Don't just focus on U.S. Treasuries, the "real risk" of the Nasdaq is approaching

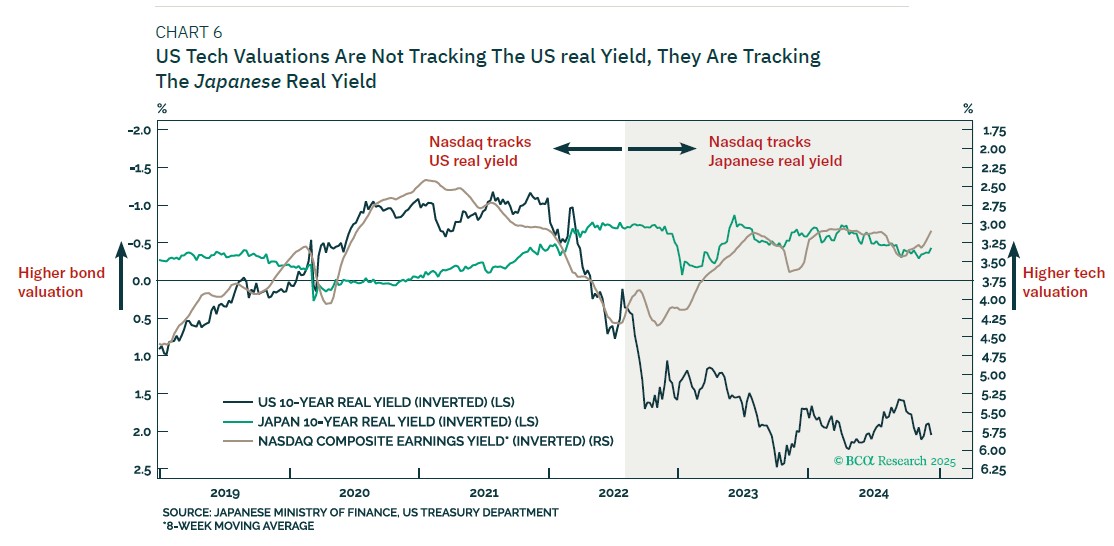

From 2023 to 2024, the returns of the Nasdaq index moved almost in sync with the real bond yields in Japan. This means that the biggest risk to the valuation of U.S. tech stocks does not come from the rise in U.S. real bond yields, but rather from the rise in Japanese real bond yields

Japan's inflation expectations are approaching the target, which may trigger the normalization of monetary policy, thereby having a significant impact on the U.S. stock market represented by the Nasdaq.

Dhaval Joshi, Chief Strategist at BCA Research, pointed out that the main reason the Bank of Japan has long implemented a zero interest rate policy is that inflation has remained below the 2% target for an extended period. However, recent Japanese inflation expectations are nearing the 2% target level. This means that the justification for the Bank of Japan to maintain a zero interest rate policy is fading, especially considering that Japan's real bond yields are already deeply negative.

The article further argues that the normalization of Japan's monetary policy could pose significant risks to global stock markets, including the United States. This is because, over the past few years, Japan has been a major source of liquidity in the global financial markets, driving up stock market valuations.

U.S. Tech Stock Valuations Highly Correlated with Japanese Bond Yields

Joshi noted in the article that from 2019 to 2022, the valuation (earnings yield) of the Nasdaq was perfectly synchronized with U.S. real bond yields, as expected. However, by the end of 2022, the Nasdaq's valuation diverged from U.S. real yields and became linked to Japan, which has the last negative real bond yields in the world.

Interestingly, from 2023 to 2024, the yield of the Nasdaq index has almost moved in sync with Japan's real bond yields. This indicates that the biggest risk facing U.S. tech stock valuations does not come from rising U.S. real bond yields, but rather from rising Japanese real bond yields.

It is precisely because Japan's real yields have not yet risen significantly that U.S. tech stock valuations have not been notably affected. However, from a structural time frame of 1-2 years, it is likely that Japan's real yields will rise. This will end the main source of liquidity that has driven the surge in stock market valuations in 2023-2024.

Therefore, Joshi expects that within this structural (1-2 year) time frame, significant setbacks are anticipated for stocks relative to bonds, especially for U.S. superstar stocks.

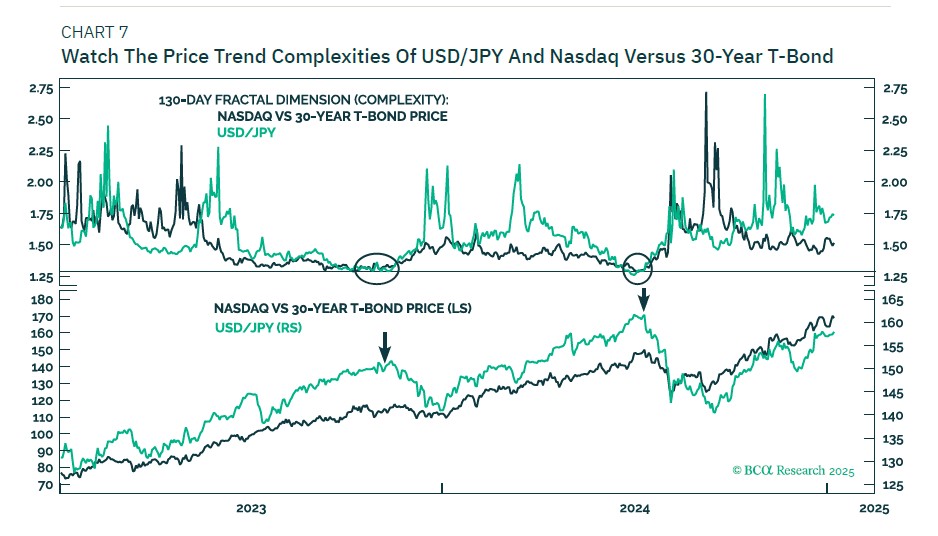

Joshi suggests that investors pay attention to indicators such as the USD/JPY exchange rate and the ratio of the Nasdaq index to 30-year U.S. Treasury bonds. When the complexity of these indicators reaches a breaking point, it may signal an impending market reversal.