AI "one misstep leads to another," Samsung Electronics' financial report is bleak

Samsung Electronics' revenue and profit in the fourth quarter both fell short of market expectations. Analysts pointed out that the main reasons for the poor performance include lagging behind competitors such as SK Hynix and Micron Technology in the AI chip sector, weak demand for traditional memory, intensified competition in the smartphone business, a decline in the utilization rate of foundry services, and increased R&D investment

Samsung Electronics' quarterly profit falls short of expectations, facing challenges in the AI chip business.

On Wednesday, January 8, South Korean electronics giant Samsung announced disappointing quarterly results: preliminary data shows that Samsung's operating profit for the fourth quarter of 2024 was 6.5 trillion won (approximately $4.5 billion), lower than the analysts' average expectation of 8.96 trillion won; revenue was 75 trillion won, also below market expectations.

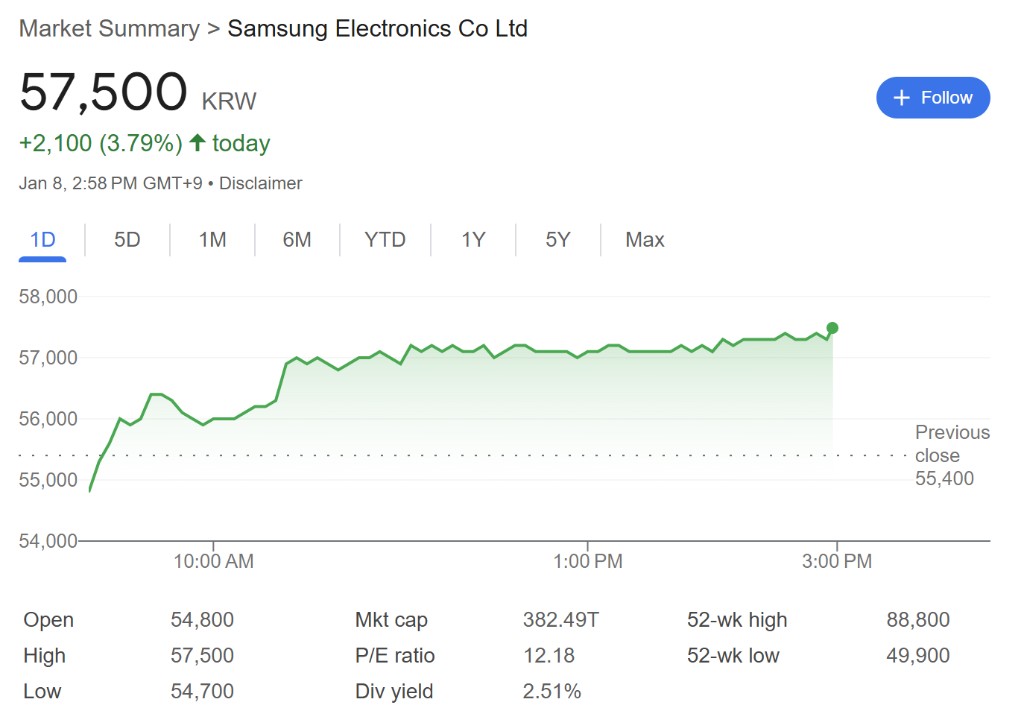

As of the time of writing, Samsung's stock in Korea rose by 3.79%, currently reported at 57,500 won per share.

Analysts pointed out that the main reasons for Samsung's poor performance include:

1. Lagging in the AI chip sector: Samsung is falling behind competitors like SK Hynix and Micron Technology in the artificial intelligence chip market, failing to obtain certification from NVIDIA in a timely manner, resulting in a reduced market share in high bandwidth memory (HBM);

Weak demand for traditional memory: The demand for conventional semiconductor products from PCs and mobile devices has weakened, dragging down Samsung's performance;

Increased R&D investment: To catch up with the rapidly growing AI market, Samsung has increased its R&D spending and capacity expansion investments;

Intensified competition in the smartphone business: The competition in the mobile device sector is becoming increasingly fierce, affecting Samsung's performance in this business segment;

Decline in foundry business utilization: The operational efficiency of the wafer foundry business has decreased.

In response to these challenges, Samsung is taking a series of measures:

Organizational culture transformation: Jun Young-hyun, head of Samsung's chip division, previously acknowledged delays in obtaining NVIDIA certification, stating that the company needs to review its organizational culture and processes;

Layoff plans: Samsung has begun layoffs in Southeast Asia, Australia, and New Zealand, planning to reduce thousands of positions globally;

Increased investment in AI chips: Samsung is striving to catch up in the high-end memory market, but this requires sustained high R&D and capacity expansion investments