The "danger signal" of the US stock market: Why did hedge funds suddenly sell off?

對沖基金在過去 5 個交易日連續淨賣出美國股票,拋售速度為 7 個多月以來最快。高盛認為,這對投資者來説可能是一個重要的警告信號。

對沖基金集體做空,華爾街敲響警鐘。

近期,美股市場屢創新高,但一個令人不安的現象正在引發華爾街分析師的關注——根據高盛集團的最新報告,機構投資者,尤其是對沖基金,正在大規模做空美股市場,這可能是一個 “對股票投資者來説的重要警告信號”。

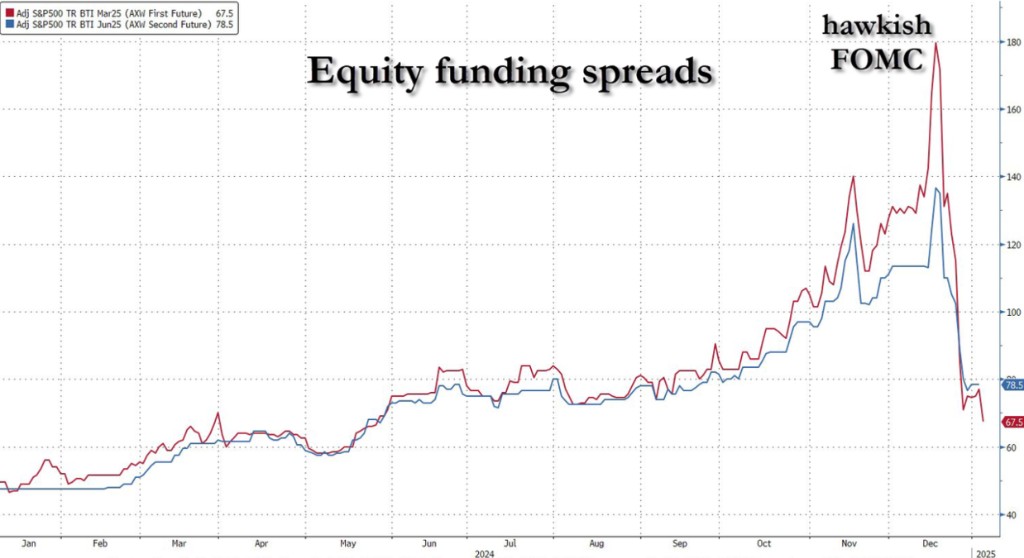

1 月 5 日,高盛衍生品策略師 John Marshall 指出,股票融資利差(equity funding spreads)是衡量專業投資者頭寸的重要指標,這一指標在去年 12 月 18 日美聯儲公佈鷹派政策立場後出現顯著下降,意味着機構投資者正在大幅減少槓桿多頭頭寸。Marshall 在報告中強調:

“通過期貨渠道的拋售在本週繼續進行,這體現在槓桿多頭融資成本的下降,週四融資利差的疲軟是一個重要現象,表明 12 月的變動不僅僅與年末因素有關。”

高盛交易員 Vincent Lin 也證實了這一趨勢,在 1 月 3 日的報告中,Lin 指出:

“對沖基金在過去 5 個交易日連續淨賣出美國股票,拋售速度為 7 個多月以來最快。”

具體來看:

-

全球股票經歷了 7 個多月以來最大規模的淨賣出,主要由做空操作驅動;

-

所有地區都出現了淨賣出,北美和新興亞洲市場尤為明顯;

-

宏觀產品和個股均遭遇淨賣出,分別佔總淨賣出額的 77% 和 23%;

-

11 個全球行業中,有 8 個遭遇淨賣出,以醫療保健、金融和工業為首;僅信息技術、材料和能源行業出現淨買入。

Marshall 認為,儘管美股估值已經連續多個月處於歷史高位,但 “這是多年來我們首次看到這兩個頭寸指標(融資利差和對沖基金淨頭寸)同時出現顯著拋售”。參考 2021 年 12 月,當時對貨幣政策的擔憂引發了專業投資者拋售,隨後標普 500 指數經歷了長達 10 個月的下跌。

不過,有觀點認為,除非出現重大宏觀因素觸發大規模拋售,否則這一輪拋售可能最終演變為又一次大規模對沖基金空頭擠壓,將會推動標普 500 指數再創新高。