英债惨跌,英国高官发声安抚市场:债市 “有序”、需求强劲、无需干预

The UK's Chancellor's deputy and chief secretary, Jones, stated that the fluctuations in the bond market are normal, with strong demand for government bonds, and there is no need for urgent government intervention. The Deputy Governor of the Bank of England, Briden, mentioned that the central bank is closely monitoring the bond market, and the situation is good so far; the central bank will gradually lower interest rates, but it is difficult to determine the appropriate pace

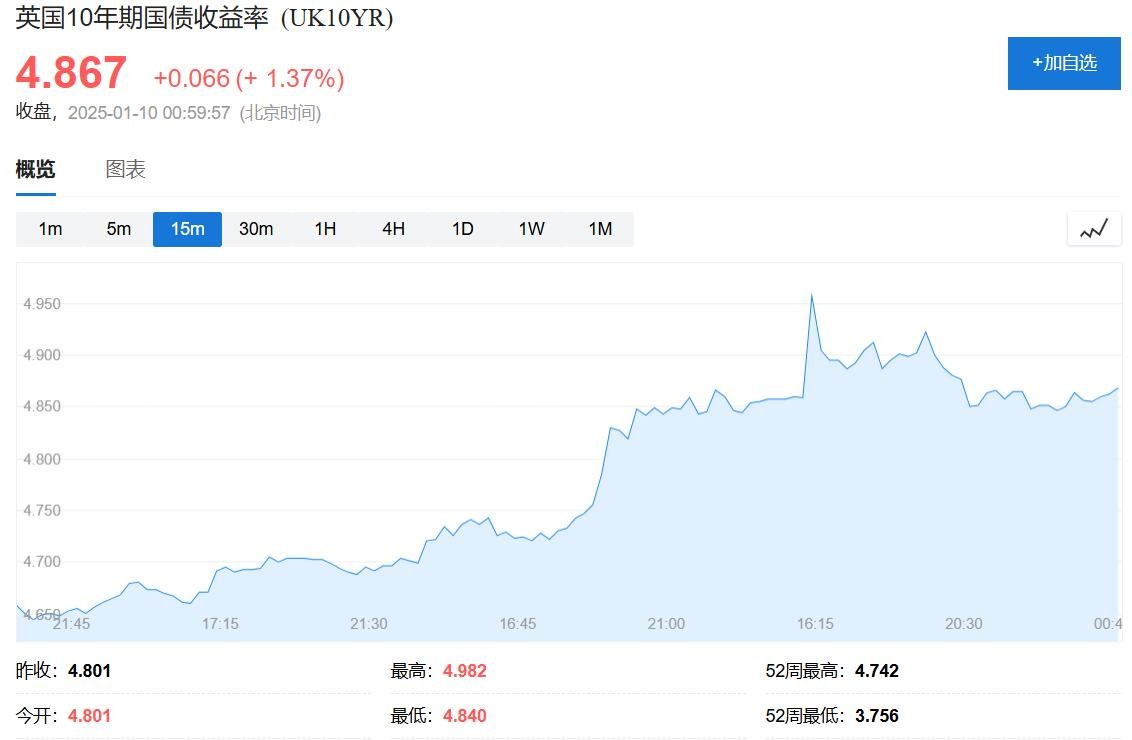

UK government bond prices have been falling for four consecutive days, with the yield on the benchmark 10-year UK government bond reaching a new high not seen since 2008, and the 30-year bond yield hitting a new high since 1998.

The turmoil in the UK bond market raises concerns about a recurrence of the "tax cut crisis" from two years ago. Former Bank of England official Martin Weale even suggested that a debt crisis similar to the one in 1976 that forced the UK to seek help from the IMF could reoccur.

Amid rising borrowing costs and a widespread sell-off in the global bond market, the pressure on the UK government is increasing day by day, prompting senior officials to take action, with officials from the Treasury and the central bank speaking out to reassure the market.

Deputy to the Chancellor: Bond market fluctuations are normal, strong demand for government bonds, no need for urgent intervention

On Thursday, January 9th, in response to the so-called urgent question raised by the opposition Conservative Party in the House of Commons, Rachel Reeves' deputy, Chief Secretary Darren Jones, stated that the UK government bond market is operating normally and that there is strong fundamental demand for UK bonds. Jones said:

"The UK government bond market continues to operate in an orderly manner. It is normal for the prices and yields of UK government bonds to fluctuate when financial markets are volatile."

Jones indicated that there is no need for the government to take urgent intervention measures to support the bond market. "The government does not comment on specific movements in financial markets; this is a long-standing practice. I will not break this practice today."

Jones also mentioned that the UK expects continued strong demand for government bonds and noted that the 5-year UK government bonds auctioned by the Treasury on Wednesday received oversubscription.

Deputy Governor of the Bank of England: The central bank is closely monitoring the bond market, and the situation is good so far; rate cuts will be gradual, speed is uncertain

Subsequently, Sarah Breeden, Deputy Governor of the Bank of England, revealed during a speech in Edinburgh on Thursday afternoon that the Bank of England is monitoring the fluctuations in the UK government bond market. Like Jones, Breeden also described the bond market as "orderly."

Breeden stated,

"The Bank of England is monitoring the bond market. So far, these (bond market) fluctuations have been orderly, and we will continue to pay attention to this area. So far, everything is good."

Breeden also mentioned that the Bank of England is "certainly monitoring the movements in the UK government bond market. This is a core market, and we care about it very much. Many price changes reflect global factors occurring in the US, Europe, and the UK, which is to be expected, as the market reacts to news about the outlook for fiscal conditions."

In her speech at the University of Edinburgh Business School, Breeden pointed out that data shows that economic activity in the UK is slowing down, and recent signs support the gradual rate cuts by the Bank of England, but it is difficult to determine the appropriate pace for the cuts. She stated that recent evidence further supports the central bank's withdrawal of restrictive policies, "I expect that over time, restrictive measures will continue to be gradually removed." At the scene, a reporter from the British media The Guardian asked whether the recent tightening of the financial environment gives the Bank of England more reason to cut interest rates. Briden said that the Bank of England will certainly pay attention to changes in borrowing rates, comprehensively review these rates, and observe changes in economic demand. Therefore, the central bank is expected to take into account the extent to which interest rates have already risen and the decline in demand.

Briden then mentioned that more than a year ago, when she just joined the Monetary Policy Committee (MPC) of the central bank in November 2023, the fixed mortgage rates for 2-year and 5-year terms were more than 100 basis points higher than they are today.

"Therefore, while we may have seen interest rates rise recently, the overall trend is downward, reflecting the waves of adjustment from those external shocks. We may expect that bank rates (benchmark rates) will be affected from now on."