What will be the next move for the US dollar? Tonight's non-farm payrolls will determine

瑞銀表示,美元大漲之後面臨方向選擇,今夜公佈的非農將成為美元下一步走勢的關鍵催化劑。瑞銀認為,要對美元產生足夠的衝擊,需要出現低於 10 萬的就業增長數據,或者失業率至少上升到 4.4%。

強勢上漲後,美元下一步怎麼走?今晚的美國非農數據十分關鍵。

美元自去年四季度開始加速上漲,進入 2025 年後,投資者面臨一個難題:一方面,推動美元在第四季度上漲的因素仍然存在,另一方面,由於第四季度的漲幅較大,市場普遍認為許多利好因素已經體現在價格中,且美元空頭頭寸已經較為擁擠。

對此,瑞銀認為,週五公佈的美國就業數據可能成為美元下一步走勢的關鍵催化劑。瑞銀經濟學家預計,12 月非農就業人數將增加 18 萬人,高於市場普遍預期的 16 萬人。

瑞銀 Shahab Jalinoos 等分析師在最新報告中表示,要對美元產生足夠的衝擊,需要出現低於 10 萬的就業增長數據,或者失業率至少上升到 4.4%:

這種情況基本上是能夠讓市場完全定價今年至少兩次 25 個基點的降息的數據,3 月降息的可能性也相當高。

即使在這種情況下,除非伴隨着重大的股市衝擊,否則在特朗普就職典禮之前,由於政策宣佈的風險,報告認為美元的即期匯率不太可能大幅波動。

儘管市場對美元的預期存在分歧,但瑞銀看多美元,認為特朗普的 “Maganomics” 議程將為美元提供持續的支持,並可能引發買入美元的跟風心理。

大漲之後,美元面臨方向選擇

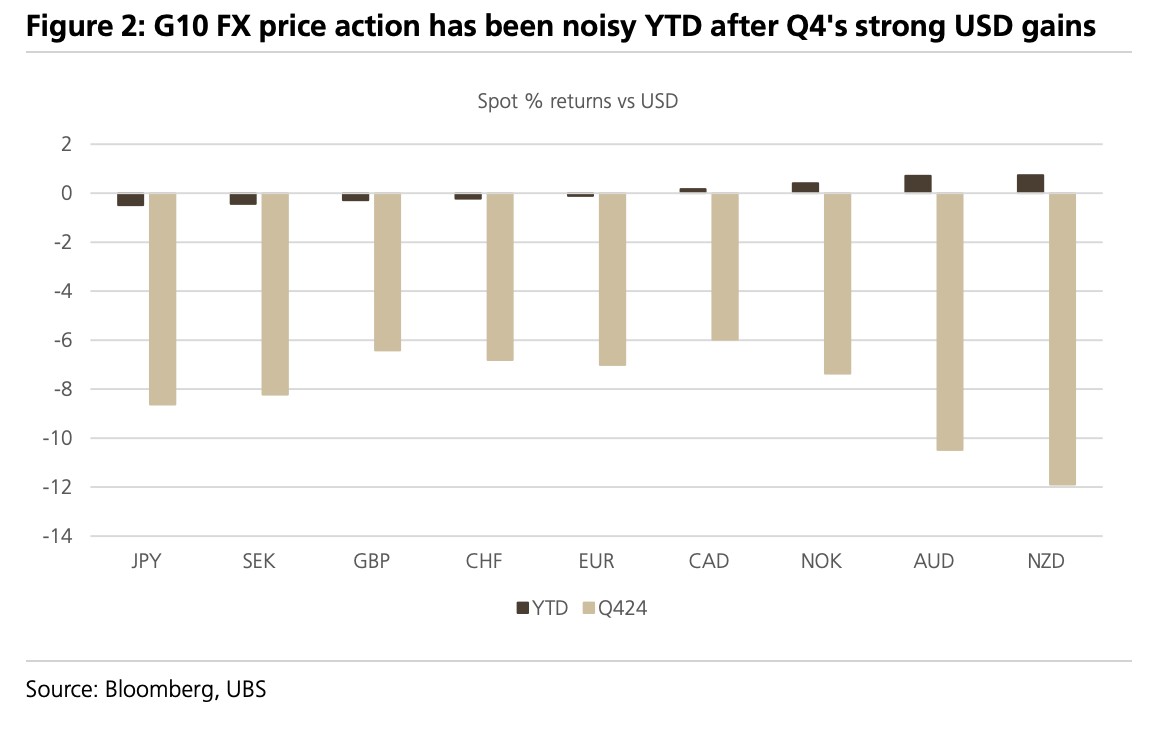

受特朗普勝選推動,美元在 2024 年第四季度兑 G10 國家貨幣實現了 6% 至 12% 的漲幅。

特朗普政府的政策目標,如廣泛關税、放鬆監管和新的財政寬鬆政策,都被市場定價為對美元有利。此外,美國相對強勁的經濟數據也助力美元走強,美國 10 年期國債收益率從 12 月 6 日的 4.15% 低點上升至接近 4.70%。

與此同時,美國以外地區的經濟數據依然疲軟,歐元區和英國的 12 月 PMI 數據表現不佳,日本央行也放棄了市場普遍預期的 12 月加息,這些因素都增加了美元的吸引力。

進入 2025 年,外匯交易員面臨着一個兩難困境。

一方面,推動美元在第四季度上漲的因素仍然存在,包括美國 10 年期實際收益率持續上升、特朗普政府可能實施的關税政策、市場對美聯儲降息的預期減少、美國股市的穩定表現以及資本流入等。

另一方面,市場也可能已經充分定價了上述對美元有利的因素,未來美元上漲的空間有限。此外,如果美國數據疲軟,未來兩年美聯儲降息的空間仍然很大,這可能會對美元產生壓力。

瑞銀認為,在這個關鍵時刻公佈的非農數據將成為決定性因素。

瑞銀繼續看多:Maganomics 為美元提供了長期支撐

瑞銀經濟學家預計,由於季節性因素和風暴後的影響,12 月非農就業人數將增加 18 萬人,高於市場普遍預期的 16 萬人和兩個月移動平均的 13.2 萬。瑞銀預計失業率將保持在 4.2%,平均時薪將增長 0.3%,工作時長保持穩定。

瑞銀表示,如果數據符合預期,美元短期內可能不會出現大幅波動。但如果出現顯著偏離預期的情況,可能會引發美元劇烈波動:

要對美元產生足夠的衝擊,例如使歐元兑美元測試 1.0550 或美元兑日元測試 155.00 的水平,需要出現低於 10 萬的就業增長數據,或者失業率至少上升到 4.4%——基本上是能夠讓市場完全定價今年至少兩次 25 個基點的降息的數據,3 月降息的可能性也相當高。即使在這種情況下,除非伴隨着重大的股市衝擊,否則在特朗普就職典禮之前,由於政策宣佈的風險,報告認為美元的即期匯率不太可能大幅波動。

另一方面,市場已經對美國通脹動態感到擔憂,那麼 22 萬或更多的就業增長數據將引發衝擊波,失業率下降至接近 4.0% 或平均時薪增長超過 0.4% 也將產生類似效果。在這種情況下,市場可能會試圖將今年美聯儲降息的預期最多定價為一次 25 個基點,如果在就職典禮後宣佈的 “Maganomics” 議程被視為具有攻擊性,這一預期可能會完全消失。在這種情況下,歐元兑美元可能會測試 1.0200 的新低,美元兑日元可能會突破 160.00,如果這些水平被突破,可能會出現更大的後續波動。

瑞銀還指出,從傳統的頭寸數據分析來看,市場對軟數據(如情緒或預期數據)的負面反應通常強於對硬數據(如 GDP 或就業數據)帶來的正面反應。

然而,瑞銀認為,特朗普的 “Maganomics” 政策議程為美元提供了長期支撐,同時市場存在買入美元的 “錯失恐懼症”(FOMO)心理。因此,與傳統觀點不同,報告認為當前市場更可能在強勁數據推動下助力美元走強,而不是在軟數據疲弱時導致美元大幅下跌。