"Back to square one overnight"! U.S. stocks erased gains after the election, and the employment report raised concerns on Wall Street about a "double loss" in stocks and bonds

Measured by the performance of the world's largest ETFs tracking the S&P and long-term U.S. Treasuries, the total returns of U.S. stocks and bonds have been negative for five consecutive weeks, marking the longest streak of negative returns since September 2023. Friday's non-farm payroll report raised concerns among traders about the Federal Reserve closing the door on this round of easing

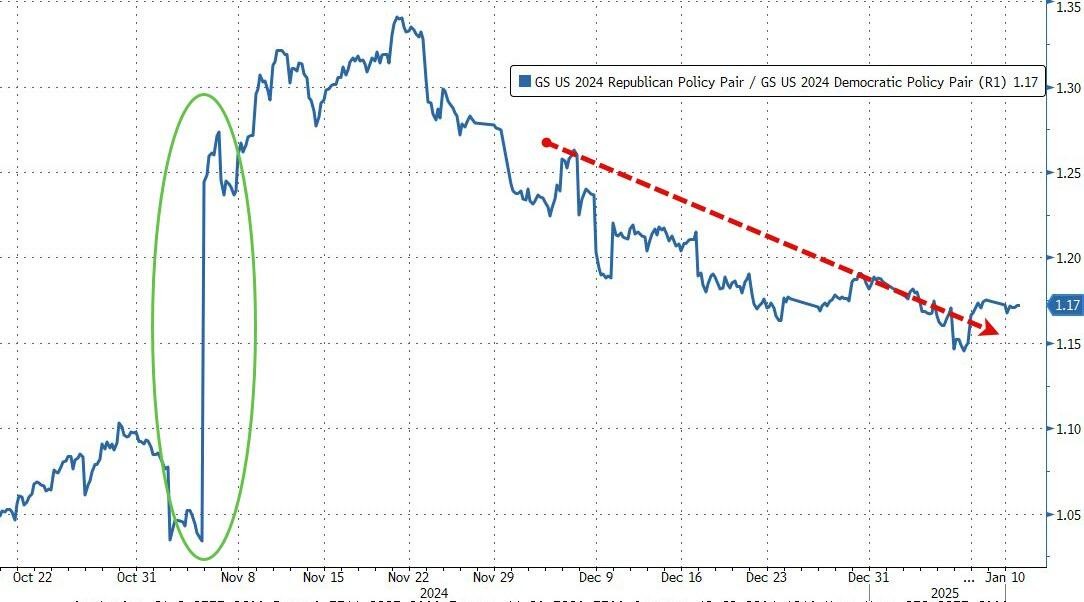

Only ten days into 2025, and with just six trading days in the U.S. stock market, the S&P 500 index has "returned to square one overnight": it closed at a new low on Friday, the lowest since November 5 of last year, erasing all gains since the U.S. elections.

This week's non-farm payroll report dashed hopes for a smooth rise in U.S. stocks this year, as the report led traders to interpret the strengthening signs in the U.S. labor market pessimistically. It is expected that the report may close the door on the easing initiated by the Federal Reserve in September last year, turning good economic news into bad news for the market.

Bloomberg reported that an increasing number of market turbulence victims are the so-called risk assets of the Trump trade, which were expected to boost the stock market due to anticipated tax cuts and deregulation after Trump's ascension. In reality, investors are facing trades they do not want to see: rising bond yields, driven by market concerns that uncontrolled fiscal spending and trade tariffs will exacerbate inflation. This situation raises fears of a "double loss" for stocks and bonds. Under a macro-driven investment mechanism, the correlation between stocks and bonds is higher.

Measured by the performance of the world's largest ETF tracking the S&P 500 index and long-term U.S. Treasury bonds, the total returns of U.S. stocks and bonds have been negative for five consecutive weeks, marking the longest streak of negative returns since September 2023.

According to reports, Bill Harnisch, who has spent over fifty years on Wall Street and manages the $1.5 billion hedge fund Peconic Partners, is one of the few who foresaw this situation. Peconic Partners has achieved a return rate of 192% for most of the past four years. Due to concerns that both weak and strong economic conditions could pose risks to bulls, the fund has been reducing leverage, shorting real estate-related stocks, and limiting exposure to tech giants.

Harnisch commented on Friday that we are now facing a "double loss situation." He stated that accelerated growth in the U.S. economy could prompt the Federal Reserve to tighten again. "We believe this is a very dangerous market."

Priya Misra, a portfolio manager at JP Morgan Asset Management, commented, "The past few weeks may be a preview of the year ahead. It is not only not easy but also turbulent and chaotic— the Federal Reserve is holding steady, valuations are high (all assets are priced with optimism and a soft landing), and the uncertainty of dual policies is at play."

Dan Suzuki, Deputy Chief Investment Officer at Richard Bernstein Advisors, stated that the stronger the economic growth is unexpectedly, the more concerned investors become about its impact on inflation. "The closer we get to no rate cuts and possible rate hikes, the closer the 10-year (U.S.) Treasury bond yield gets to a new cycle high, and investors start to worry more about what this means for liquidity, growth, and credit issues." After the non-farm payroll report was released, the consumer survey results published by the University of Michigan this Friday raised new inflation concerns. The survey showed that consumers' long-term inflation expectations for the next five to ten years rose from 3.0% in December to 3.3%, the highest level since 2008, exacerbating worries about persistent high inflation; consumers' inflation expectations for the next year increased from 2.8% to 3.3%, the highest level in eight months.

The University of Michigan report stated that the inflation expectation data from the survey was influenced by anticipated future policies of the Trump administration. The proportion of consumers worried about future tariff increases continues to rise. Nearly one-third of consumers spontaneously mentioned tariffs, a higher proportion than the 24% in the December survey and less than 2% before the U.S. election. These consumers generally indicated that higher tariffs would be passed on to consumers in the form of price increases, raising their inflation expectations.

Joanne Hsu, the director of the consumer survey, stated: "Inflation expectations have risen across multiple groups, both in the short term and long term, with particularly strong increases among low-income consumers and independent consumers."