Guotai Junan Securities (Hong Kong): Concerns over "re-inflation" weigh heavily, will risk assets continue to retreat?

Guotai Junan Securities (Hong Kong) pointed out that the impact of macroeconomic uncertainty on the stock market is gradually becoming apparent. If concerns about "re-inflation" cannot be eliminated, the market rebound may only be a short-term phenomenon. Trump is about to take office, but risk assets such as U.S. stocks and Bitcoin have significantly corrected, erasing the gains made after Trump's victory. U.S. economic data shows resilience, with 256,000 new non-farm jobs added in December and the unemployment rate falling to 4.1%. However, the services PMI price index has risen, indicating increased cost pressures, and market expectations for future interest rate cuts are also decreasing

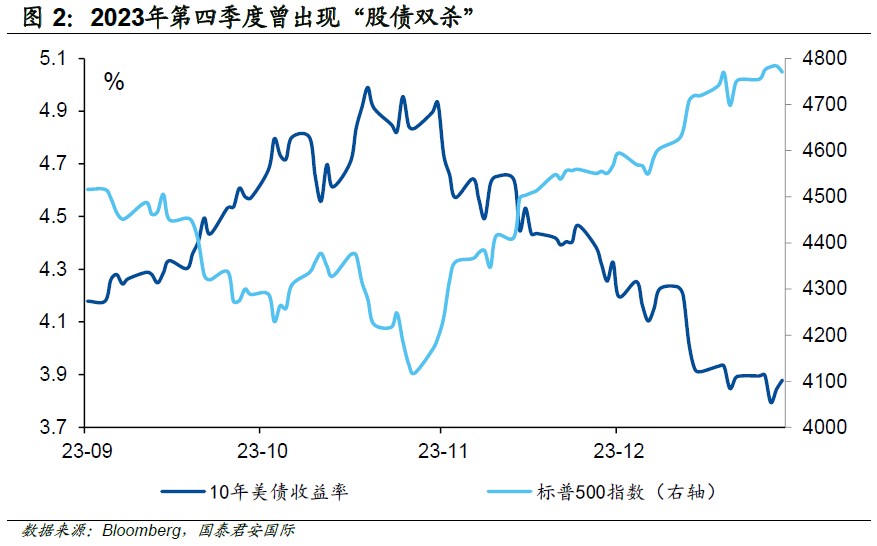

Trump's official inauguration is imminent, but the Trump trade has begun to show signs of "receding"—U.S. stocks and risk assets like Bitcoin have experienced a significant pullback, essentially erasing all gains made after Trump's victory. Behind the pullback in risk assets is a substantial rise in U.S. Treasury yields.

Data from the past week indicates that the U.S. economy remains resilient. The preliminary December Markit Services PMI reached a new high for the past 33 months, while the later-released ISM Services PMI recorded 54.1, exceeding market expectations and the previous value. We believe that the strong performance of the services data can be attributed to the frequent statements made by President-elect Trump in the media; although there is still a week until his official inauguration, businesses are preparing in advance for the upcoming tariff adjustments, which has driven a rapid expansion in commercial activity.

It is worth mentioning that from a price perspective, both the Markit Services PMI and the price index in the ISM Services PMI components did not perform very optimistically in December. Notably, the index measuring raw material and service payment prices in the ISM Services PMI surged by 6.2 points, skyrocketing to 64.4, the highest level since the beginning of 2023, indicating that the services sector will also face significant cost pressures.

Additionally, data released by the U.S. Bureau of Labor Statistics showed that non-farm payrolls in December increased by 256,000, the largest gain in nine months, exceeding the expected 165,000 and surpassing the expectations of nearly all economists surveyed. Meanwhile, the unemployment rate fell to 4.1%, below expectations and down from 4.2% in November. Undoubtedly, this is a very strong employment report.

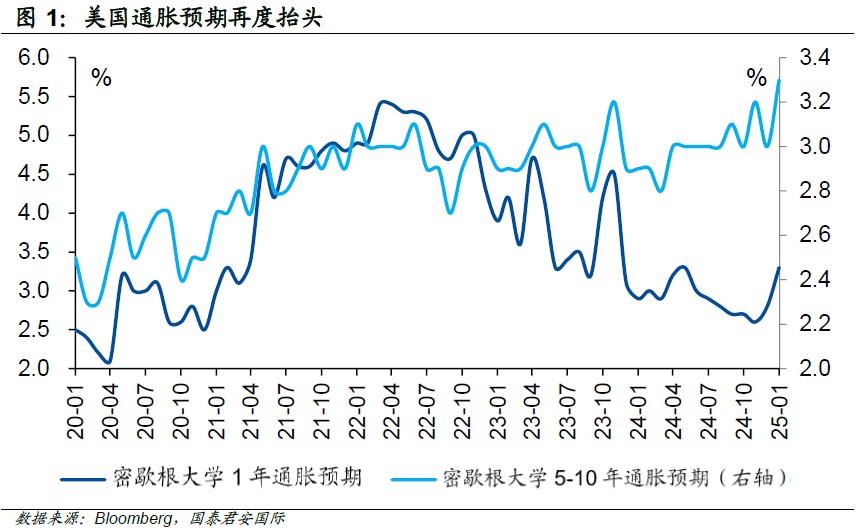

Since the Federal Reserve cut interest rates by 100 basis points last September, the 10-year U.S. Treasury yield has risen by about 100 basis points. The main reason behind this is market concerns about "re-inflation." The non-farm employment data released last Friday once again made inflation a "big elephant in the room," and the market has repeatedly lowered its predictions for interest rate cuts in 2025. Currently, the market believes there will only be one rate cut in 2025, a significant convergence compared to the market's previous expectation of about four cuts before the December FOMC meeting.

Frankly, in the coming year, the Federal Reserve will either choose not to cut rates (or even raise them) or opt for consecutive rate cuts. If a rate cut occurs, it is highly likely that the market will form expectations for continuous rate cuts. Therefore, the market's expectation of one rate cut does not reflect possible Federal Reserve actions but merely shows the market's helplessness regarding the current situation. At present, the market lacks certainty. From the perspective of bond pricing, the market cannot confirm whether rate cuts will occur again, which leads to uncertainty in determining the "value range" for short-term rates like the 2-year Treasury yield. Meanwhile, due to the uncertainty regarding medium- to long-term inflation, the term premium for 2-10 years is also difficult to accurately position. For long-term bonds, the only good news is that with the rise in long-term bond yields, carry has turned positive. From this perspective, long-term bonds seem to have a greater margin of safety than short-term bonds—of course, this safety cushion does not have sufficient persuasive power Currently, what the market lacks is certainty. From the perspective of bond pricing, the market cannot confirm whether interest rate cuts will occur again, which leads to the inability to determine the "value range" for short-term rates like the 2-year U.S. Treasury yield. Meanwhile, due to the uncertainty regarding medium to long-term inflation, the term premium for the 2-10 year range is also difficult to accurately position. For long bonds, the only good news is that with the rise in long bond yields, carry has turned positive. From this perspective, long bonds seem to have a greater margin of safety than short bonds—of course, this safety cushion is not sufficiently convincing.

For the stock market, the uncertainty from the macro level has begun to gradually transmit. If the market cannot eliminate concerns about "re-inflation," all reassurances are likely to be only short-term. How tariffs and immigration policies are deployed after Trump took office, and how U.S. economic data performs, will require months of waiting. Coupled with the Federal Reserve's almost certain pause in interest rate cuts in January, the market may need to wait until around the March monetary policy meeting to see a new direction.

This article is from the "Guotai Junan Overseas Research" public account, edited by Zhitong Finance: Jiang Yuanhua.

This article is from the "Guotai Junan Overseas Research" public account, edited by Zhitong Finance: Jiang Yuanhua.