U.S. Treasury yields break 5%, has the $18 trillion rally in the S&P 500 come to an end?

U.S. Treasury yields have surpassed 5%, raising concerns on Wall Street that this could undermine the upward momentum of the S&P 500. Since the beginning of 2023, the S&P 500 has risen over 50%, adding $18 trillion in market value. However, with rising bond yields, the risks in the stock market have increased, and traders are beginning to focus on the possibility of the 10-year Treasury yield approaching 5%, which could trigger a market correction

The Zhitong Finance APP noted that for many years, there seemed to be nothing that could stop the unstoppable rise of the stock market, with the S&P 500 soaring more than 50% from the beginning of 2023 to the end of 2024, adding $18 trillion in value in the process. However, Wall Street is now seeing a factor that could ultimately undermine this rally: U.S. Treasury yields exceeding 5%.

For months, stock traders have dismissed warnings from the bond market, focusing instead on the windfall from tax cuts promised by President Trump and the seemingly limitless possibilities of artificial intelligence. But as U.S. Treasury yields climbed to an ominous milestone, stock prices fell, and risk became the focus last week.

The 20-year U.S. Treasury yield broke above 5% on Wednesday and rose back above that level on Friday, reaching its highest level since November 2, 2023. Meanwhile, the 30-year U.S. Treasury yield briefly surpassed 5% on Friday, reaching its highest level since October 31, 2023. These yields have risen about 100 basis points since the Federal Reserve began lowering the federal funds rate in mid-September, while the federal funds rate has decreased by 100 basis points during the same period.

Jeff Blazek, Co-Chief Investment Officer of Multi-Asset Strategies at Neuberger Berman, stated, "This is unusual." He added that over the past 30 years, mid-term and long-term bond yields have remained relatively stable or slightly increased in the months following the Fed's initiation of a series of rate cuts.

Traders are watching the policy-sensitive 10-year U.S. Treasury yield, which has reached its highest level since October 2023 and is rapidly approaching 5%. They are concerned that this level could trigger a stock market correction. The last time this yield briefly surpassed this threshold was in October 2023, and before that, you would have to go back to July 2007.

Matt Peron, Head of Global Solutions at Janus Henderson, stated, "If the 10-year Treasury yield reaches 5%, investors will instinctively sell stocks. This situation could take weeks or even months to resolve, during which the S&P 500 could drop by 10%."

The reason is simple: rising bond yields make U.S. Treasury yields more attractive while also increasing the cost for companies to raise funds.

On Friday, the spillover effect on the stock market was evident, with the S&P 500 falling 1.5%, marking the largest single-day decline since mid-December, and the 2025 rally turning negative, nearly erasing all gains from the excitement following Trump's election in November

Establishing Barriers

Kristy Akullian, Head of Investment Strategy at BlackRock iShares, stated that while there is "no magic" to the obsession with 5% beyond the psychological factor of whole numbers, perceived barriers can create "technical obstacles." This means that rapid fluctuations in yields may make it difficult for the stock market to rise.

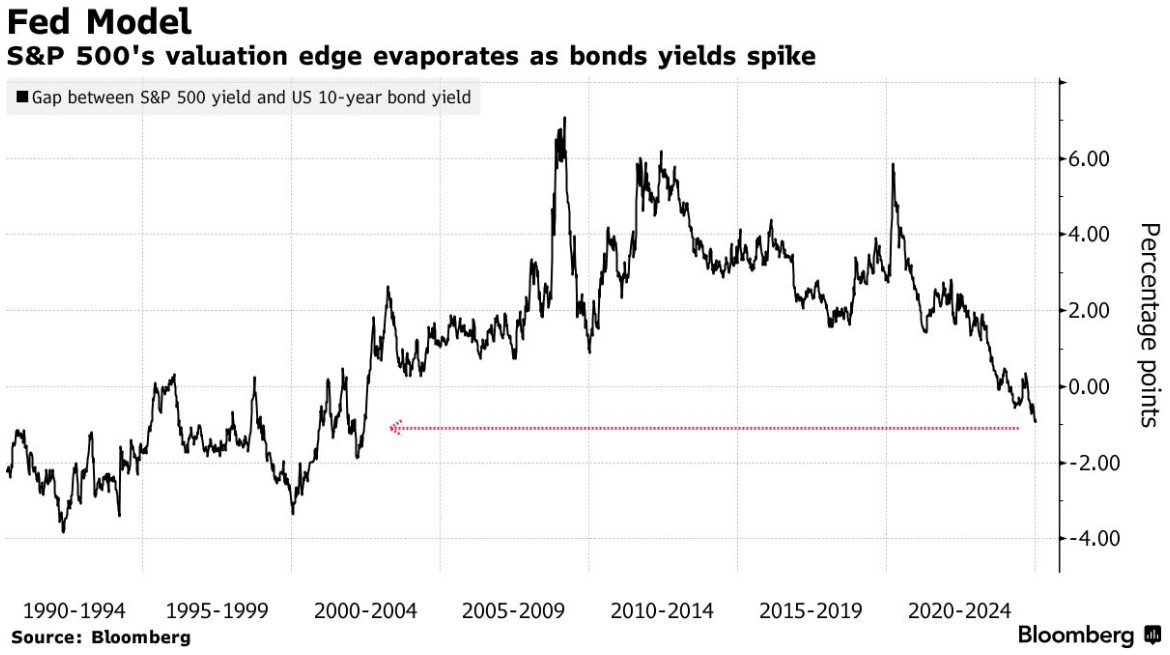

Investors have already seen this. The yield on the S&P 500 is 1 percentage point lower than the yield on 10-year U.S. Treasury bonds, a situation that hasn't occurred since 2002. In other words, the returns on assets that carry much lower risk than the U.S. stock benchmark haven't been this good in a long time.

Mike Reynolds, Vice President of Investment Strategy at Glenmede Trust, said, "Once yields rise, it becomes increasingly difficult to justify valuation levels. Problems arise if earnings growth starts to slow."

Unsurprisingly, strategists and portfolio managers predict a bumpy road ahead for the stock market. Mike Wilson of Morgan Stanley expects the stock market to struggle over the next six months, while Citigroup's wealth management division has informed clients that there are buying opportunities in bonds.

On Friday, strong employment data led economists to lower expectations for interest rate cuts this year, making the path to a 5% yield on 10-year U.S. Treasury bonds more realistic. But this is not just a Federal Reserve issue. The bond sell-off is global, rooted in persistently high inflation rates, a hawkish stance from central banks, ballooning government debt, and the extreme uncertainty brought by the incoming Trump administration.

Mark Malek, Chief Investment Officer at Siebert, stated, "When you're at a disadvantage, yields above 5% mean that everything is unpredictable."

What equity investors now need to know is whether serious buyers are stepping in and when they will do so.

"The real question is how we will develop next," said Rick de los Reyes, a portfolio manager at Prudential Securities. "If rates hover between 5% and 6%, people will be concerned; if rates hover around 5% and then stabilize and eventually decline, then everything will be fine."

Danger Signals

Market experts say the key is not the rise in yields, but why they are rising. A slow rise in yields can boost the stock market as the U.S. economy improves. However, a rapid rise in yields due to concerns about inflation, federal deficits, and policy uncertainty is a dangerous signal.

In recent years, whenever yields have risen rapidly, stocks have been sold off. What’s different this time is that investors seem complacent, as seen in their optimistic attitude in the face of valuation bubbles and uncertainty surrounding Trump’s policies. This leaves the stock market in a vulnerable position"When you see rising prices, a strong job market, and a robust economy overall, all of this indicates that inflation may rise," said Eric Diton, president of Wealth Alliance. "This does not even include Trump's policies."

One area that could become a safe haven for stock investors is the group that has driven most of the gains over the past few years: large technology companies. The so-called seven giants—Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla—are still achieving rapid profit growth and massive cash flow. Furthermore, looking ahead, they are expected to be the biggest beneficiaries of the artificial intelligence revolution.

Eric Sterner, chief investment officer of Apollon Wealth, stated, "During market turbulence, investors typically look for high-quality stocks with strong balance sheets and cash flow. Large tech stocks have recently become part of this defensive strategy."

This is what many stock investors hope for, that the influence of mega-cap tech companies and their relative safety will limit any weakness in the stock market. The seven giants account for over 30% of the S&P 500 index.

Meanwhile, the Federal Reserve is cutting interest rates, although the pace of cuts may be slower than expected. This is in stark contrast to 2022, when the Fed rapidly raised rates, causing the index to plummet.

However, as interest rate risks can manifest in various unexpected ways, many Wall Street professionals still urge investors to proceed with caution for the time being.

Peron from Janus Henderson stated, "The companies with the largest gains in the S&P 500 index may be the most vulnerable, which could include the 'seven giants,' while some bubbly growth areas in small and mid-cap stocks may face pressure. Our firm has consistently focused on quality and valuation. This will be very important in the coming months."