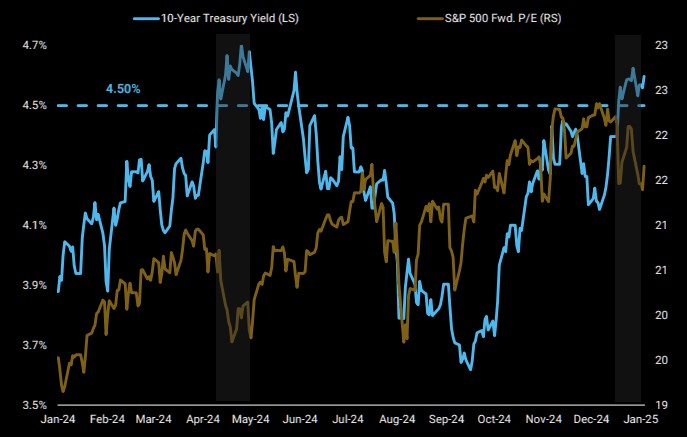

With the rise in U.S. Treasury yields, should the U.S. stock market be worried?

大摩分析稱,隨着 10 年期美債收益率漲至 4.5% 上方,已對美股估值形成壓力,標普 500 指數和美債收益率之間的相關性已經轉為 “明顯負相關”,考慮到市場廣度較差、美元承壓下行以及美聯儲偏鷹的政策前景,美股在未來六個月內可能面臨嚴峻挑戰。

通脹擔憂推高美債收益率飆升和美元走強,美股面臨下行風險。

近日,摩根士丹利首席策略師 Michael Wilson 在一份報告中警告説,隨着 10 年期美債收益率攀升至 4.5% 以上,已對美股估值形成壓力,標普 500 指數與債券收益率之間的相關性已經轉為"明顯負相關",美股在未來六個月內可能面臨嚴峻挑戰。

華爾街見聞此前提及,距離特朗普正式上任美國總統時日漸近,債市對通脹前景的擔憂開始升温,10 年期美債收益率週二攀升至 4.695%,創下自去年 4 月以來的新高。

30 年期美債收益率也漲至 2023 年 10 月下旬以來的最高水平,突破區間高點。

實際上,12 月以來,由於對經濟增長的擔憂以及美聯儲比預期更加鷹派的政策前景,美股的反彈勢頭已經有所減弱。

Wilson 表示,美元目前的水平已使具有大量國際業務的公司承壓,而按照 200 日移動平均線衡量,標普基準指數整體與其各個組成部分之間的差距處於歷史最高水平,意味着市場廣度較差,這可能會在今年上半年更廣泛地影響股市。

“我們認為 2025 年可能是一個前後兩半年表現不同的年份。”

不過 Wilson 同時補充道,潛在的減税等市場友好政策可能會在今年下半年支撐股市,

Wilson 表示,美股要想改善漲勢集中度,可能要 “依賴於利率下降、美元走弱、關税政策明朗化以及盈利修正走強等綜合因素”。

在去年 11 月發佈的展望報告中,大摩設定標普 2025 年的目標價為 6500 點,較上週五收盤水平高出約 9%。