Goldman Sachs: What does it mean that hedge funds are suddenly shorting the market in large numbers?

高盛分析師 John Marshall 指出,12 月 18 日美聯儲的鷹派轉變導致融資利差暴跌,本週通過期貨渠道的拋售仍在繼續。這與 2021 年 12 月的情況類似,預示着美股可能面臨下跌的風險。

近期美股市場屢創新高,然而,一個月前,市場就已顯現出一些異常跡象。

財經博客 ZeroHedge 指出,機構的動向與散户相反。散户表現出追漲熱情,但機構投資者(尤其是對沖基金)卻在悄悄做空。

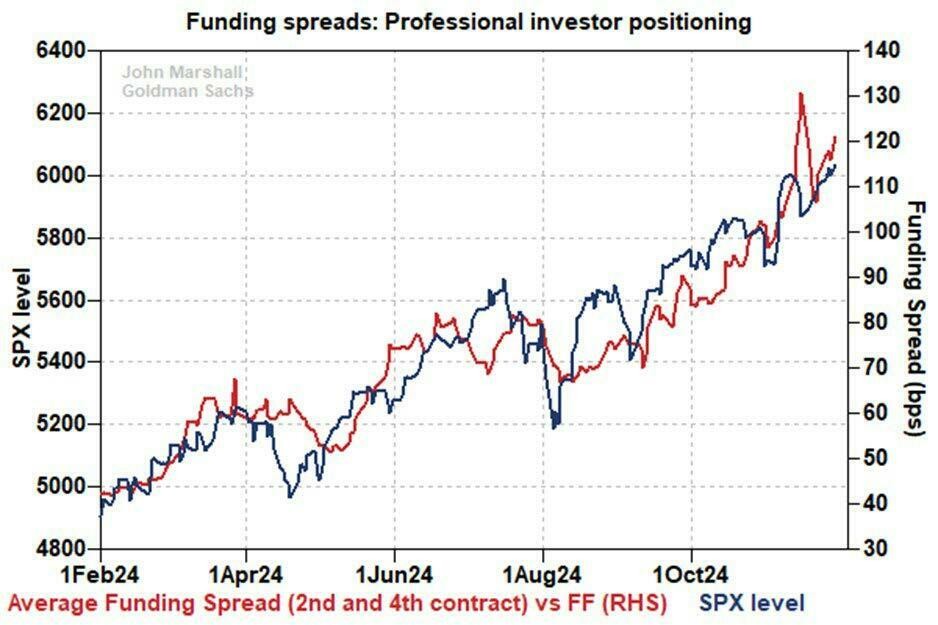

對此,高盛的衍生品策略師 John Marshall 曾指出,融資利差是衡量專業投資者倉位的重要指標。11 月中旬,融資利差曾觸及十年高點後回落,後又回升,當時被解讀為看漲信號。12 月 18 日,美聯儲的鷹派轉變導致融資利差暴跌,抹去了過去六個月的漲幅。

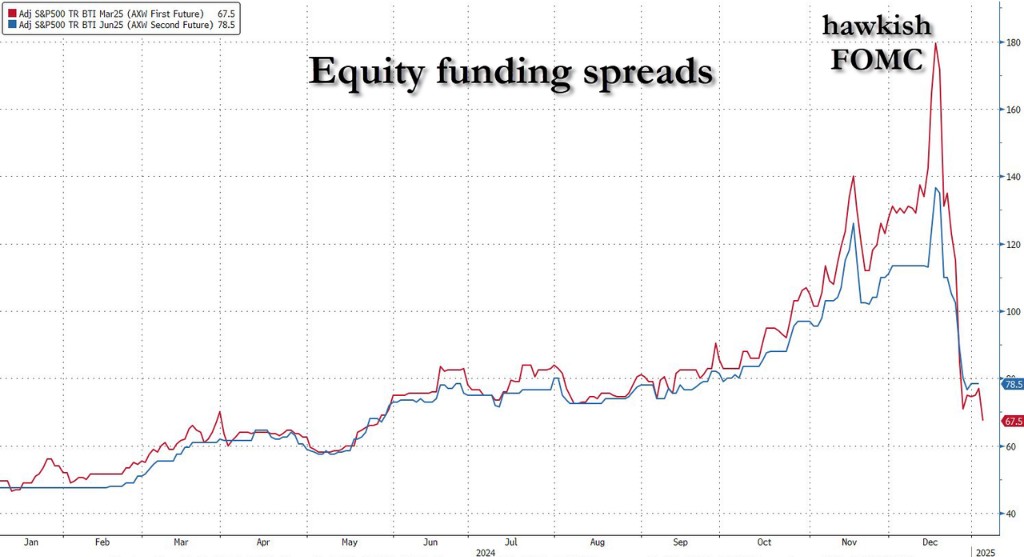

高盛認為,融資利差的暴跌表明機構投資者正在持續減持,這是一個重要的警告信號。本週通過期貨渠道的拋售和融資槓桿多頭成本的下降都印證了這一點。這與 2021 年 12 月的情況類似,預示着美股可能面臨下跌的風險。

高盛:融資利差預示美股或將大幅回調

ZeroHedge 指出,早在數週前,市場就已顯現出一些異常跡象:在標普指數不斷創下歷史新高的同時,0DTE 期權交易異常活躍,股票回購激增,散户投資者也表現出追漲熱情。

與此同時,大型機構的動向卻與散户截然不同。通過觀察標普 500 指數的融資利差,AXW 利差在 11 月 15 日觸及十年高點後反轉,之後又再次開始上升。

對此,Marshall 曾指出,融資利差是衡量專業投資者配置的重要指標。

11 月中旬,融資利差一度觸及十年高點後急劇逆轉,隨後又開始回升。Marshall 當時認為,這表明專業投資者對股票上漲的興趣並未減弱,是近期股市表現的看漲信號。事實證明,在接下來的兩週裏,標普指數持續上漲。

然而,12 月 18 日,美聯儲的鷹派立場轉變,打破了市場的平靜。“政治鮑威爾” 一改此前鴿派論調,暗示加息幅度將超出市場預期,融資利差也隨之崩盤,兩週內抹去了過去六個月的漲幅。

如果説融資利差的飆升是看漲信號,那麼其暴跌是否意味着看跌?Marshall 在 1 月 5 日的最新報告中給出了肯定答案。

他指出,機構持續減持的跡象是 “股票投資者的重要警告信號”。本週通過期貨渠道的拋售仍在繼續,融資槓桿多頭成本的下降也印證了這一點。

他特別強調,週四融資利差的疲軟是一個重要事件,表明 12 月的市場走勢並非僅僅是受年終因素影響。即使在標普指數上漲 1.3% 的情況下,週五融資利差也表現平平,這與正常的市場相關性明顯不符。

更令人擔憂的是,Marshall 認為,當前的情況與 2021 年 12 月非常相似。當時,對貨幣政策的擔憂引發了專業投資者的拋售,隨後標普指數下跌了 10 個月。

對沖基金加速拋售美股,是警告還是空頭陷阱?

高盛另一位交易員 Vincent Lin 也在 1 月 3 日發佈報告稱,過去五個交易日,對沖基金以七個多月以來最快的速度淨賣出美國股票。

數據顯示,全球股市出現了七個多月以來最大的淨賣出,其中賣空交易遠多於多頭賣出。所有地區均出現淨賣出,北美和亞洲新興市場的淨賣出量相對較小。宏觀產品和個股均被淨賣出。在全球 11 個板塊中,有 8 個板塊出現淨賣出,其中醫療保健、金融和工業板塊位居前列。

Marshall 總結道:

“雖然股票估值多年來一直處於歷史高位,但這是我們多年來第一次在這兩個定位指標中看到大量拋售。”

不過,也有觀點認為,除非出現重大的宏觀因素觸發大規模拋售,否則這一輪拋售可能最終演變為又一次大規模的對沖基金空頭擠壓,反而會推動標普 500 指數再創新高。