Morgan Stanley's outlook on the top ten investment trends for 2025: nuclear energy revival, AI revolution in the financial industry, quantum computing, oral weight loss drugs

Morgan Stanley pointed out that historically, popular themes with strong profit momentum tend to have strong sustainability, such as AI, defense spending, and obesity drugs; negative pricing and quantum computing are expected to emerge as new investment hotspots

In 2025, what investment themes are worth paying attention to in the face of the rapidly changing global economy and markets?

On the 9th, Morgan Stanley released the "Top 10 Theme Strategies for 2025," where the Edward Stanley team analyzed important investment trends for the coming year.

Morgan Stanley pointed out that historically, popular themes with strong profit momentum tend to have significant sustainability, such as artificial intelligence, defense spending, and obesity drugs. These themes have already had a profound impact on the market, and this impact is expected to continue to expand this year.

Additionally, some themes that have not yet received full attention from investors may become increasingly important in 2025, such as negative electricity prices and quantum computing. These themes are expected to emerge as new investment hotspots.

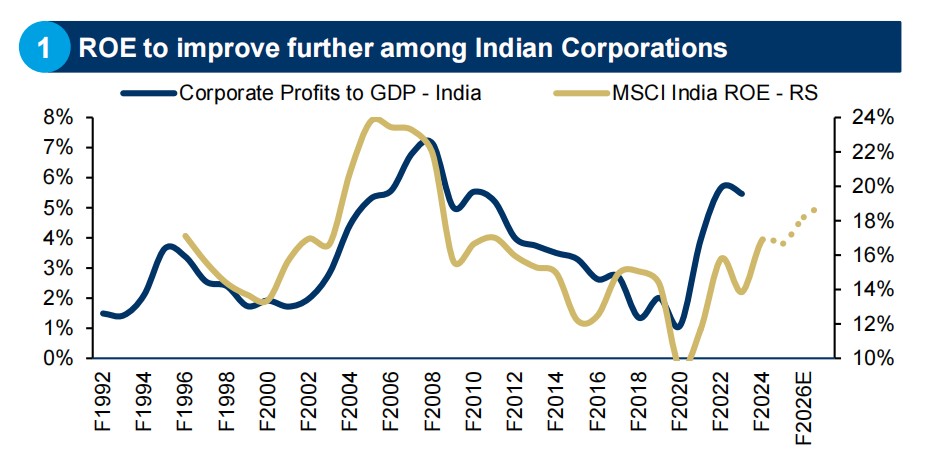

1. India's Golden Decade

Morgan Stanley expects that in 2025, the Indian economy will continue to be a highlight among emerging markets. Thanks to strong domestic demand growth, India's GDP growth rate is expected to reach 6.5%.

The report noted that the balance sheets of Indian companies and the financial sector are robust, and there is ample policy space, which supports economic development. The recovery of consumer demand, improvement in the rural economy, and growth in public and household capital expenditures will be the main drivers of the Indian economy.

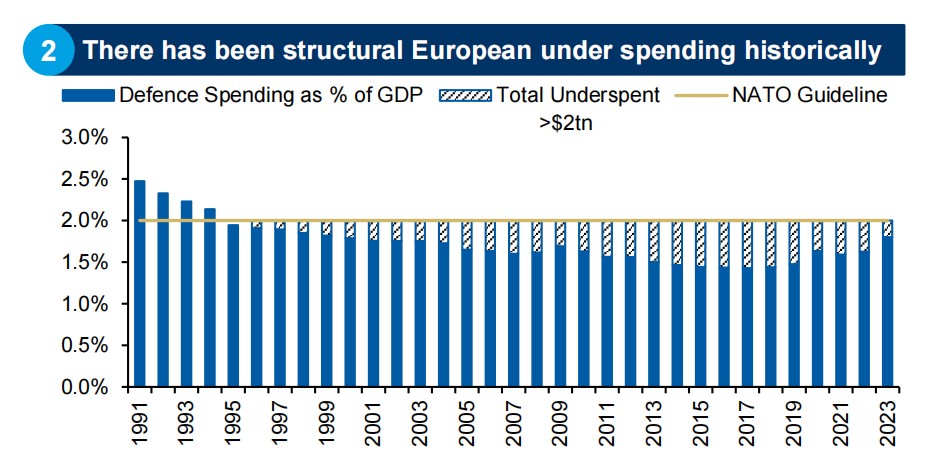

2. Rising European Defense Spending

Morgan Stanley pointed out that European defense spending has entered a multi-year growth phase, driven by factors including: compensating for low investments over the past 30 years, reducing dependence on U.S. defense support, and replenishing military equipment stocks after the Russia-Ukraine conflict.

Morgan Stanley predicts that to fill the investment gap of the past, Europe needs to increase defense spending by over $2 trillion at current prices. Additionally, NATO allies may respond to U.S. requests to increase their respective defense budget ratios, further deepening this trend.

3. Recovery of Mergers and Acquisitions and IPOs

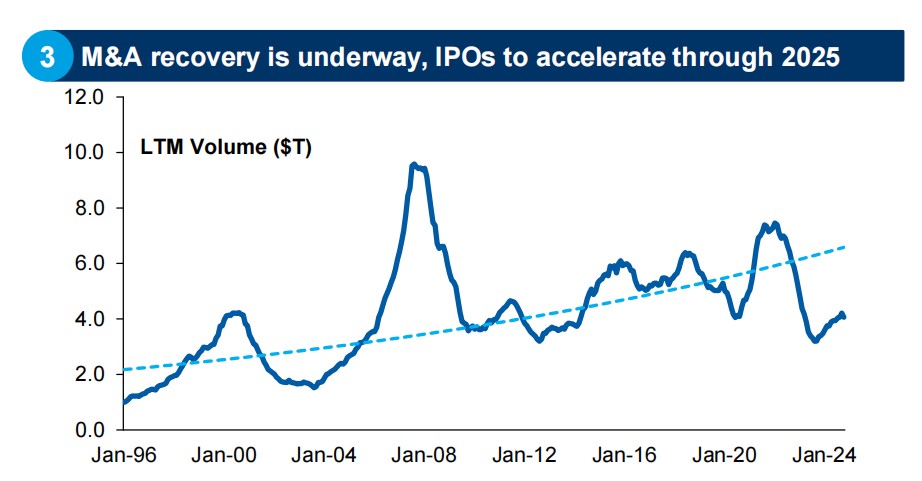

With declining interest rates and an improving capital market environment, global mergers and acquisitions and IPO activities are expected to see a recovery.

Morgan Stanley estimates that the volume of merger announcements in 2025 will increase by 50% year-on-year. This is attributed to lower interest rates, a strong stock market, and corporate confidence. A Republican victory in the presidential election may further promote regulatory policy relaxation, accelerating this trend.

Particularly in Europe, a 49% year-on-year growth is expected to lead, while the U.S. has $4 trillion in "dry powder" (uninvested private equity funds) waiting to be deployed in the market. Additionally, companies hold $7.5 trillion in cash reserves, creating favorable conditions for mergers and acquisitions and IPOs

4. The Repatriation of American Manufacturing

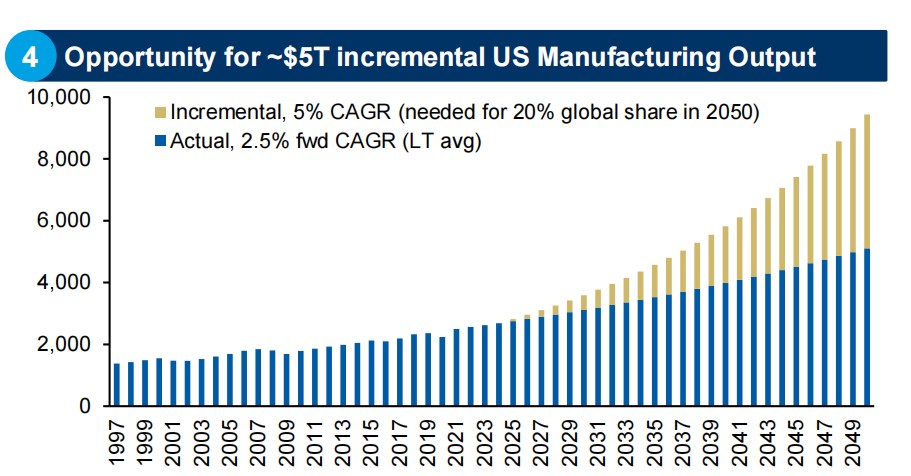

The report states that the United States is in the early stages of re-industrialization, a process that will represent a long-term economic opportunity of up to $10 trillion.

American manufacturing has experienced significant decline over the past 20 years. While it is commonly believed that "reshoring" refers to closing factories in Asia and then reopening alternative factories in the U.S., Morgan Stanley indicates that this is only an exception.

"We believe that there is a need to increase manufacturing capacity globally, and due to its structural and resilience emphasis, the U.S. is more capable of acquiring new factories than it has been in the past 40 years."

Morgan Stanley points out that the U.S. is the least self-sufficient country among major global economies, a phenomenon expected to improve over the coming decades.

5. The Renaissance of Nuclear Energy

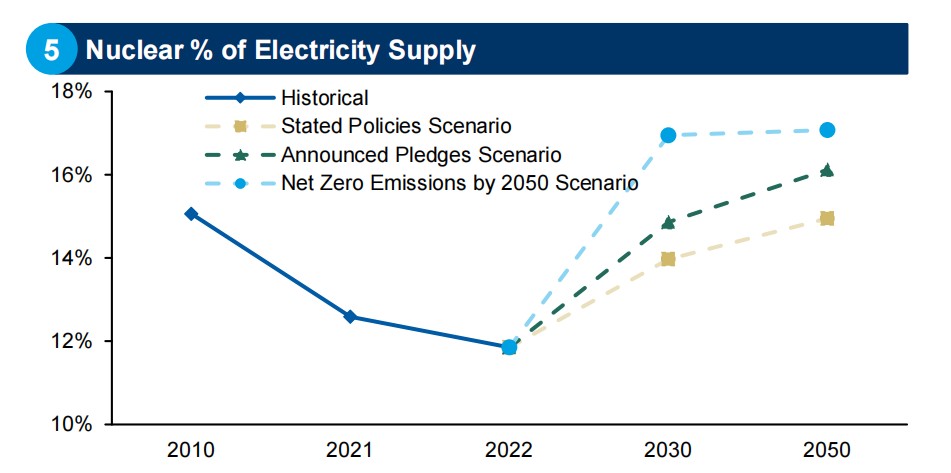

Nuclear energy is regaining attention due to its potential in decarbonization, energy security, and support from artificial intelligence technologies. Morgan Stanley predicts that by 2050, the share of nuclear energy in global electricity supply will increase from 12% in 2022 to 17%.

The development of small modular reactors (SMRs), innovations in nuclear financing models, and the push for carbon neutrality will create over $1.5 trillion in investment opportunities for the nuclear energy sector.

"We believe there are five major trends in the nuclear renaissance: COP28 goals, GenAI, financing, construction risks, and SMR."

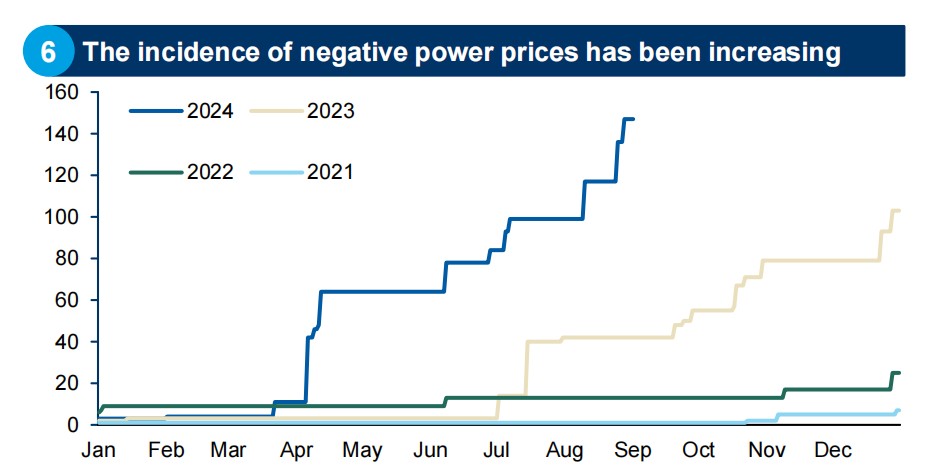

6. The Rise of Negative Electricity Prices

The European renewable energy market is facing the increasing challenge of negative electricity prices, and with the continued growth of renewable energy capacity, this trend is expected to persist. Morgan Stanley believes that negative electricity prices pose risks to renewable energy developers, but also present opportunities for grid infrastructure development.

Morgan Stanley notes that companies capable of flexibly adjusting power generation (such as energy storage and smart grids) will benefit from this situation. For example, pumped storage power stations can store electricity when prices are negative and release electricity during peak prices to profit.

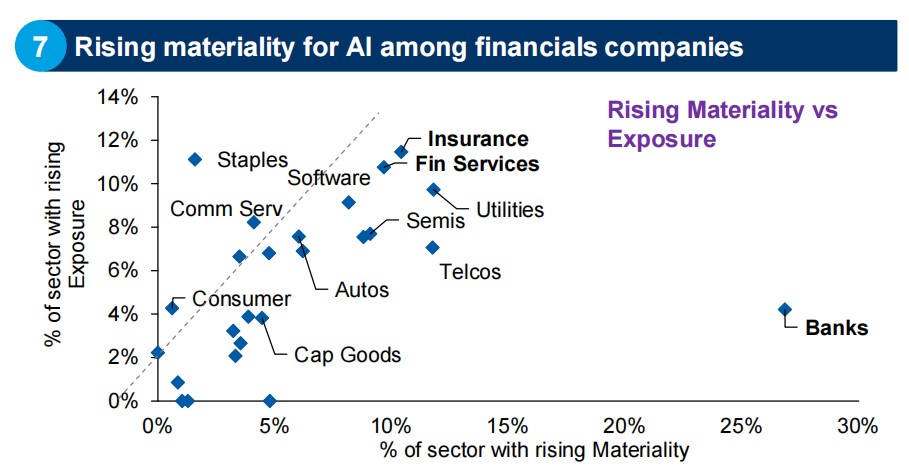

7. The AI Revolution in the Financial Industry

The application of artificial intelligence in the financial industry is experiencing explosive growth. Morgan Stanley points out that banks and insurance companies are the leaders in AI applications In a recent analyst survey, 27% of financial companies achieved substantial improvements in their business due to AI applications. In the future, AI application scenarios in the financial sector will include risk management, customer service automation, and investment advice optimization, which brings significant investment opportunities for financial stocks.

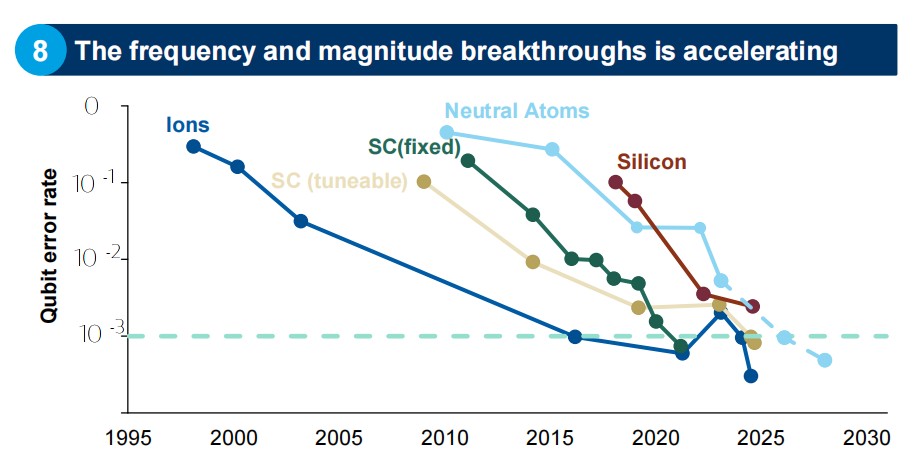

8. Preliminary Exploration of Quantum Computing

Quantum computing is viewed by Morgan Stanley as a "known unknown," with potentially far-reaching long-term impacts.

Although quantum computing is still in its early development stage, the report suggests that businesses and governments need to proactively lay out plans in related fields, such as post-quantum cryptography, to address potential cybersecurity threats in the future. Additionally, quantum computing also brings investment opportunities in telecommunications, satellite, and network infrastructure.

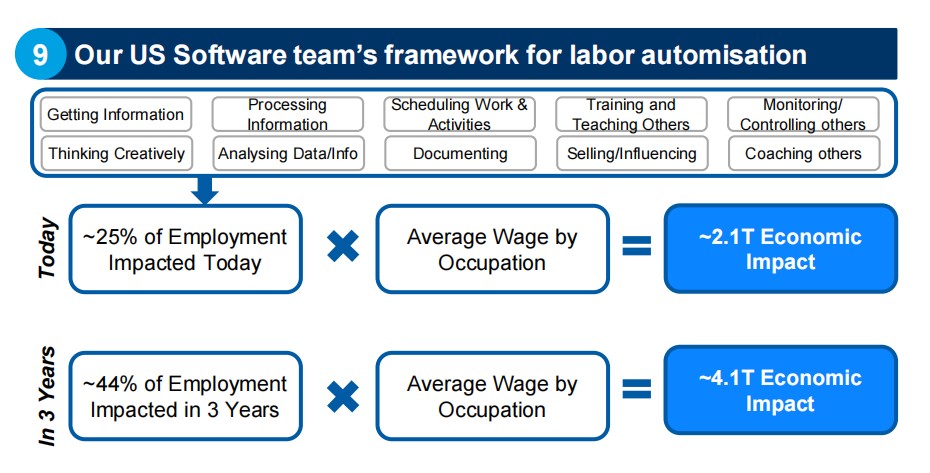

9. The Rise of AI Agent Technology

Morgan Stanley points out that generative AI has made significant breakthroughs in the past two years, and by 2025, it will enter the development stage of AI agents (Agentic AI).

This technology will shift AI from a passive response mode to a new stage of actively solving problems and enhancing productivity. For example, AI agents can predict user needs, automate tasks, and significantly improve the efficiency of businesses and individuals. Morgan Stanley expects this trend to bring trillions of dollars in economic impact to the enterprise software market.

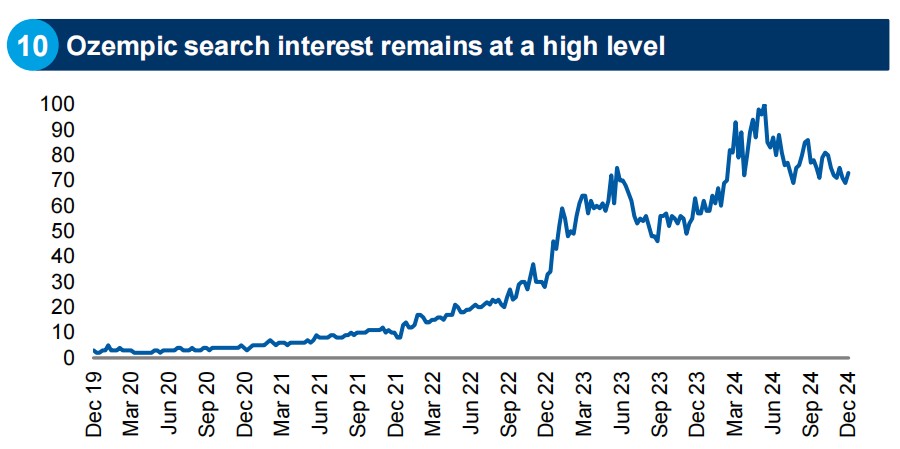

10. Market Potential of Oral Weight Loss Drugs

The obesity drug market faced a bottleneck in 2023 due to a supply shortage of injectable GLP-1 drugs. Morgan Stanley believes that the launch of oral GLP-1 drugs in 2025 will reignite market interest and may drive obesity drugs to become one of the largest single categories in the history of the pharmaceutical industry.

Moreover, the increasing health awareness among consumers will also positively impact investments in health foods and related fields.