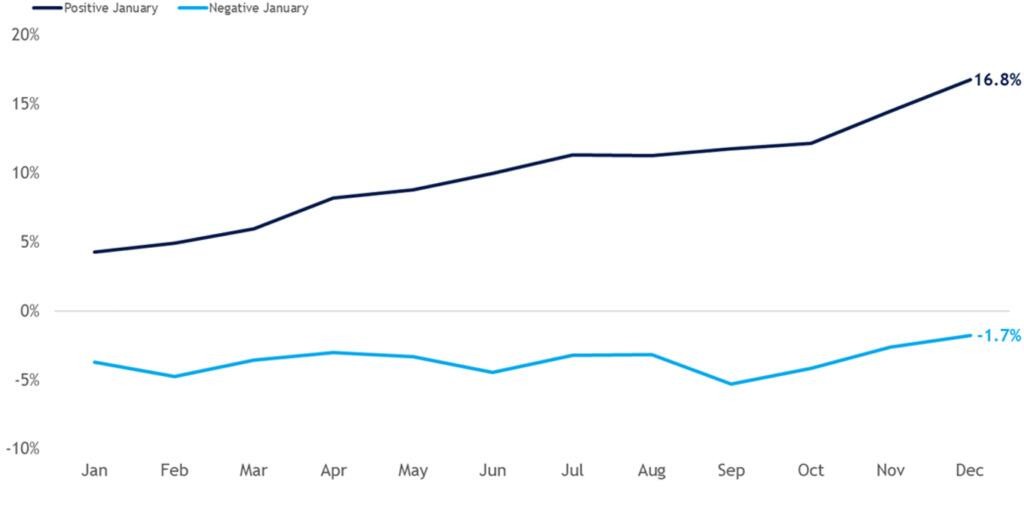

January has traditionally been a barometer for the U.S. stock market. Historically, a rise in January is a bullish signal for the market. Since 1950, in years when the S&P 500 index performs strongly in January, there is an 89% probability of generating positive returns, with an average annual return of 16.8%. In contrast, when the index declines in January, only 50% of the years see an increase, with an average return of just -1.7%

January has traditionally been a barometer for the U.S. stock market. Historically, an increase in January is a bullish signal for the stock market.

Since 1950, in years when the S&P 500 Index performs strongly in January, there is an 89% probability of generating positive returns, with an average annual return of 16.8%.

In contrast, when the index declines in January, only 50% of the years see an increase, with an average return of just -1.7%.