After the misjudgment in December, Morgan Stanley still maintains a bearish outlook on the US dollar: a decline is just a matter of time

Morgan Stanley believes that considering factors such as the potential underperformance of the new U.S. government's policy strength, the possibility of the Bank of Japan raising interest rates, and the excessive positioning of dollar bulls, the current risk for the dollar is tilted to the downside and may weaken this year, but it may still be too early to trade on this theme

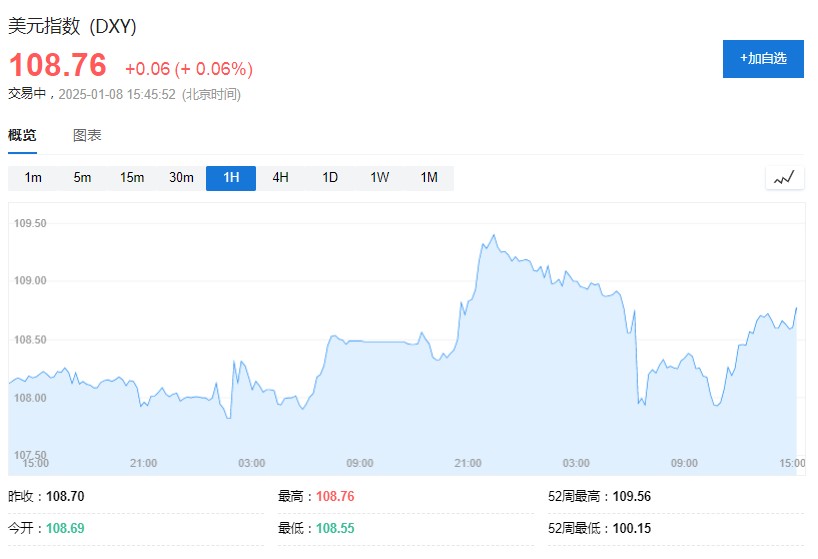

Overnight U.S. employment data and service industry data both performed strongly, pushing the U.S. dollar index to briefly rise above 109. Will the dollar continue to be strong moving forward?

In a research report released on the 7th, Morgan Stanley stated that being bearish on the dollar in December is not a misjudgment, but rather "premature." Although there is a lack of clear downward catalysts in the short term, the dollar index may still decline in the long term, potentially by 2025.

The report indicated that while the Federal Reserve's unexpected hawkish stance in December boosted long-term U.S. Treasury yields and subsequently strengthened the dollar, this does not mean the dollar is free from downside risks.

The interest rate paths of major central banks in the short term will be the biggest factor affecting the dollar's trend

Morgan Stanley believes that the factors influencing the dollar's trend are currently very complex, making it difficult to see a clear directional catalyst for the dollar's movement in either direction.

First, due to seasonal factors, U.S. economic data, especially inflation data, will have potential upward risks, which may continue to support the dollar in the short term.

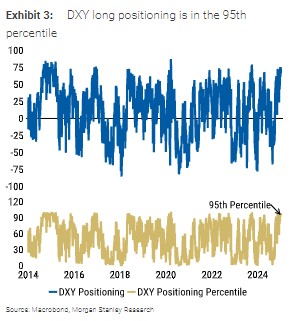

Second, the current long positions in the dollar are at historical highs (reaching the 95th percentile), and this "overexposure" brings the risk of a pullback.

Moreover, considering that if Japanese wage growth exceeds expectations, the Bank of Japan may announce a 25 basis point rate hike at its monetary policy meeting in January, this would be favorable for the yen and put pressure on the dollar.

However, based on leading indicators, the report expects significant recovery in Japanese wage growth to occur only in the second half of this year.

Regarding the outlook for U.S. policies, Morgan Stanley expects the implementation of trade policies and the scale of fiscal deficit expansion to be lower than expected, thus the risks for the dollar tend to be downward, although there may not be much pricing activity related to this event in the short term.

In the short term, the interest rate paths of major central banks will be the biggest factor affecting the dollar's trend, but the report also notes that there may not be sufficiently clear economic data in the coming weeks to drive significant adjustments in market expectations for central bank policies.

The report concludes that the current risk for the dollar is tilted downward and may weaken this year, but trading on this theme may still be premature, thus maintaining a neutral stance on the dollar for now