加州山火持续肆虐,美国保险业受创,保险公司股价大跌

The California wildfires continue to spread, causing severe losses to local residents and businesses, while also putting immense pressure on the insurance industry. Several insurance companies saw their stock prices plummet, with Allstate down over 7% and Chubb down over 5.4%. JP Morgan analysis pointed out that Allstate, Chubb, and Travelers face compensation risks, with losses estimated to exceed $20 billion, making it the most expensive wildfire in California's history. The Palisades fire is the largest, having burned over 17,000 acres of land and destroyed more than 1,000 buildings

As the wildfires in Los Angeles continue to spread, causing severe losses to local residents and businesses, they are also putting immense pressure on the insurance industry. Due to the potential for massive compensation claims resulting from the wildfires, the stock prices of several insurance and reinsurance companies have collectively declined.

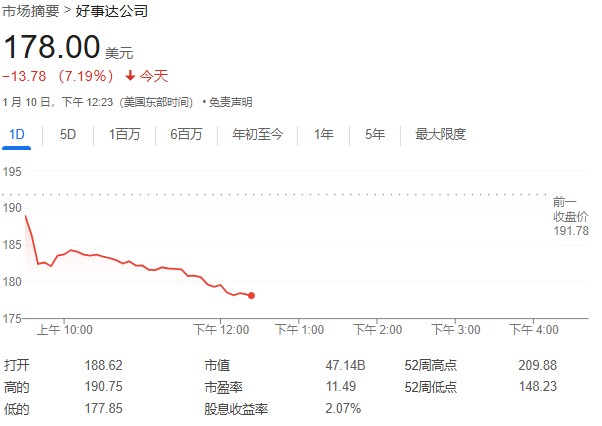

On Friday morning, during early trading in the U.S. stock market, the stock prices of insurance companies heavily involved in the California homeowners market saw significant drops, with Allstate falling over 7% at one point, Chubb dropping over 5.4%, AIG declining nearly 3.1%, and Travelers decreasing nearly 4.5%.

JP Morgan's analysis pointed out that Allstate, Chubb, and Travelers are the insurance companies facing the greatest compensation risks from this wildfire, particularly Chubb, which primarily serves high-net-worth clients, potentially exposing the company to higher risk.

Additionally, reinsurance companies were not spared. On Friday morning, Arch Capital Group fell over 1.5% at one point, and RenaissanceRe Holdings dropped over 2.6%. JP Morgan noted that the increase in estimated losses raises the likelihood of reinsurance clauses being triggered for various insurance companies.

Could Become California's Most Expensive Wildfire in History

This wildfire could become the most costly in California's history. According to JP Morgan's estimates on Thursday, the insurance losses from this week's wildfires could exceed $20 billion, and if the fire continues to spread, this figure could be even higher. This loss is expected to far surpass the $12.5 billion in insurance losses caused by the 2018 Camp Fire. According to Aon data, the Camp Fire was previously the most expensive wildfire in U.S. history.

Moody's Ratings also anticipates that due to the high value of homes and businesses in the affected areas, the insurance losses from this wildfire could reach billions of dollars.

Among the five fires, the Palisades fire is the largest. According to official statistics from California, this fire has burned over 17,000 acres of land and destroyed more than 1,000 buildings. The Pacific Palisades area is a wealthy community, and JP Morgan noted that the median home price in the area exceeds $3 million.

Regarding the compensation issues that may arise from this fire, according to a document submitted by a company to regulators, insurance companies have requested Southern California Edison to preserve evidence related to the Los Angeles wildfires.

Risk Warning and Disclaimer

The market carries risks, and investment should be approached with caution. This article does not constitute personal investment advice and does not take into account the specific investment objectives, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investing based on this is at one's own risk