The People's Bank of China increased its gold holdings for the second consecutive month, with foreign exchange reserves decreasing by 1.94% month-on-month in December

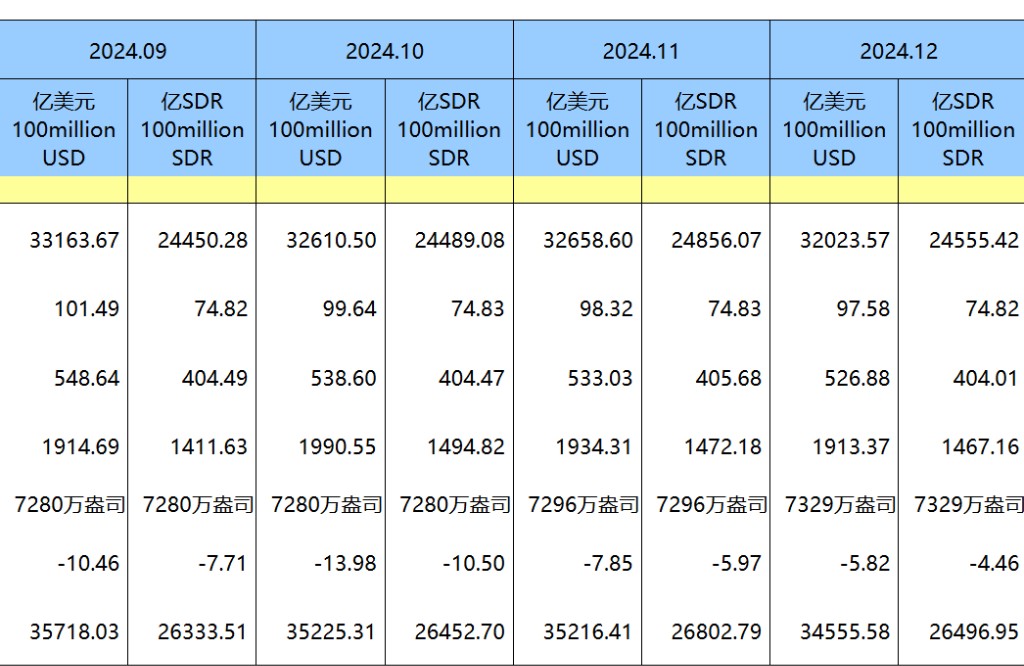

In December 2024, the People's Bank of China increased its gold reserves for the second consecutive month, reaching 73.29 million ounces, an increase from 72.96 million ounces in November. At the same time, the foreign exchange reserves stood at USD 3202.36 billion, a decrease of USD 63.5 billion from November, representing a decline of 1.94%. The State Administration of Foreign Exchange pointed out that the rise in the US dollar index and the decline in global financial asset prices are the main reasons for the decrease in foreign exchange reserves

In December 2024, the People's Bank of China continued the momentum of increasing gold reserves that began in November, marking the second consecutive month of increases after a six-month pause.

On January 7, the State Administration of Foreign Exchange announced that China's gold reserves at the end of December stood at 73.29 million ounces, up from 72.96 million ounces at the end of November.

As of the end of December 2024, China's foreign exchange reserves amounted to USD 3,202.36 billion, a decrease of USD 63.5 billion from the end of November, representing a decline of 1.94%.

The foreign exchange administration stated that in December 2024, influenced by expectations of monetary policy from major economy central banks and macroeconomic data, the U.S. dollar index rose while global financial asset prices generally fell. The combined effects of exchange rate conversions and asset price changes led to a decrease in foreign exchange reserves for the month. The overall operation of China's economy remains stable, with steady progress and solid advancement in high-quality development, which is conducive to maintaining the basic stability of foreign exchange reserves.

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment objectives, financial conditions, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investment based on this is at one's own risk