U.S. consumer credit unexpectedly fell by the largest margin in over a year in November

U.S. consumer credit unexpectedly decreased by $7.5 billion in November, marking the largest decline in over a year, while economists had originally predicted an increase of $15 billion. Credit card and other revolving debt balances fell by $13.7 billion, while non-revolving credit such as auto loans and tuition loans increased by $6.2 billion. Consumers are working to pay off credit card debts, with borrowing rates nearing 20%. Despite the Federal Reserve lowering the benchmark interest rate, high rates continue to put pressure on consumers. Auto sales accelerated in November, reflecting the increase in non-revolving credit

According to Zhitong Finance APP, while credit card balances have significantly decreased, U.S. consumer debt unexpectedly saw its largest decline in over a year last November. Data released by the Federal Reserve on Wednesday showed that total consumer credit fell by $7.5 billion in November, while economists had predicted a median increase of $15 billion, with revised October data showing an increase of $17.3 billion. Additionally, the balance of unpaid credit card and other revolving debts decreased by $13.7 billion, marking the largest decline since the early days of the COVID-19 pandemic, following a significant increase the previous month. The Federal Reserve's report indicated that non-revolving credit, such as auto loans and tuition loans, increased by $6.2 billion in November.

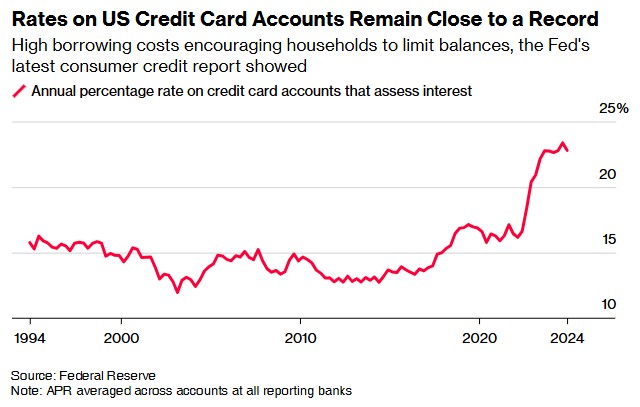

The data shows that U.S. consumers are struggling to pay off credit card debts as borrowing rates remain close to record levels exceeding 20%. The Federal Reserve's report indicated that the credit card rate in November was 22.8%. In recent years, amid persistent inflation, Americans have increasingly relied on credit for consumption.

Although the Federal Reserve cut the benchmark interest rate by a full percentage point in 2024, officials indicated a tendency to slow down interest rate cuts this year. This means that U.S. consumers can only expect slight relief from the high rates on credit card accounts and other forms of borrowing.

Meanwhile, the increase in non-revolving credit may reflect strong growth in auto sales. According to Ward’s Automotive Group, U.S. auto sales accelerated at the fastest pace in over three years last November. With lower auto loan rates and more manufacturer incentives attracting buyers to showrooms, auto sales continued to rise in December