What is the Bank of Japan "dragging" on?

The Bank of Japan plans to postpone interest rate hikes until March due to increased uncertainty brought by U.S. President Trump. Although the rise in Japanese wages has expanded, indicating that the conditions for rate hikes are maturing, real wages have continued to decline, and consumer spending and confidence remain sluggish, creating no urgent need for rate hikes to curb inflation. Japan's economic recovery relies on inflation, but the actual purchasing power has failed to keep up, leading to weak economic growth. Japanese stocks face challenges in the context of interest rate hikes, and weak economic data forces the central bank to ramp up bond purchases again, creating a vicious cycle

Bank of Japan Plans to Delay Interest Rate Hike Until March

On January 9, former policy committee member of the Bank of Japan, Makoto Sakurai, stated,

“Given the increasing uncertainty brought by the election of Donald Trump as President of the United States, the likelihood of the Bank of Japan delaying its interest rate hike until March is increasing.”

On the same day, Reuters reported that the Bank of Japan stated,

“Due to structural labor shortages making companies more aware of the necessity to continue raising wages, the extent of wage increases in Japan is expanding, indicating that the conditions for a rate hike are continuously being met.”

Taken together, this means that the Bank of Japan believes the internal conditions for a rate hike are ripe, but external uncertainties from Trump make them hesitant to act rashly.

Is this really the case? Has the Japanese economy overheated to the point where further rate hikes are needed to suppress it?

Recovery Built on Inflation

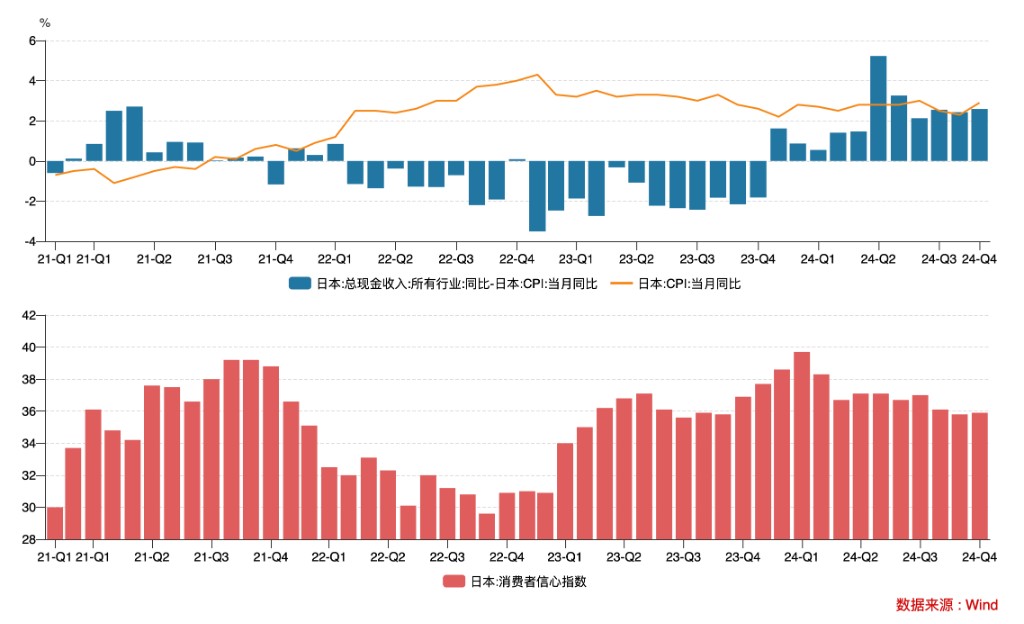

On January 9, Japan's Ministry of Health, Labour and Welfare released data showing that nominal wages in Japan increased by 3% year-on-year in November, better than economists' expectations of 2.7%.

However, real wages in Japan fell by 0.3% year-on-year in November, marking the fourth consecutive month of decline.

Currently, while Japan's inflation growth rate is indeed declining, it still exceeds the growth rate of residents' real income. The actual purchasing power cannot keep up with inflation, leading to continued low consumer spending and confidence in Japan. In this context, there is no urgent need for a rate hike to suppress inflation.

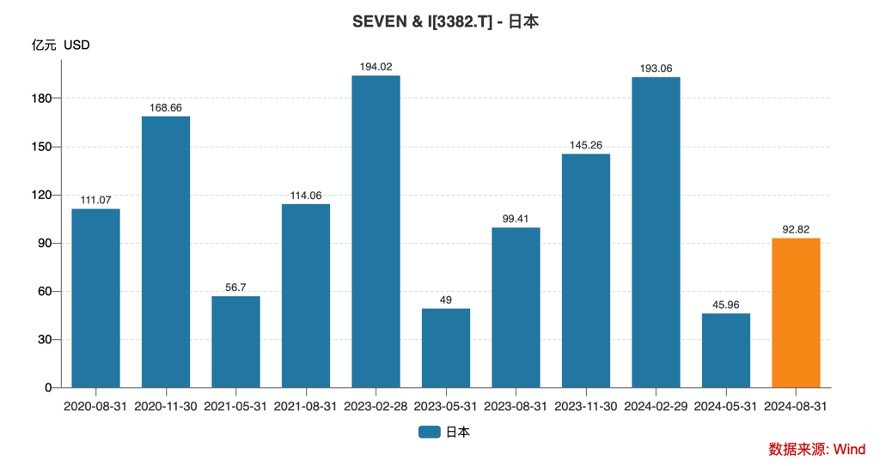

Japan's largest retail chain, "7-11," which derives about a quarter of its revenue from Japan, reported that its parent company Seven&I's revenue in Japan for the second quarter of fiscal year 2024 (June-August) was $9.282 billion, a year-on-year decline of 6.6%.

Japanese Stocks Also Benefit from Inflation.

For Japan, the initial narrative of its stock market trading was “inflation rebound -> income increase -> economic recovery,” but there is a discrepancy between reality and expectations, and the aforementioned chain has yet to be realized. Raising interest rates in this context would break the original logic.

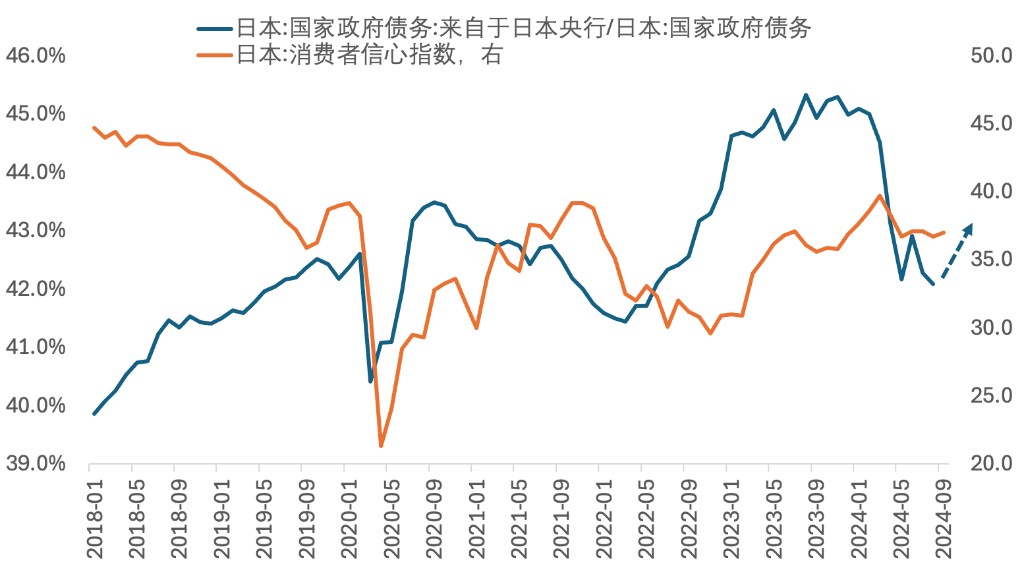

Another perspective is to combine Japanese consumer confidence with the Bank of Japan's easing efforts:

Since the pandemic, the Bank of Japan has attempted three times to reduce its holdings of government debt. However, each time, it has dragged down the Japanese economy, with actual GDP growth rate, private consumption expenditure, and consumer confidence index all declining. After observing the marginal weakness in the economy, the Bank of Japan had to increase its bond purchases again, creating a cycle. Currently, they have yet to break free from this spiral.

Japanese Stocks, Can They Withstand Interest Rate Hikes?

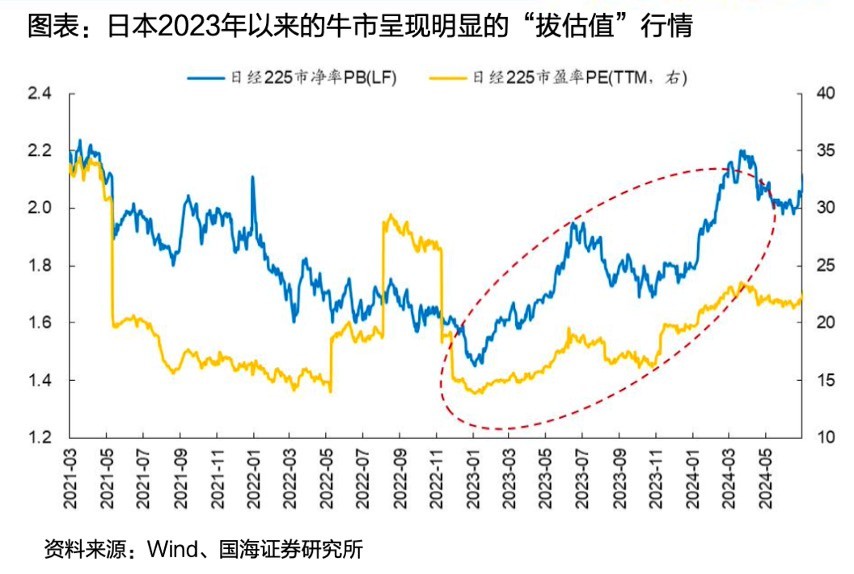

In the past two years, Japanese stocks have been favored by international investors, reaching a new high since 1989. However, behind the surge, it is more about valuation expansion.

According to Guohai Securities' estimates, during the bull market from 2023 to the first half of 2024, the Nikkei 225 index rose by 62% overall, with an EPS contribution of -4% and a valuation contribution of 104%.