When will generic drug companies hit bottom?

Generic drug companies are facing price pressure, with the 3-cent aspirin sparking heated discussions, reflecting the success of drug centralized procurement in China. Although centralized procurement has reduced drug prices and brought benefits to patients, it has also led to fluctuations in the performance of generic drug companies. Drawing on Japan's experience, since the full implementation of drug centralized procurement in 1988, although initial performance declined, as centralized procurement deepened, the usage rate of generic drugs increased, ushering in a "golden decade." The aging population is the core reason for Japan's implementation of centralized procurement, with the proportion of medical expenses in GDP continuing to grow

The 3-cent aspirin has once again made headlines for generic drugs due to its low price.

On the surface, the key medication for treating illnesses costing only 3 cents per piece is indeed surprising to many. However, if we think deeper, under the premise of "lower prices without compromising quality," doesn't 3 cents represent the success of China's drug procurement?

Everything has two sides. The significant price reduction from centralized procurement has indeed benefited patients, but it also inevitably leads to performance fluctuations for many generic drug companies. In the context of normalized centralized procurement, do generic drug companies really have no opportunities at all?

The development path of Japanese generic drug companies actually provides the best answer to this question. Since 1988, Japan has fully promoted drug procurement, adjusting the prices of drugs in the medical insurance catalog every two years. This procurement policy has continued to this day.

In the 35 years since the full implementation of centralized procurement in Japan, generic drug companies did experience a decline in performance due to reduced drug prices, and at one point became the "abandoned children" of the capital market. However, with the deepening of centralized procurement, the usage rate of generic drugs in Japan has surged, triggering a "golden decade" for Japanese generic drug companies.

Centralized procurement is not the "endgame" for generic drugs, but a test to reshape the supply side.

01 The Burden of Aging

The core reason Japan fully initiated drug procurement is the continuous aggravation of aging.

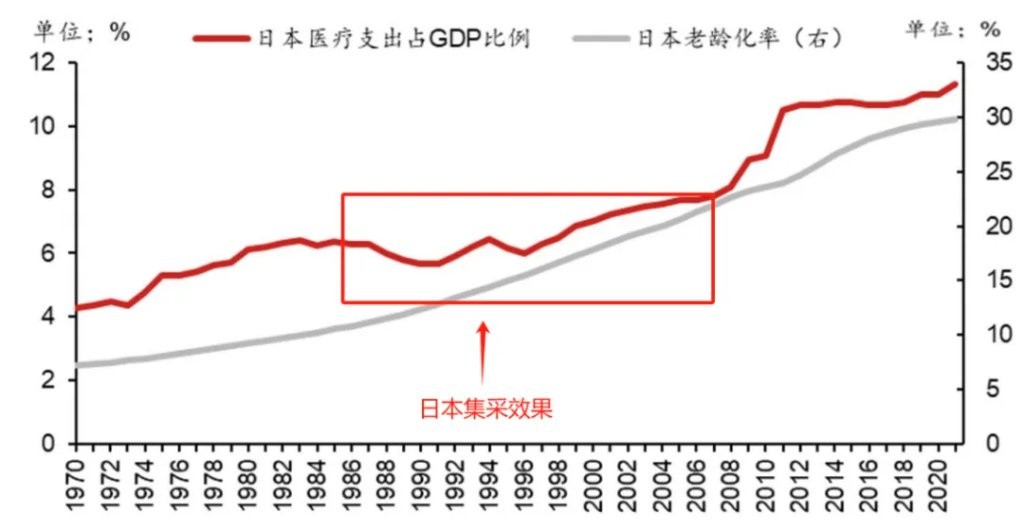

In 1960, the proportion of elderly people in Japan was less than 5%, making it the youngest developed country in the world at that time. However, just twenty years later, the aging rate in Japan rapidly climbed to 10%, and the pace of aging continues to accelerate. As a result of the increasing aging population, Japan's medical expenses as a percentage of GDP have rapidly grown, rising from 2.5% in 1960 to nearly 6% in 1980.

The trend of increasing aging continues, and it is almost certain that the proportion of medical expenses in GDP will further increase. To mitigate this trend, Japan gradually began small-scale drug procurement trials in 1981 and fully implemented it in 1988. Since 1988, the government has adjusted the prices of drugs in the medical insurance catalog every two years, with an average reduction of over 6%. This procurement system has continued to this day.

Figure: Japan's aging rate and medical expenditure as a percentage of GDP, Source: Nomura Securities

Figure: Japan's aging rate and medical expenditure as a percentage of GDP, Source: Nomura Securities

While lowering drug prices, Japan also further broke the previously highly monopolized "distribution fortress" by reforming distribution, eliminating the control of major pharmaceutical companies over complex wholesaler networks, and helping the drug circulation process return to transparency. This approach led to a major reshuffle among domestic pharmaceutical distributors in Japan and allowed Western pharmaceutical giants to enter the Japanese market.

Relevant data shows that in 1990, the sales of the top 5 pharmaceutical companies in Japan were 3.5 times that of the top five non-Japanese companies in the domestic market; by 2010, this figure had dropped to less than 2 times In terms of results, the effects of Japan's drug procurement are immediate. Over the next twenty years, although Japan's aging rate continued to accelerate, the proportion of medical spending in GDP was well controlled. When Japan's aging rate exceeded 20% in 2005, the share of medical expenses in GDP was still less than 8%.

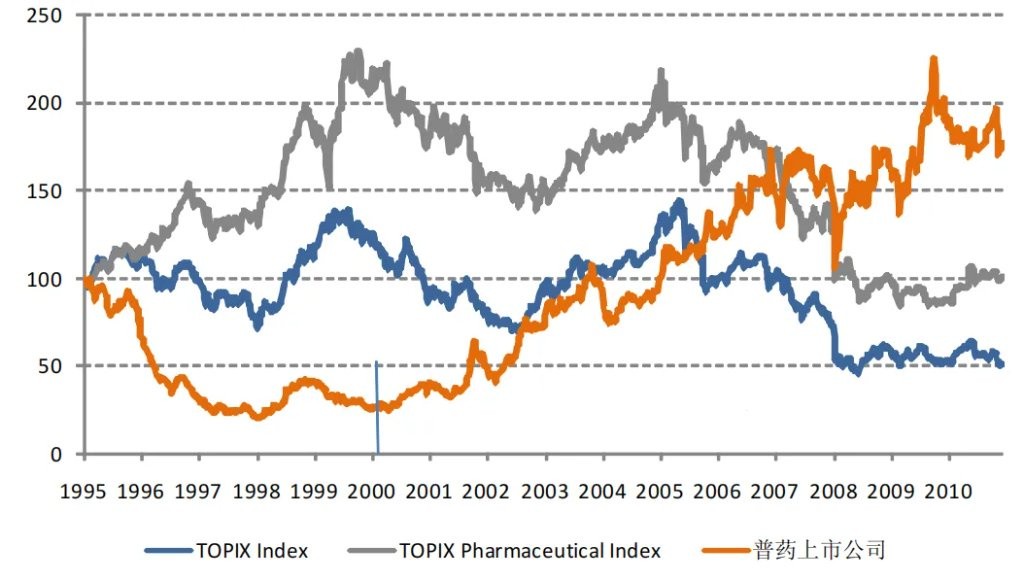

Of course, the negative impact of comprehensive price control on drug prices is the significant decline in pharmaceutical companies' profits, which also led to the stock performance of Japanese pharmaceutical companies lagging behind the market before 2000. In particular, the expectations for generic drug companies were driven to rock bottom, with many companies hitting historical lows in stock prices between 1998 and 2000.

Figure: Overview of stock price trends of Japanese generic drug companies, Source: Guojin Securities

Figure: Overview of stock price trends of Japanese generic drug companies, Source: Guojin Securities

However, generic drug companies were not destroyed by the procurement but instead underwent a period of consolidation and achieved a phoenix-like rebirth after 2003, entering a decade-long "golden period."

02 The "Golden Decade" of Generic Drugs

The rise of Japanese generic drugs is driven by policy promotion.

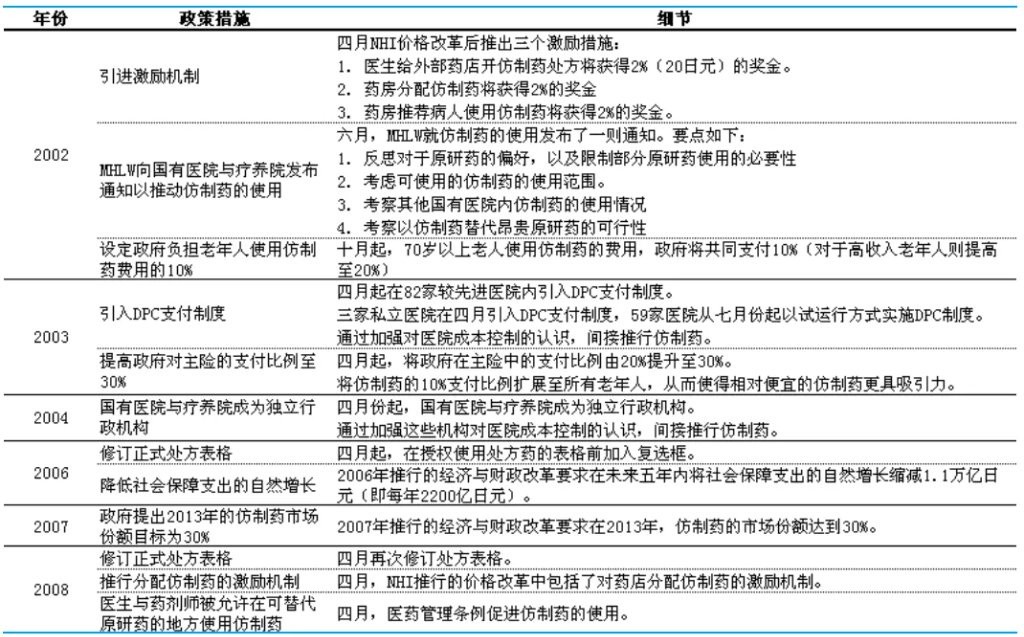

For the Japanese government, bringing down drug prices is not the ultimate goal of procurement; rather, the goal is to benefit more patients. Although drug prices in Japan have decreased, public acceptance of generic drugs has not been high, with the usage rate of generic drugs remaining below 30% for a long time. Therefore, to encourage public acceptance of generic drugs, Japan launched a series of government subsidies for generic drugs in 2002, with the core goal of significantly increasing the usage rate of generic drugs.

Figure: Incentive policies for Japanese generic drugs, Source: Guojin Securities

Figure: Incentive policies for Japanese generic drugs, Source: Guojin Securities

First is the comprehensive bonus incentive. In hospitals, Japan actively encourages doctors to prescribe generic drugs to patients, who can receive a 2% incentive; when patients pick up generic drugs at pharmacies, the pharmacies can also receive a 2% incentive; pharmacies that recommend patients to use generic drugs can also receive a 2% incentive. For elderly people over 70 using generic drugs, Japan will also cover 10% of the costs.

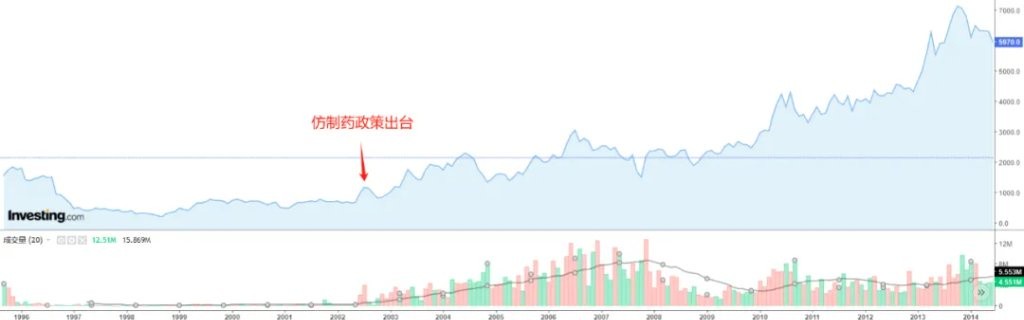

It was a series of incentive policies in 2002 that reshaped the expectations of Japanese generic drug companies and reactivated growth for generic drug companies that were previously facing performance bottlenecks. After the introduction of the generic drug incentive policy, the stock prices of Japanese generic drug companies quickly rebounded. Sawai Pharmaceutical (Sawai) is a leading traditional generic drug company in Japan, and its stock price fell to a low due to procurement around 2000, while the long-term turning point of its stock price also came from the incentive policy in April 2002.

Figure: Overview of Sawai Pharmaceutical's stock price, Source: Yingwei Caijing

In the following years, the Japanese government continued to strengthen its encouragement policies for generic drugs, directly stating in 2007 that the usage rate of generic drugs should exceed 30% by 2013, and proposing a long-term goal of over 80% by 2020. Influenced by these long-term policies, the usage rate of generic drugs in Japan has significantly increased, with the current substitution rate of generic drugs exceeding 80%.

Figure: Overview of Sawai Pharmaceutical's stock price, Source: Yingwei Caijing

In the following years, the Japanese government continued to strengthen its encouragement policies for generic drugs, directly stating in 2007 that the usage rate of generic drugs should exceed 30% by 2013, and proposing a long-term goal of over 80% by 2020. Influenced by these long-term policies, the usage rate of generic drugs in Japan has significantly increased, with the current substitution rate of generic drugs exceeding 80%.

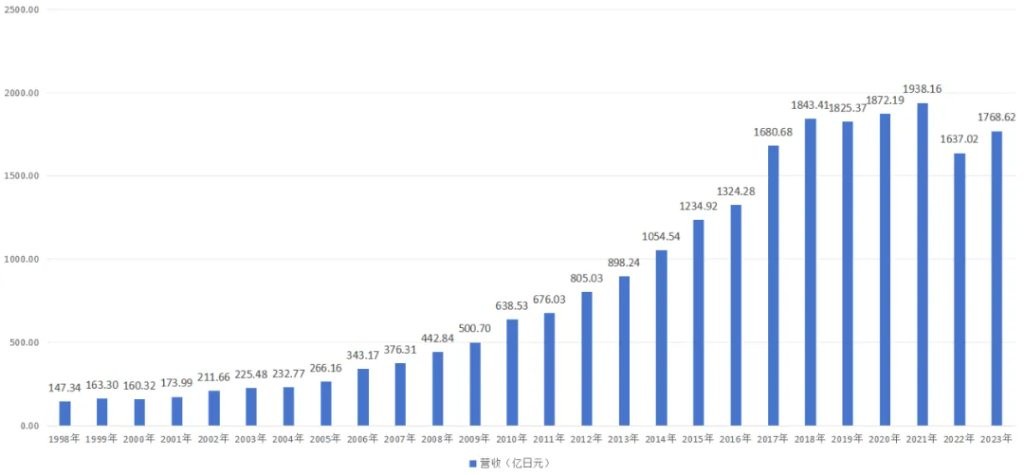

During the gradual increase in the substitution rate of generic drugs, leading generic drug companies such as Sawai Pharmaceutical have greatly benefited. Sawai Pharmaceutical's revenue soared from 17.399 billion yen in 2001 to 184.341 billion yen in 2018, a tenfold increase; net profit also surged from 1.434 billion yen in 2001 to 19.376 billion yen in 2018, similarly increasing tenfold.

Figure: Overview of Sawai Pharmaceutical's revenue, source: JinDuan Research Institute

Figure: Overview of Sawai Pharmaceutical's revenue, source: JinDuan Research Institute

The history of the Japanese market illustrates the essence of drug procurement: the core is not in the process of price reduction, but in the beneficial results for the public.

03 A Dramatic Change on the Supply Side

Although leading generic drug companies have gained "policy dividends" with the help of the Japanese government, not all generic drug companies have benefited from this.

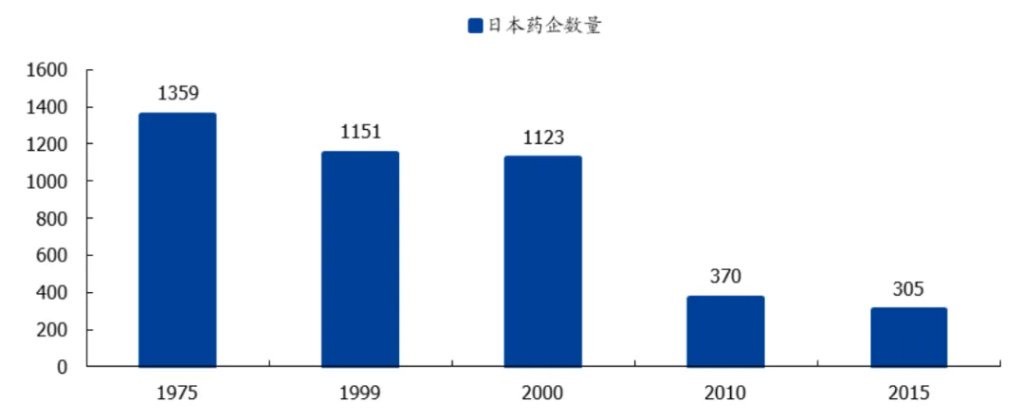

The 1970s was the peak of the Japanese pharmaceutical industry, with over 1,359 pharmaceutical companies in Japan. However, after subsequent procurement reforms, the number of Japanese pharmaceutical companies had decreased to 1,123 by 2000. Although the government later initiated policy incentives, the number of Japanese pharmaceutical companies still fell to 305 by 2015, with nearly 80% of companies ruthlessly eliminated.

Figure: Number of pharmaceutical companies in Japan, source: Guosheng Securities

Figure: Number of pharmaceutical companies in Japan, source: Guosheng Securities

Essentially, drug procurement is a supply-side reform. In this reform, by lowering prices, it forces generic drug companies to better control costs. In this process, smaller companies with poor cost control are ultimately eliminated, while players with strong operational capabilities are expected to flourish after overcoming the winter.

Although there are differences in the situation between us and Japan, the essence of procurement "supply-side reform" has not changed. To this day, there are still over 4,000 generic drug companies in our country, most of which lack strong competitiveness. For them, the efficiency-focused procurement is indeed too harsh, but isn't life inherently cruel?

Using neighbors as a mirror and history as a reference. Drug procurement can indeed play a positive role in controlling drug expenditures, and most citizens have benefited from this process. As procurement becomes normalized, China's generic drug industry is bound to face a large-scale merger and acquisition wave, and the winners of that merger wave are expected to enjoy the "sales dividends" truly brought about by sacrificing prices Yiyao, original title: "When Will Generic Drug Companies Hit Bottom?"

Risk Warning and Disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investment based on this is at one's own risk