Inflation concerns linger as UK stocks, bonds, and currency continue to decline

英國資產價格週一再次下跌,因關鍵通脹數據出爐前的焦慮情緒可能導致市場拋售潮延續。英鎊兑美元跌 0.8%,創 2023 年 11 月以來最低水平,國債收益率回升至 4.92%,為 2008 年金融危機以來最高。富時 250 指數跌近 0.3%,顯示在 12 月 CPI 數據公佈前,英國資產仍脆弱。經濟學家預測 12 月 CPI 同比漲幅將保持在 2.6%,高於央行目標,可能引發市場波動。

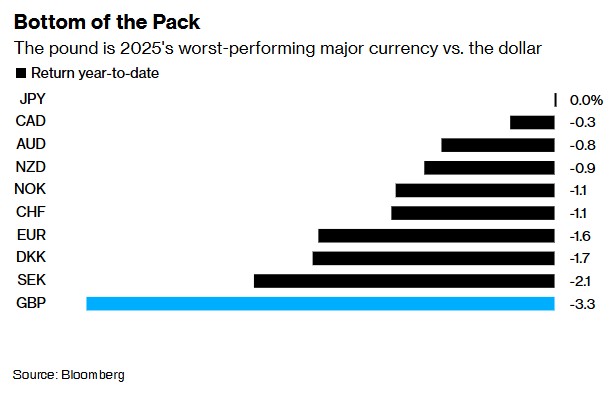

智通財經 APP 獲悉,英國資產價格週一再次下跌,關鍵通脹數據出爐前的焦慮情緒可能會導致英國市場的拋售潮延續。英鎊是週一表現最差的十國集團 (G10) 貨幣,英鎊兑美元匯率跌 0.8%,至 1 英鎊兑 1.2106 美元,為 2023 年 11 月以來的最低水平。英國國債同樣走低,十年期英國國債收益率重回上週 4.92% 的高點,這是 2008 年全球金融危機以來的最高水平。英國股市也遭受打擊,富時 250 指數在上週的表現是 2023 年 6 月以來最差的單週表現。截至發稿,富時 250 指數跌近 0.3%。

這些走勢表明,至少在英國 12 月 CPI 數據於週三公佈之前,英國資產仍將保持脆弱。雖然全球債券自去年 12 月初以來就表現不佳,但鑑於投資者對英國持續高通脹和國家公共財政緊張的擔憂,英國國債的表現尤其疲弱。

MUFG 資深外匯策略師 Lee Hardman 表示:“在當前的市場環境下,英國國債的持續拋售正在引發市場參與者對英國政府財政狀況的更多擔憂,即使英國通脹報告更為強勁,也可能對英鎊產生更負面的影響。”

經濟學家預測,英國 12 月 CPI 同比漲幅將保持在 2.6%,仍高於英國央行 2% 的目標。價格壓力重燃的跡象則可能會引發進一步的市場波動。

與此同時,期權交易表明,英鎊的弱勢將持續下去。衡量市場情緒的一個月風險逆轉指標顯示,交易員對英鎊的態度是 2022 年 12 月以來最悲觀的。此外,未來一個月對沖英鎊波動的成本升至 2023 年 3 月以來的最高水平。

紐約銀行市場策略與洞察主管 Bob Savage 表示:“英國的經濟數據可能會在 2025 年帶來一個主題——‘新滯漲’,即財政和貨幣政策加劇增長,導致反通脹進程停滯不前。”

投資者還將密切關注週二發售的 30 年期英國通脹掛鈎債券和週三發售的 10 年期英國國債。上週,一場長期債券發售創下了自 2023 年以來的最低超額認購水平,而新的 5 年期國債則獲得了強勁的需求。

經濟學家發出 3% 通脹預警

經濟學家警告稱,今年春季英國通脹率將超過 3%。英國央行可能面臨一場新的戰役,以安撫投資者對其降息承諾的信心。

到 2025 年,能源賬單將再次成為推動價格上漲的更大因素 Oxford Economics 首席英國經濟學家 Andrew Goodwin 表示,“我們已經認為今年通脹將高於英國央行預估,但近期能源價格的上漲意味着通脹率可能還會更高”。他預計第三季度通脹將達到 3.3% 的峯值。

在動盪的全球經濟背景下,英國央行行長貝利和其他利率制定者面臨着另一個艱難的權衡。官員們有可能會變得更有遠見,透過通脹可能暫時上升的現象,把注意力放在經濟增長前景上,而最近幾天英國國債收益率飆升只會削弱經濟增長前景。或者,英國央行可以繼續關注近期不斷惡化的通脹形勢,對降息採取非常謹慎的態度。

Bloomberg Economics 首席英國經濟學家 Dan Hanson 表示:“英國央行面臨的更廣泛問題是,如果通脹高於目標,失業率上升,他們將在未來一年關注什麼。”“最近的通脹事件告訴我們,通脹預期可能會飄忽不定,”“這意味着,如果英國央行在疫情前面臨同樣的權衡,它不太可能像以前那樣大力支持經濟。而結果將是很難擺脱漸進式降息。”

英鎊即將再跌 8%?

期權市場的交易員正準備迎接英鎊再跌 8% 的局面,因為上週引發英國市場痛苦拋售的財政困境對英鎊造成了壓力。根據美國存託與清算公司 (DTCC) 的數據,押注英鎊兑美元跌至 1.20 以下的合約需求相當大,比上週五的交易價格低近 2%。一些交易員甚至押注英鎊兑美元價格跌破 1.12,這是兩年多來的最低水平。

Candriam 基金經理 Jamie Niven 表示:“在這個關鍵時刻,英鎊阻力最小的方向是下跌。一方面,你對英國央行降息的預期非常有限,而財政方面的擔憂也對英鎊不利。”

德意志銀行策略師 Shreyas Gopal 認為英鎊的前景不太樂觀。他建議減少英鎊對包括歐元、美元、日元和法郎在內的一籃子其他主要貨幣的頭寸。他表示,“英鎊最近的疲軟還有進一步下跌的空間”,是時候 “轉做空了”。