The 10-year U.S. Treasury auction suffered a major setback, with the winning yield reaching a new high since August 2007

The winning yield for this 10-year U.S. Treasury auction was 4.680%, marking a new high since August 2007, and the first appearance of a tail spread reflecting weak demand since October last year. The indicator measuring overseas demand plummeted significantly, reaching its lowest level since October 2023. Earlier that day, two major U.S. economic data points—JOLTS job openings and ISM services PMI—were both very strong. Following the data release, the U.S. Treasury market plummeted, dragging down this auction

On Tuesday, the U.S. Treasury auctioned $39 billion in 10-year Treasury bonds, and the auction results were disappointing, showing poor performance across multiple indicators.

During the early trading hours of U.S. stocks on Tuesday, due to two major economic data releases in the U.S.—JOLTS job openings and ISM services PMI being very strong—the bond market plummeted, and interest rates surged, leading to a disastrous 10-year Treasury auction a few hours later.

The winning bid rate for this 10-year Treasury auction was 4.680%, marking a new high since August 2007, significantly exceeding the winning bid rate of 4.235% from the previous auction on December 11. The pre-auction rate for this 10-year Treasury was 4.678%, reflecting a tail spread of 0.2 basis points, indicating weak demand; this is the first appearance of a tail spread since October of last year.

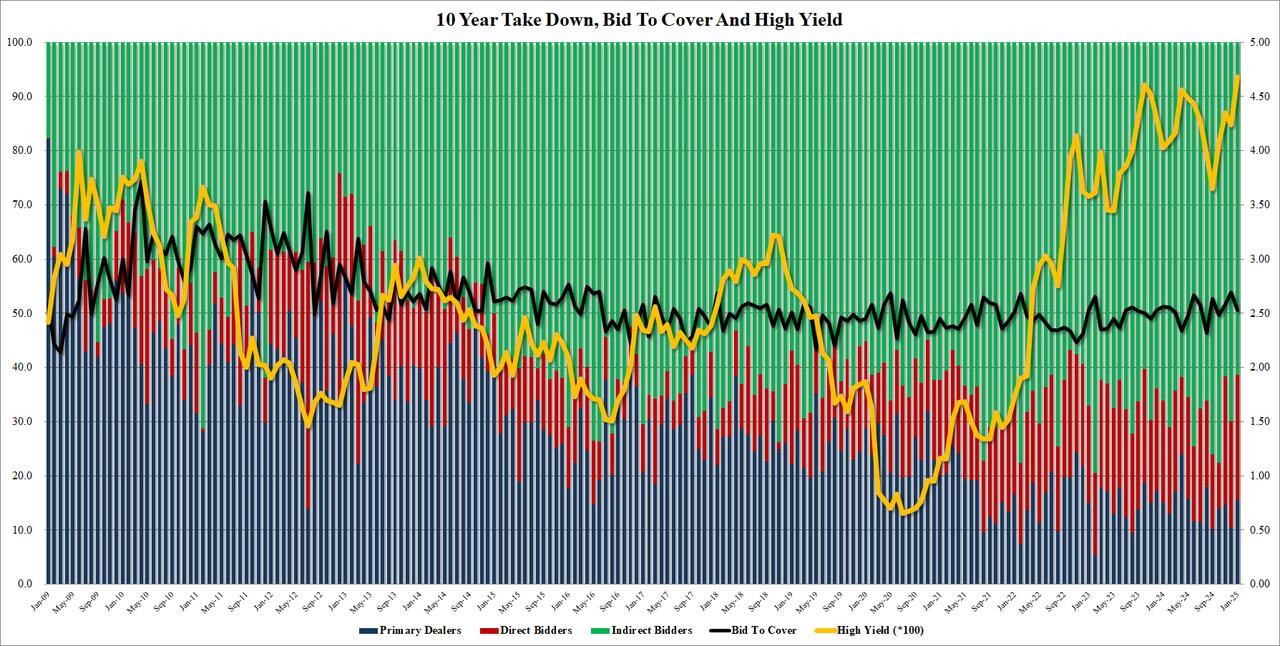

The bid-to-cover ratio for this auction was 2.53, down from 2.70 in the previous auction, which had set the highest level since 2016.

As a measure of domestic demand, the allocation ratio for direct bidders—including hedge funds, pension funds, mutual funds, insurance companies, banks, government agencies, and individuals—was 22.97%, the highest since November of last year.

As a measure of overseas demand, the allocation ratio for indirect bidders—typically foreign central banks and other institutions participating through primary dealers or brokers—was 61.39%, a significant drop from the previous 70.0%, the lowest since October 2023.

As the "buyers" of all unsold supply, primary dealers received an allocation ratio of 15.6%, the highest level since August of last year.

Financial blog Zerohedge commented:

This Treasury auction was terrible. Although the market's reaction to the auction results was somewhat muted, this is only because the yield on the 10-year Treasury is currently at 4.70%, the highest level since April 2024, with only higher yields seen in October 2023.

However, in October 2023, yields quickly fell afterward due to concerns about a sharp slowdown in the U.S. economy. This time, there are almost no signs of weakness in the data, at least before Trump took office, and yields are likely to rise significantly before inevitably declining