Consumer Insights | New Retail War: RT-Mart to the Left, Sam's Club to the Right

The year of delivery for traditional and emerging retailers

In the retail sector at the beginning of 2025, two major events occurred, symbolizing that the new retail war has reached a mid-game stage with intensifying competition.

One is Alibaba's announcement to sell all shares of China's largest supermarket, SUNART RETAIL, with a selling price not exceeding HKD 13.138 billion. From the acquisition in 2017 to the completion of control in 2020, Alibaba's cumulative investment was:

“HKD 50.4 billion.”

Source: Alibaba announcement

Source: Alibaba announcement

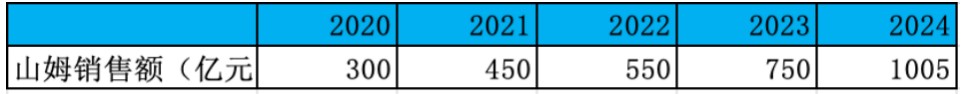

The other is the new retail giant Sam's Club, which disclosed its latest achievements for 2024, with total omni-channel sales exceeding 100 billion, reaching 100.5 billion. Among them, online sales accounted for over 48%.

The Chinese consumer market can be described as "ice and fire," with some sinking and exiting while others are surging forward. Behind the starkly different business models lies a deep confrontation between old and new industrial forms.

Traditional enterprises are sinking to the left; emerging enterprises are innovating and rebirthing to the right.

Tripling in 5 Years

Although the retail sales data is mediocre and the "consumption downgrade" sentiment is rising, the strong never complain about the environment. Sam's Club China proves with strength that Chinese middle and high-end consumers have money and are willing to spend.

They have facilitated a tripling of Sam's sales over five years, achieving an average annual compound growth rate of 50%, and it is expected to continue expanding in the coming years.

Source: Public information compilation, Consumption Insights charting

Source: Public information compilation, Consumption Insights charting

Currently, Sam's has a total of 73 stores in China and is advancing at a double-digit new store opening rate each year, progressing in both high-tier and low-tier cities to meet urgent user demands.

Note: The above store data is as of the end of November 2024.

Source: Public information compilation, Consumption Insights charting

In many cities where Sam's stores have not yet opened, a large number of purchasing agents have emerged, trading on various second-hand and information platforms, profiting handsomely from the rebate mechanism of membership stores.

Behind Sam's, a large group of "Sams" are racing in the market, truly reconstructing Chinese retail from the bottom-up business logic, and 2025 is likely to usher in a watershed moment.

The rapidly advancing retail enterprises fall into two categories: one is the typical foreign-funded ones like Sam's, Aldi, and Costco Wholesale; the other is the atypical domestic ones like Pang Donglai and Hema. These two types of retail enterprises that are still growing have strong operational labels:

“Quality upgrade and replacement, service to niche customer groups, no price wars.”

The companies that have achieved “three times in five years” have been doing the right things and doing things right. They emphasize the optimization and streamlining of SKUs, highlight quality and differentiation through self-owned brands, and ultimately gain excess profits and user reputation through scaling.

The logic of emphasizing explosive products is likely a blind spot in thinking that traditional retail enterprises in China have never considered. Aren't products produced by enterprises? Can retail channels actually do work?

Dimensionality Reduction Attack

Sam's growth momentum proves one thing: the industrial logic of China's “consumption upgrade” is still viable. The essence of many enterprises engaging in price wars is still insufficient innovation and supply.

Taking the typical domestic enterprises Yonghui Supermarket and the sold-out RT-Mart as examples, traditional large and comprehensive supermarkets have a wide range of SKUs, but they are very scattered. The core profit model is not about achieving a win-win situation for enterprises and users by finding a perfect match between supply and demand, but rather earning money through a large amount of display fees, entry fees, and other revenues, which weakens the overall consumption willingness and capacity.

The essence is still the outdated operational model from 30 years ago. This “people looking for goods” business model is precisely the fragile area most impacted by e-commerce.

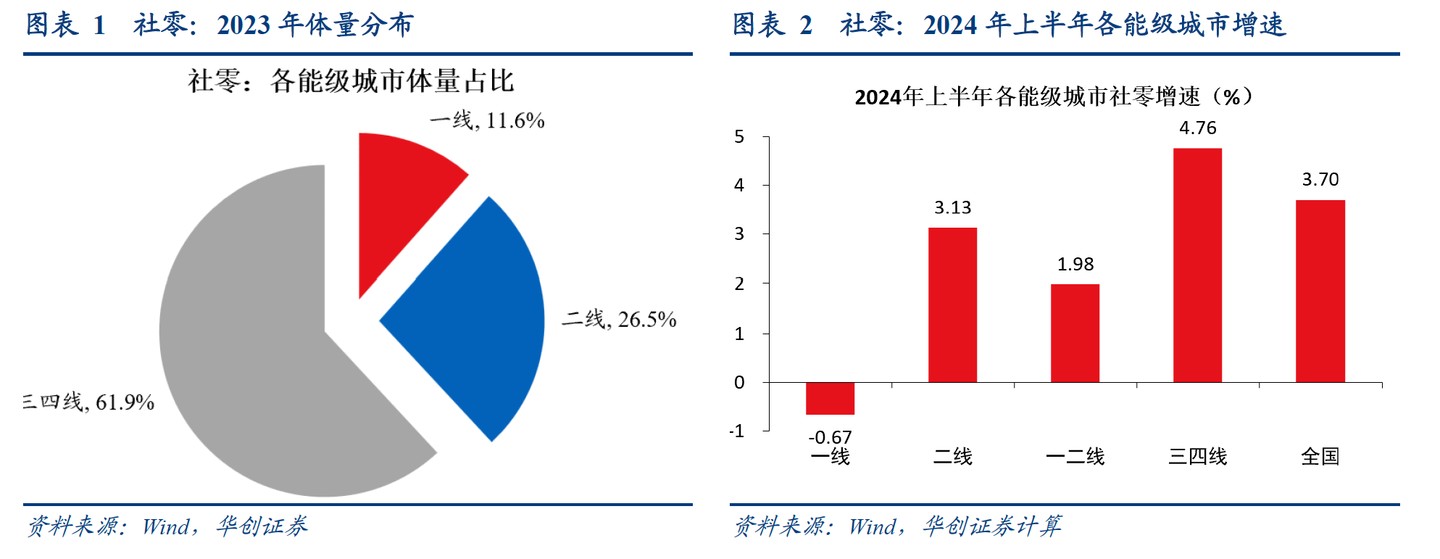

What is even more concerning and frightening for traditional forces is that emerging forces, after sharpening their knives in high-tier cities, are gradually advancing their expansion into sinking markets, entering a broader:

“1 billion people market.”

This market is considered a region that should experience “consumption downgrade,” but it is becoming the backbone of Chinese consumption. Residents in lower-tier cities are less affected by the downturn in the real estate market and stock market fluctuations, and their consumption growth rate is actually better than that of high-tier cities.

If everyone has been paying attention to the consistently exceeding expectations financial reports of giant catering companies, such as Yum China, the parent company of KFC and Pizza Hut, one thing they have been emphasizing in recent quarters is:

“Deepening into China's sinking market.”

In this market where demand is huge and rigid, but supply is relatively short and lagging, large enterprises exist like a dimensionality reduction attack, sweeping consumers' wallets. Domino's first store in Northeast China opened in Shenyang, turning this takeaway-focused pizza shop into a bustling hotspot.

Source: Domino's official account

For example, the first “town demonstration store” opened by Hema in Fuyang, Zhejiang, achieved sales of 960,000 on its first day, and subsequently ranked first in sales nationwide for three consecutive days, surpassing core cities like Beijing, Shanghai, Guangzhou, and Shenzhen, which was unexpected by the management. **

Throughout 2024, while domestic peers are making significant adjustments, closing stores, and reflecting, Hema has opened 72 new stores against the trend, bringing the total number of stores to over 420 by the end of the year. It has withstood a series of operational shocks such as "selling itself, leadership changes, supply chain tensions, and SKU adjustments," and is back on the road.

Of course, there is also Yonghui Superstores, which is transitioning from "traditional" to "innovative."

After adjustments made by Pang Donglai, the Yonghui Chengdu cultural store saw its monthly sales rise from several million to 23 million yuan. The average daily sales reached seven times that of before the adjustments, simply by doing a few grounded things: 20,000 SMS surveys, 1,500 suggestions, and removing over 10,000 SKUs.

Even when facing competitors like Sam's Club, Yonghui is not to be outdone. In the Yonghui Beijing Xilongduo store,

the adjusted store also achieved impressive results of 41 million in the first month and 37 million in the second month.

Insights even learned during the research process that the mall property has started to reduce rent for the adjusted Yonghui store by 30%, with the reason being:

“The traffic at the Yonghui store after the explosion is too high.”

Wang Shoucheng, Vice President of Yonghui Superstores and head of the national adjustment team, reflects:

“We are indeed immature, have taken some detours, and have caused many customers to lose trust in us, making them indifferent to whether there is a Yonghui nearby.”

Those who change survive, those who do not perish

There is no doubt that the trend of differentiation between quality retail and traditional retail will intensify by 2025.

The way of heaven is to cut off the insufficient and supplement the abundant.

Traditional, outdated, and non-customer-centric stores face a still bleak retail landscape, increasingly difficult corporate clients, and shrinking revenue.

Innovative, upgraded, and customer-centric retail stores will find that foot traffic is becoming more concentrated. With the support of the short video era, the development momentum of explosive products is very strong, forming a traffic center that ultimately benefits retail enterprises, product merchants, and consumers.

Summarizing the advantages of "foreign capital," there are roughly three points—

First, the procurement center system. All retail enterprises essentially serve customers by selecting truly high-quality products; the core soul of a retail enterprise must be a team of procurement experts deeply engaged in the industry.

Second, the strategic binding system. Taking Sam's Club as an example, it uses several hundred million in sales as "bait" to force domestic companies that want to cooperate to continuously develop new products, increase innovation investment, and ensure price competitiveness while maintaining quality. This strategic approach is similar to that of previous companies like Apple and Tesla; since it is a long-term strategic partnership, it must compel partner companies to improve together and grow stronger.

Third, the global network advantage. Foreign capital enjoys selection advantages on a global scale, which is something that domestic "Pang Donglai" companies currently do not possess.

However, one can find from Pang Donglai's current business success that even achieving just the first and second points is enough to benefit a region. The essential difference between the old and the new industries lies in the operational processes of "actively exploring user demand to customize products" and "passively collecting money while waiting for products to be shelved."

Retail enterprises are no longer just a channel; they integrate upstream product development and data utilization, midstream customer service and display, as well as terminal experiential capabilities. The core competitiveness comes from the company's insight into user needs and merchant capabilities.

When a retail enterprise makes consumers willing to drive several kilometers or even dozens of kilometers to spend money, then consumption becomes a reality.

The low ebb of the retail industry over the past three years has indeed been influenced by the pressure of consumers' tight wallets. However, objectively, we have observed that innovation in products and services has relatively stagnated. The supermarkets and retail enterprises that consumers frequent have not changed much, lacking fresh stimulation in consumption scenarios and experiences, which is also a significant phenomenon. In contrast, several retailers that have been continuously innovating have seen their stock prices soar; the market does not lie.

Spend more time communicating with consumers and manufacturers to thoroughly understand market demands and supply gaps. In the year 2025, when consumption will bear the economic banner, seize new opportunities.

Those who change will thrive, while those who do not will perish.