The largest biotechnology merger in the past two years! Johnson & Johnson acquires Intra-Cellular for billions, with the latter soaring nearly 38% in pre-market trading

This is the largest transaction in the biotechnology industry in the past two years and the first biopharmaceutical merger exceeding $10 billion since 2024, indicating a resurgence in merger and acquisition activity in the healthcare sector. Goldman Sachs stated that large biopharmaceutical companies have a potential financing capacity of at least $500 billion, providing significant operational space for R&D investment, merger expansion, and other areas

Johnson & Johnson acquires Intra-Cellular, aiming at the central nervous system disease market.

On the 13th, Johnson & Johnson acquired Intra-Cellular Therapies for $14.6 billion to enhance its position in the treatment market for neurological diseases. This is the largest biotechnology merger and acquisition deal since 2023 and the first biopharmaceutical acquisition exceeding $10 billion since 2024.

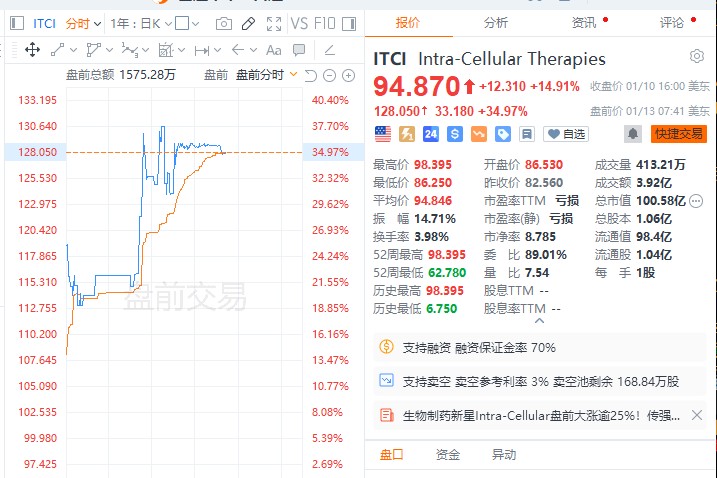

Intra-Cellular's stock price soared nearly 38% in pre-market trading, and over the past 12 months, the company's stock price has risen about 40%, with a market capitalization of approximately $10 billion.

Meanwhile, Johnson & Johnson's stock price remained flat, with the company's stock price declining about 12% over the past 12 months, resulting in a market capitalization of $342 billion.

Intra-Cellular develops new therapies for treating mental health disorders and neurological diseases. Its flagship product, Caplyta, is a medication used for treating depressive episodes associated with bipolar disorder. It is estimated that Caplyta's sales reached $675 million last year. Johnson & Johnson stated that the annual sales of the drug are expected to reach $5 billion.

In addition to Caplyta, Intra-Cellular is also seeking regulatory approval in the U.S. to expand the drug's use as an adjunct treatment for major depressive disorder. Furthermore, the company is conducting mid-stage studies for another drug, ITI-1284, aimed at treating generalized anxiety disorder and Alzheimer's disease-related psychosis and agitation.

Analysts believe this deal is the latest move in Johnson & Johnson's series of acquisition plans aimed at driving growth beyond 2025. By then, Johnson & Johnson's blockbuster psoriasis drug Stelara may face competition from up to six biosimilars. Through this acquisition, Johnson & Johnson will gain ownership of Intra-Cellular's oral drug Caplyta.

This is the largest deal in the biotechnology sector in nearly two years, indicating that merger and acquisition activity in the healthcare industry is warming up again after a decline in 2024. Earlier this month, medical device manufacturer Stryker Corp. agreed to acquire Inari Medical Inc. for approximately $4.9 billion.

Large biopharmaceutical companies have strong financial capabilities. Goldman Sachs stated in a report on the 10th that with a debt leverage of 2.5 times EBITDA (earnings before interest, taxes, depreciation, and amortization), these companies have a potential financing capacity of about $500 billion. If the leverage level rises to 4 times EBITDA, their financing capacity could approach $900 billion. This indicates that large biopharmaceutical companies have significant financial maneuverability in areas such as R&D investment and merger expansion