Crude oil, U.S. Treasury bonds, and the U.S. dollar are all suppressing emerging markets

U.S. Treasury yields continue to rise, strengthening the dollar and putting pressure on emerging market stocks. Since 2025, the market has shifted from the "Trump trade" to the "second inflation trade," with gold and oil prices rebounding. U.S. service sector data has improved, with the December services PMI reaching a 33-month high, and non-farm payrolls adding 256,000 jobs, exceeding expectations and demonstrating economic resilience

US Treasury Rates, Too Strong

Since entering 2025, the market seems to have shifted back from the fervent "Trump trade" to the "second inflation" trade, with the following signs:

-

The US dollar and US Treasury yields continue to rise, but previously weak gold and oil prices have also begun to rebound;

-

US stocks have started to adjust due to the strengthening of US Treasury rates, with some emerging market stock markets experiencing even greater declines.

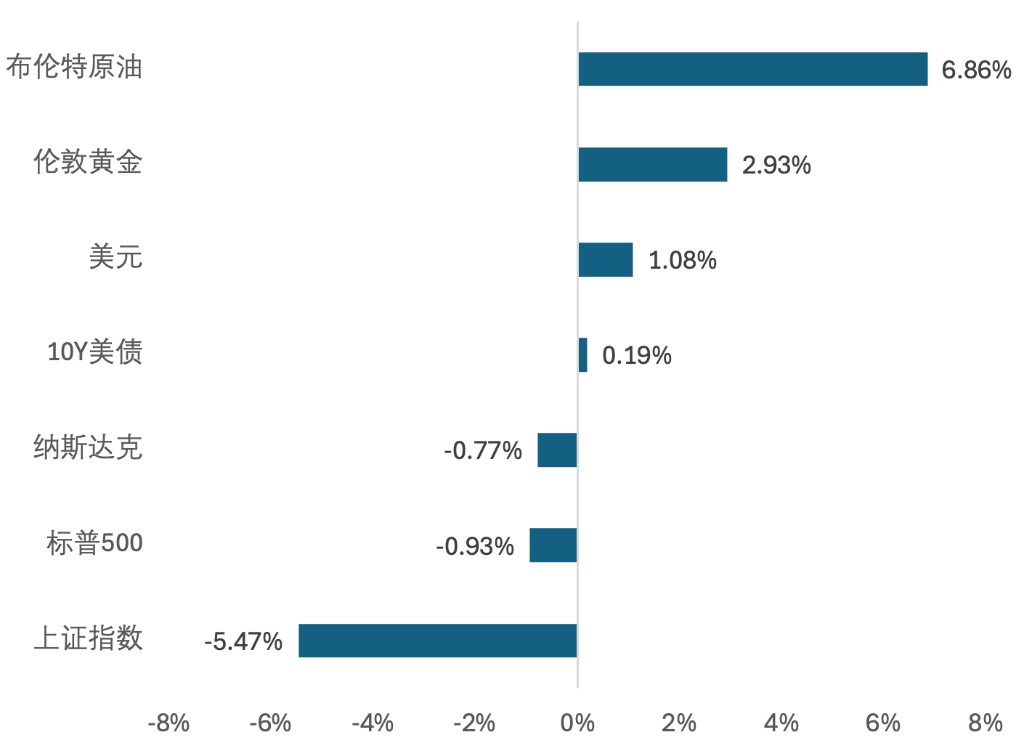

Image: Asset performance from 2025 to present (Note: 10Y US Treasury refers to the increase in yield)

To understand this logic switch, one must realize that US Treasuries are currently the "eye of the storm."

Why are US Treasury rates so strong?

US Service Sector Data Fully Rebounds

The continued rise in US Treasury rates is primarily driven by economic data.

A series of US economic data released last week conveyed signals of resilience in the service sector to the market.

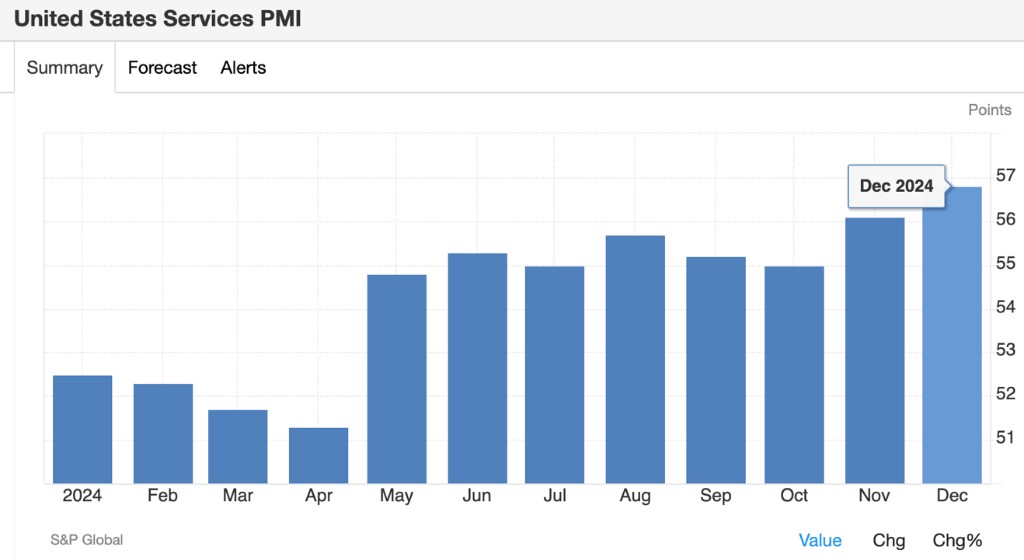

On one hand, the S&P Global US December Services PMI final value released on January 6 recorded 56.8, although lower than the preliminary value of 58.5, it still set a new 33-month high since March 2022.

From the sub-indices, the employment sub-index final value rose to 51.4, marking a new final high since July 2024, ending the contraction trend; the new business sub-index final value also reached a new final high since March 2022.

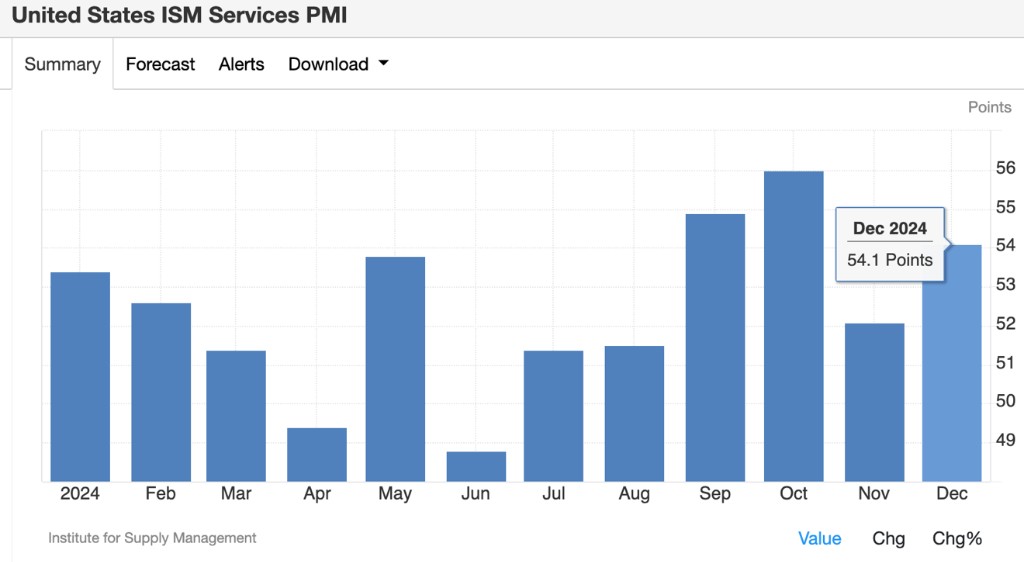

On the other hand, the December Services PMI under the US Institute for Supply Management (ISM) released on January 7 recorded 54.1, exceeding market expectations of 53.5 and the previous value of 52.1.

It is worth mentioning that on the price front, both the Markit Services PMI and the price index in the ISM Services PMI sub-index showed increases in December, especially the indicator measuring raw material and service payment prices in the ISM Services PMI sub-index surged by 6.2 points to 64.4, reaching the highest level since early 2023, indicating that the service sector is facing significant cost pressures.

Further solidifying the strong logic of the US economy is Friday's non-farm payroll report.

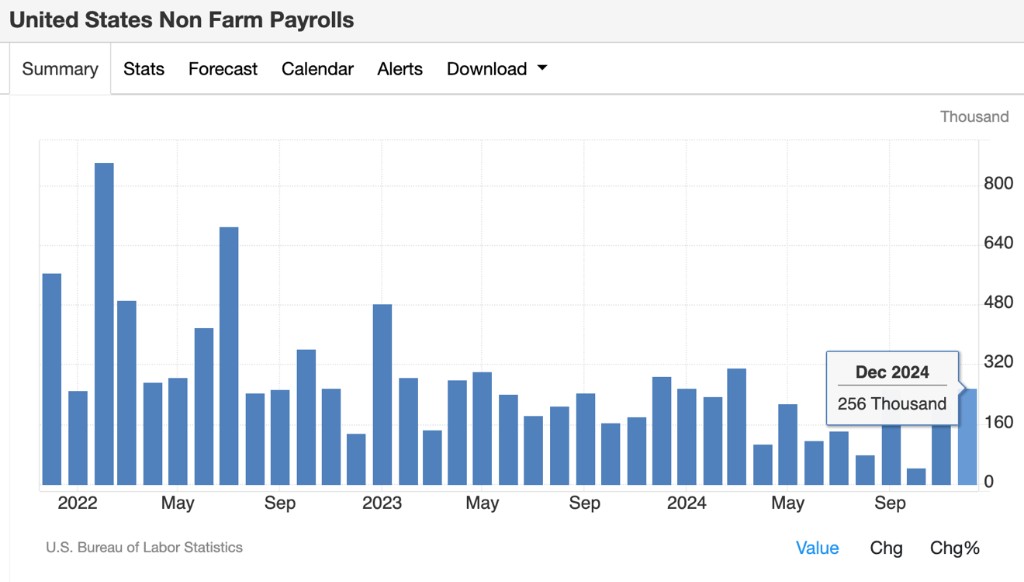

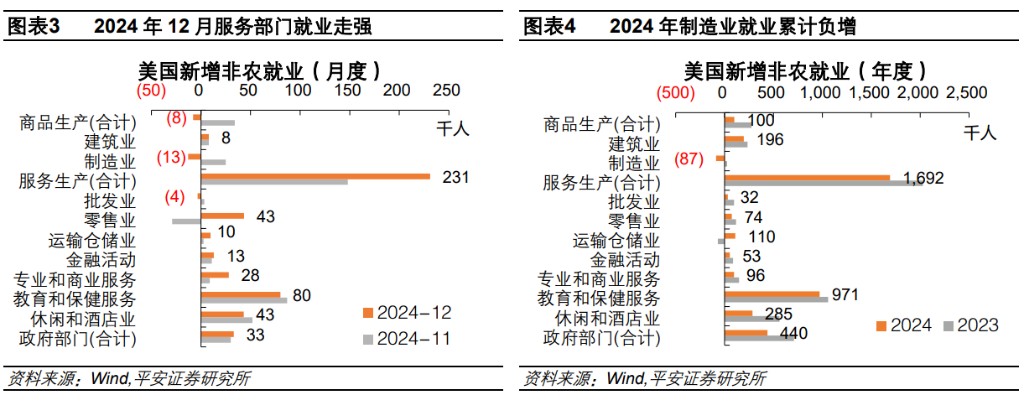

In December, the US non-farm payrolls added 256,000 jobs, marking the largest increase in nine months, far exceeding the expected 165,000, and higher than the majority of economists' expectations in media surveys

From the industry perspective, employment in the manufacturing sector is significantly weaker than in the service sector, with a slight month-on-month negative growth in the goods production sector, marking the third negative growth of the year, while employment in the service production sector saw a substantial increase of 231,000 people, recording the best performance of the year.

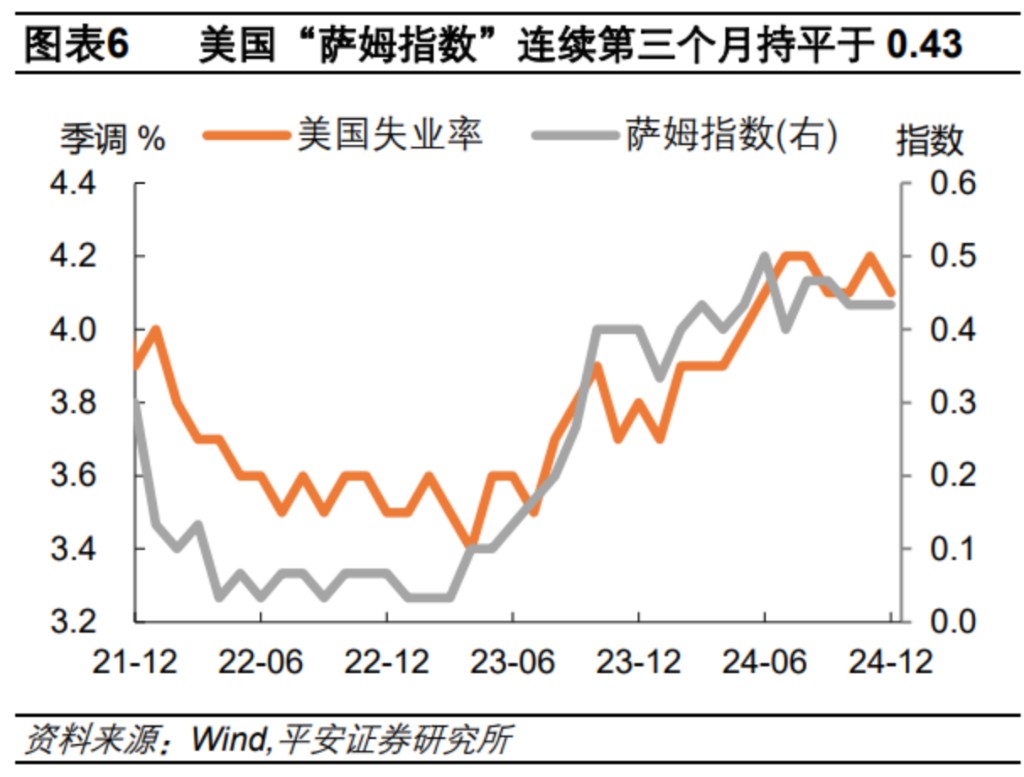

In addition, in December, the U.S. labor force population increased by 243,000 people month-on-month, and the number of unemployed decreased by 235,000, leading to a drop in the unemployment rate to 4.1%. The "Sam Indicator" remained flat at 0.43 for the third consecutive month, staying below the warning line.

There is no doubt that this is a very strong employment report.

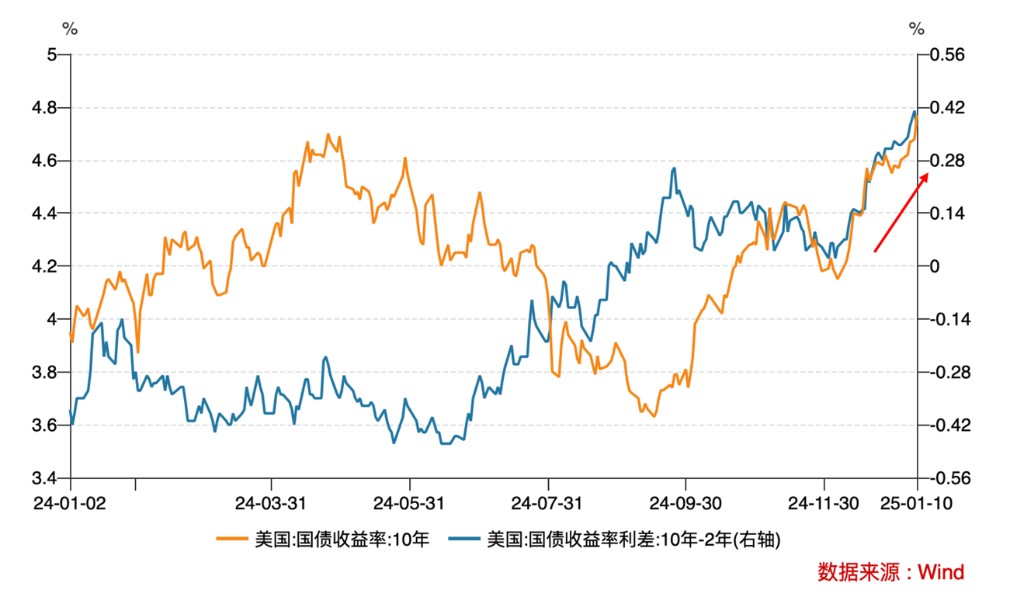

The strong growth in the service sector has pushed up the U.S. neutral interest rate and raised the term premium on U.S. Treasuries.

Since December, the 10-year U.S. Treasury yield has risen by 59 basis points, while the 10Y-2Y spread has widened by 32 basis points.

On the other hand, the fundamental differences between the U.S. and Europe, the UK, etc., have also impacted exchange rates, contributing to the strengthening of the U.S. dollar index.

From the Federal Reserve to the market, all are confirming "secondary inflation"

On January 9, the minutes of the Federal Reserve's December FOMC meeting were released.

The minutes indicated that "almost all" Federal Reserve officials believe that the risks of inflation rising have increased.

Additionally, the minutes repeatedly mentioned that changes in immigration and trade policies could impact the U.S. economy and suggested that future rate cuts may indeed slow down.

In the market, pricing has become even more extreme.

The latest inflation expectations data from the University of Michigan shows that U.S. inflation expectations for 5-10 years have risen to 3.3%, matching the level of June 2022, reaching the highest level since 2008, significantly above the expected 3.0%, with the previous value in December being 3.0%. The initial value for 1-year inflation expectations is 3.3%, significantly higher than the expected 2.8%, with the previous value in December being 2.8%