Morgan Stanley: Strong dollar puts pressure on US stock earnings season, significant differentiation will occur

摩根士丹利預計,強美元將導致美國企業財報季出現重大分化,國內市場導向行業表現優於國際收入較高的行業。美元升值與美國經濟強勁相關,可能促使美聯儲維持高利率。高盛也上調了美元預測,預計未來一年將上漲約 5%。

智通財經獲悉,摩根士丹利策略師表示,美元走強可能會導致本季美國企業財報出現巨大差異,以美國國內市場為導向的行業的表現將超過那些擁有大量國際收入的行業。自特朗普去年 11 月贏得總統大選以來,由於市場預期他的税收和關税政策可能引發通脹,美元大幅升值。美國經濟的彈性也促使人們押注美聯儲可能在更長時間內維持較高利率,從而進一步提振美元。

Michael Wilson 領導的摩根士丹利團隊表示,美元走強通常會導致標普 500 指數成分股的表現差異更大,因為該指數成分股的國際銷售額不到 30%。他認為,家用產品、科技硬件和食品飲料類股的海外敞口最大,而電信服務和公用事業類股的風險最小。

Wilson 在報告中寫道:“我們認為,美元走強可能是本季業績差異加大的關鍵因素。” 這位策略師説,他預計與美元聯繫更緊密的行業近期表現不佳的情況將繼續下去。

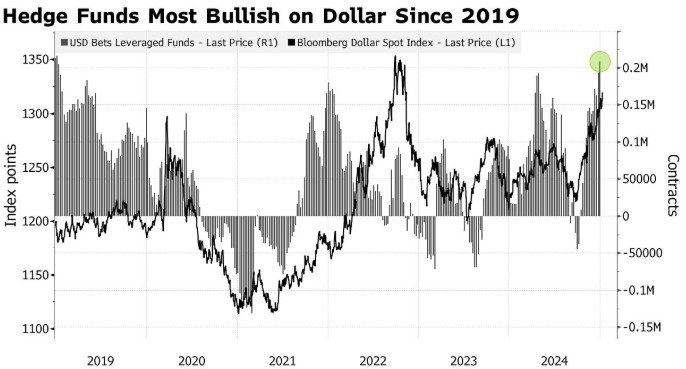

強美元勢頭難擋

與此同時,高盛上調了對美元的預測,理由是美國經濟強勁,而特朗普政府擬實施的關税政策可能會減緩美聯儲放鬆貨幣政策的步伐。包括 Kamakshya Trivedi 在內的高盛策略師在一份報告中表示:“我們預計,隨着新關税的實施和美國經濟繼續表現強勁,美元將在未來一年上漲約 5%。”

而且高盛補充稱,即使在上調對美元的預測後,仍認為美元有進一步走強的風險。該行表示,這在一定程度上可能是因為儘管關税提高,但美國經濟仍有可能保持韌性。該行表示:“雖然我們承認,外匯市場參與者顯然預計關税政策會有一定程度的變化,而且很難弄清近期走勢的驅動因素,但我們認為美元未來會進一步走強。”

據悉,這是高盛的大約兩個月內第二次上調其對美元的預測,理由是美國經濟持續強勁增長,以及特朗普擬徵收的關税可能加劇通脹、並導致美聯儲的寬鬆政策脱軌。上週五公佈的美國 12 月非農就業報告強化了對就業市場韌性的看法,導致市場對美元走強的預期進一步增強。

強美元疊加美債收益率走高,美股大盤恐承壓

Wilson 表示,“只要強勁的美國經濟成長是美元上行的主要動力”,標普 500 指數整體表現就可能保持彈性。在 2024 年中旬,這位策略師放棄了他長期以來對美國股市的悲觀看法。

然而,科技行業為標普 500 指數中的主要板塊,具有較高比例的業務和收入來自海外,強勢美元或為這些公司帶來負面財務影響。FactSet 的數據顯示,美國信息技術、材料和通信服務行業的國際收入敞口最高,海外收入佔總收入的比例分別高達 57%、52% 和 48%。而且帶動標普 500 指數上漲的七大科技巨頭均有較高比例的海外業務。

根據美國銀行全球研究部的估計,美元每同比上漲 10%,標普 500 指數成分股公司的收益就會減少約 3%。其次,防範美元走強的公司還必須投入資源實施對沖策略,以抵消美元升值對其利潤的影響。

而且儘管分析師在第四季財報季來臨前下調了盈利預期,但 Wilson 表示,相對於最近幾個季度,預期仍然較高,提高了企業超越預期的門檻。高盛首席執行官 David Kostin 也表示,他預計本季度的收益增幅將 “温和”。

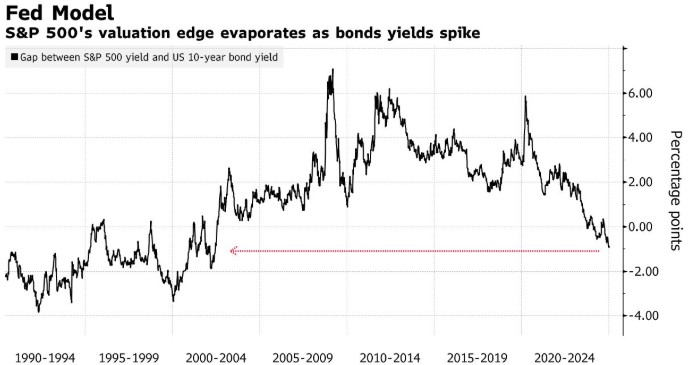

美國股市的漲勢在新的一年裏有所減弱,原因是美聯儲的政策前景更加鷹派,導致債券收益率飆升。隨着 10 年期美國國債收益率逼近 5% 的關鍵關口,投資者和策略師警告稱,美國股市可能還會遭受進一步的痛苦。

交易員們還正在關注對政策敏感的 10 年期美國國債收益率——一度突破 4.8%,這是自 2023 年 10 月以來的最高水平,正迅速接近 5%,他們擔心這一水平可能引發股市回調。上一次短暫突破這一門檻是在 2023 年 10 月。

Janus Henderson 全球解決方案主管 Matt Peron 説:“如果 10 年期美國國債收益率觸及 5%,投資者就會下意識地拋售股票。像這樣的事件需要幾周甚至幾個月的時間才能結束,在此期間,標準普爾 500 指數可能會下跌 10%。”

原因很簡單:債券收益率上升使美國國債的回報更具吸引力,同時也增加了企業的融資成本。標普 500 指數的收益率比 10 年期美國國債收益率低 1 個百分點,上一次出現這種情況是在 2002 年。換句話説,持有風險遠低於美國基準股票的資產的回報,在很長一段時間內都沒有這麼好。

華爾街策略師和投資組合經理預測,股市未來的道路將崎嶇不平。Wilson 預計,美國股市將經歷艱難的 6 個月,而花旗的財富部門則告訴客户,債市存在買入機會。