英镑,再迎 “特拉斯” 时刻?

The GBP/USD exchange rate fell below 1.25, with implied volatility soaring to 10%. The UK economy is sluggish, with the year-on-year GDP growth for the third quarter revised to 0%, and the unemployment rate rising to 4.3%. Inflation remains high, with the November CPI rebounding to 2.6%. Compared to the United States, the proportion of consumer savings in the UK is high, and consumer spending is growing slowly. The UK economy has long lacked significant growth and faces severe challenges

The Pound Continues to Decline

Recently, the exchange rate of the pound against the dollar has quietly fallen below the 1.25 mark, just a step away from last April's low.

On January 9th afternoon, the one-month implied volatility of the pound surged to 10%, reaching the highest level since the banking crisis in March 2023.

Since October, under the pressure of a strong dollar, the pound has even been weaker than the euro.

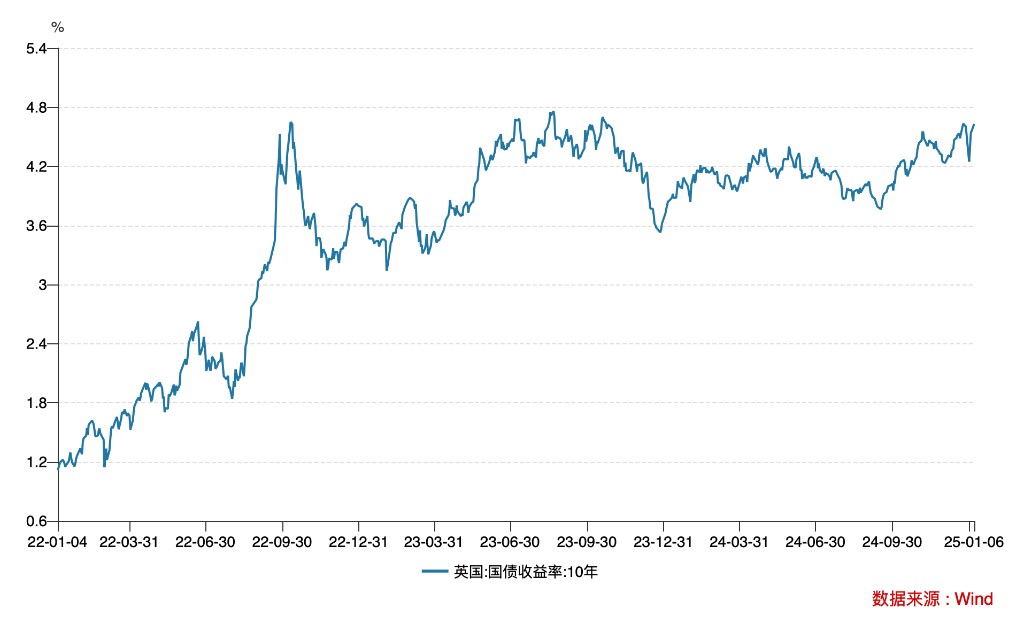

In the bond market, investors are aggressively selling off UK long-term government bonds, with the yield on 10-year UK government bonds approaching the peak seen during the "Truss" moment in 2022.

Why does the pound continue to decline? What is happening to the UK economy?

Economic Recession Again

First, let's take a look at the UK economy.

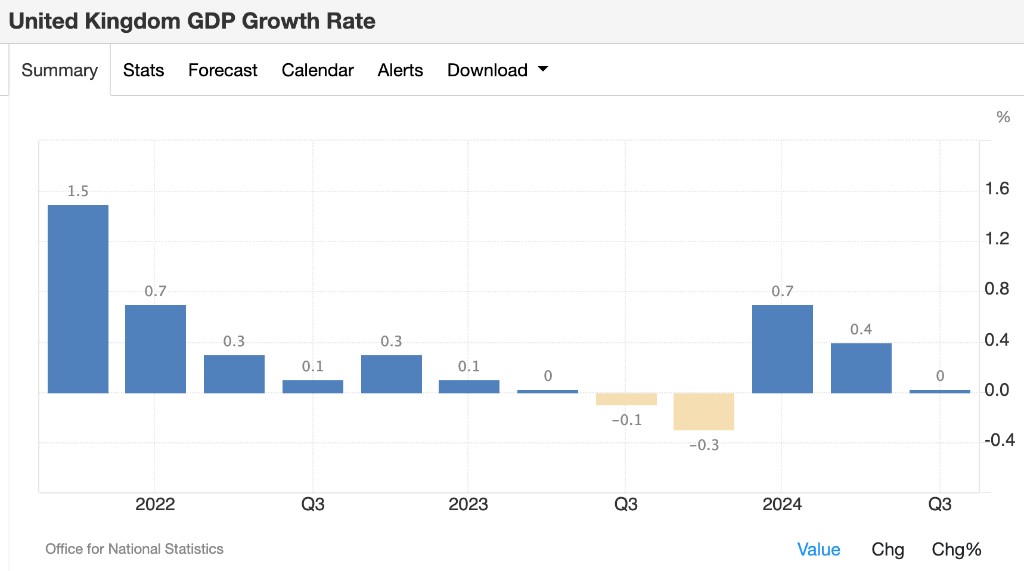

On December 23rd, the UK Office for National Statistics released the revised GDP data for the third quarter of 2024.

The year-on-year GDP growth for the third quarter was revised down from an initial value of 0.1% to 0%, and the GDP growth rate for the second quarter was also revised down from 0.5% to 0.4%.

In terms of structure, the UK construction industry grew by 0.7% in the third quarter, but manufacturing declined by 0.4%, and the service sector saw zero growth.

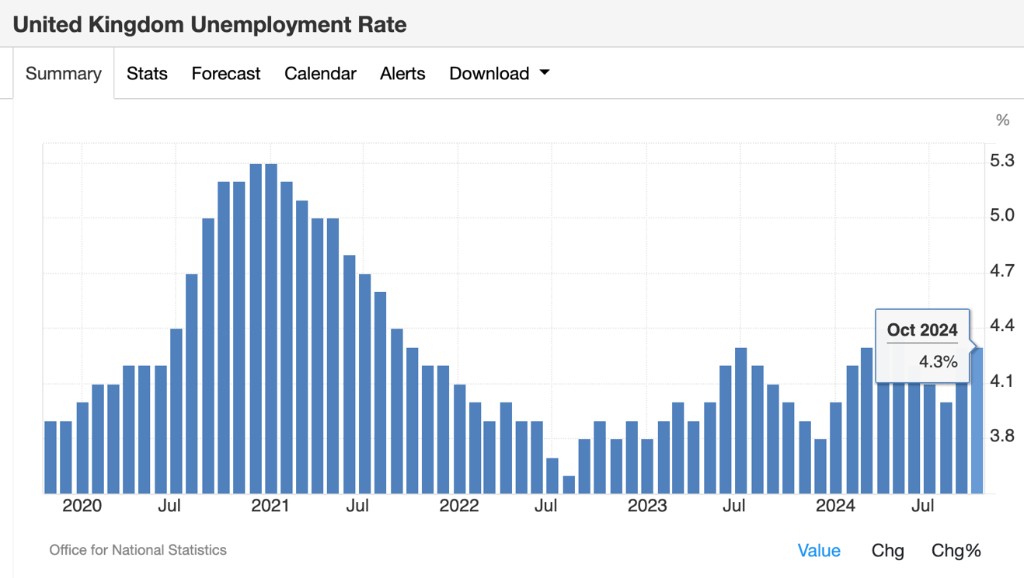

In the labor market, the unemployment rate in the UK has rebounded since September, currently standing at 4.3%.

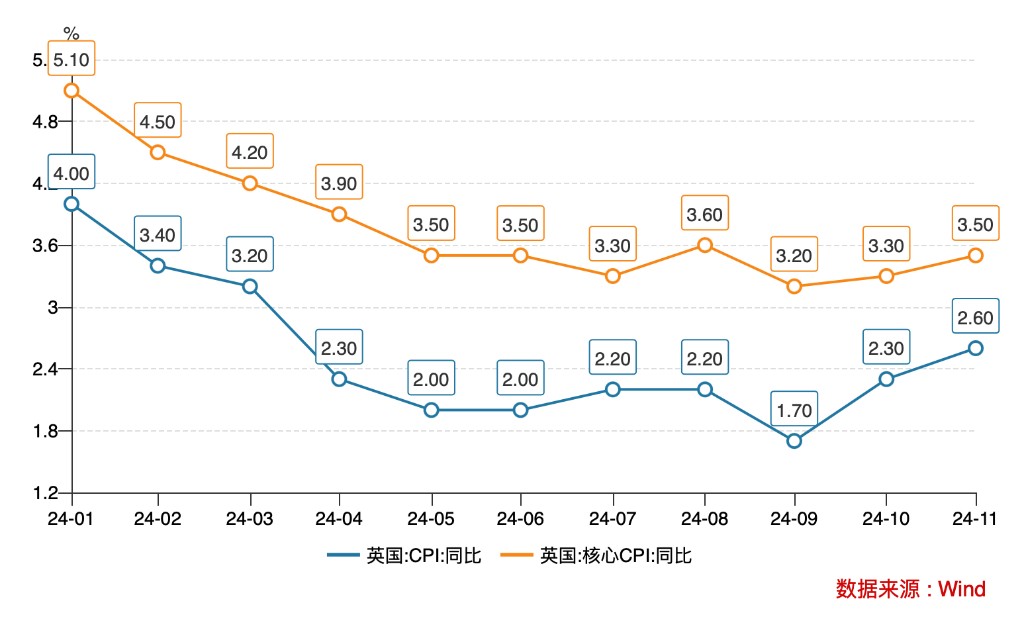

Regarding inflation, the UK's CPI further rebounded to 2.6% in November, with core CPI rebounding to 3.5%. Even excluding the volatile food and energy prices, inflation in the UK remains high.

Compared to the United States, UK consumers currently have a higher savings ratio and a lower consumption ratio.

American consumers are willing to reduce precautionary savings, which is why the U.S. has become the strongest economy in the G7 post-pandemic. U.S. consumer spending is currently about 14% higher than pre-pandemic levels, while UK consumer spending is only slightly above that.

Looking at the long term, the UK has not seen significant economic growth for many years after "deindustrialization." In the mid-18th century, no country in the world could match the economic achievements of the United Kingdom, but today the UK economy is even outperformed by France across the Channel.

With nearly the same population size, the UK has fewer than 30 million housing units, while France has about 37 million;

France has 3.4 million households owning a second home, while the UK has only 800,000;

The UK's per capita electricity generation is 4,800 kilowatt-hours per year, while France's is 7,300 kilowatt-hours per year, and the United States' is 12,672 kilowatt-hours per year;

The UK's tram project costs 2.5 times more per mile than France's;

The last nuclear power plant in the UK was built between 1987 and 1995, with installation costs per megawatt being 4 to 6 times that of South Korean nuclear power plants;

……

I remember when Labour Party leader Keir Starmer took office in July 2024, his promise to the nation was "change." During the campaign, he proposed a series of policy reforms, including stimulating economic growth, reducing healthcare waiting times, and reforming the education system.

Why, six months later, does the UK economy still show no signs of recovery?