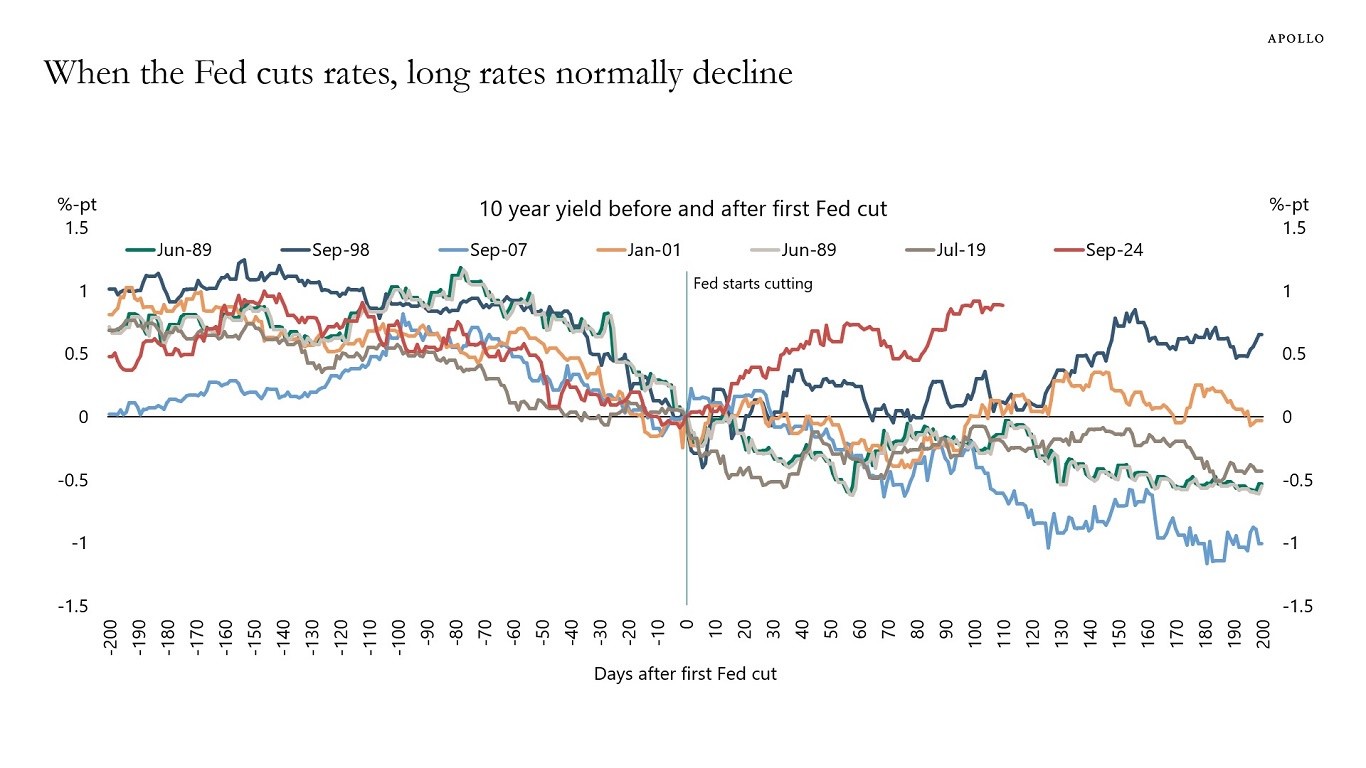

Rare! The Federal Reserve has begun a rate-cutting cycle, yet U.S. long-term bond yields have surged

The Federal Reserve began its rate-cutting cycle in September, having lowered rates by 100 basis points, yet the yield on the 10-year U.S. Treasury bond has risen by a cumulative 100 basis points, a rare occurrence. Historically, only the 1981 rate-cutting cycle performed weaker. The market may be pricing in fiscal concerns, reduced demand, or a lack of rationale for rate cuts. Francis Yared of Deutsche Bank believes that the market has largely completed the repricing of interest rates and expects the yield on 10-year bonds to be 40 basis points higher

Since the beginning of the interest rate cut cycle in September, the Federal Reserve has lowered rates by 100 basis points, while during the same period, the yield on 10-year U.S. Treasuries has fallen sharply, with yields cumulatively rising by 100 basis points.

This is very rare!

The only previous interest rate cut cycle that performed worse than the current U.S. Treasury situation was in 1981, during the tail end of Paul Volcker's iron-fisted approach to controlling inflation, when there were significant changes in Federal Reserve policy and interest rates.

What is the market pricing in? Is it fiscal concerns? Is it reduced demand? Or is it that the Federal Reserve's rate cuts make no sense?

Before Christmas, Francis Yared of Deutsche Bank discussed that the rate repricing so far is likely aimed at pricing the neutral rate in the range of 3.75-4%, and that the Federal Reserve will maintain rates above the neutral level until 2025.

He believes that the market has largely completed this pricing, but considering the supply of government bonds and inflation expectations, the global term premium remains too low.

Most importantly, if the term premium returns to the average level from 2004 to 2013, the yield on 10-year bonds should be about 40 basis points higher.