How can the UK emerge from the crisis? The depreciation of the pound may be a way out

Concerns about the UK's dual deficit crisis are rising, and Deutsche Bank believes that the depreciation of the pound may be a solution. Depreciation can improve net external liabilities, lower asset prices to attract international investment, and adjust the current account deficit. The current crisis stems from external pressures, with UK government bonds moving in sync with US Treasuries, making it vulnerable due to reliance on external financing. Analysis indicates that the current account deficit is a key factor affecting fiscal risk

Nearly three years later, the market is once again concerned about the possibility of a "twin deficit crisis" (fiscal deficit + current account deficit) in the UK. However, according to Deutsche Bank, this situation is different from that in 2022.

Therefore, Deutsche Bank believes that this time, a depreciation of the pound may be the answer for the UK to emerge from the crisis, with three main effects:

- Improving the net external liabilities situation through the revaluation of overseas assets held by the UK;

- Lowering the prices of UK assets (including government bonds), making them more attractive in the international market;

- Helping to adjust the current account deficit and reduce the UK's reliance on foreign funds.

Deutsche Bank believes that the reason for adopting this approach is that the severe fluctuations in the UK bond market this time are mainly due to "external pressures," unlike the "internal turmoil" of 2022.

The economic crisis in the UK back then was entirely caused by domestic policies, leading to a disconnection between the fluctuations in the UK bond market and those in other countries' bond markets, resulting in a unique sell-off.

In contrast, the current turmoil in UK bonds is not caused by the UK government itself; the movements of UK bonds are almost synchronized with US bonds, without the disconnection seen in other bond markets, which has led to a lack of effective solutions.

The yield spread between 10-year US Treasuries and UK gilts (UST - Gilt spread) has not changed much in recent months, remaining at roughly the same level as six months ago.

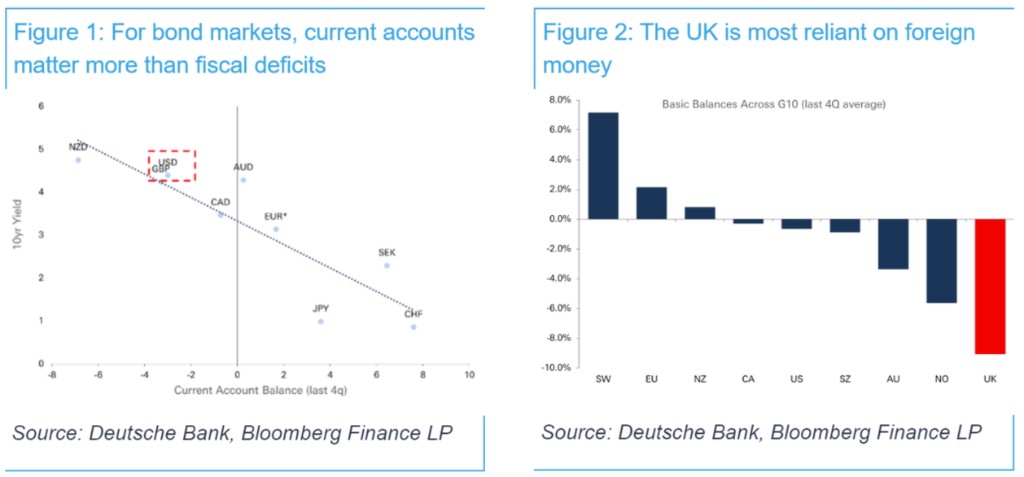

Analysts point out that the fundamental problem facing the UK today is not high debt or low growth, but the UK's external deficit—for years, analysts have argued that it is the current account, not the fiscal account, that determines the fiscal risks of developed markets. Currently, the relationship between the UK's current account deficit and yields is closer than any fiscal indicator.

Undoubtedly, the more a country relies on foreign financing to issue domestic debt, the more susceptible it is to global conditions. From the perspective of external capital flows, the UK is the most vulnerable among G10 countries, as it has a huge current account deficit and capital flow deficit.

Thus, it can be seen that the marginal price setter for UK government bonds is not domestic policy, but global yields (i.e., US Treasuries). When US Treasuries are sold off, UK government bonds naturally decline more severely than other bond markets.

Deutsche Bank stated that they had already begun to adopt a cautious stance on the pound at the end of last year and warned investors that the hot money arbitrage inflows accumulated over the past 12 months may face the risk of reversal—against the backdrop of rising global uncertainty (especially US Treasury yields), small open economies like the UK will become more vulnerable Risk Warning and Disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk