Worried about the impact of U.S. Treasuries? Bank of America Merrill Lynch: This is the "golden pit" for bottom-fishing AI U.S. stocks

美銀認為,長期看,美債衝擊下的股市回調能幫助投資者提前排除 AI 泡沫風險,現在可能是一個 “重大的買入機會”。科網泡沫期間,科技股不僅抵禦了巨大的宏觀面衝擊,還在 10 年期美債收益率高於當前水平的情況下實現了 80% 的年度回報。

美債收益率持續衝擊市場,美股 AI 概念股或迎來絕佳抄底機會。

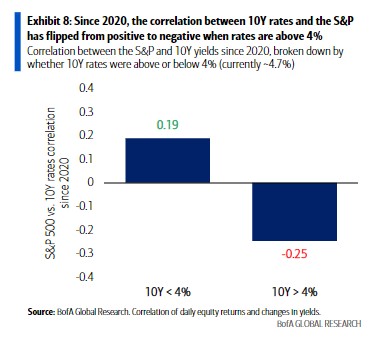

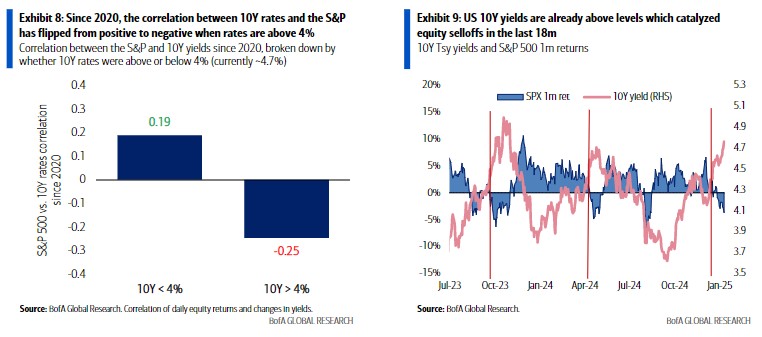

由於通脹前景堪憂,美國 10 年期國債收益率持續上行逼近 5% 關口,股市與債券收益率的相關性轉負。

在 1 月 14 日發佈的研報中,美銀分析師 Gonzalo Asis 等表示,長期看,美債衝擊下的股市回調能幫助投資者提前排除 AI 泡沫風險,現在可能是一個 “重大的買入機會”。

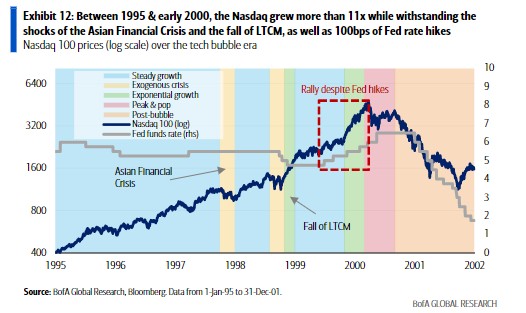

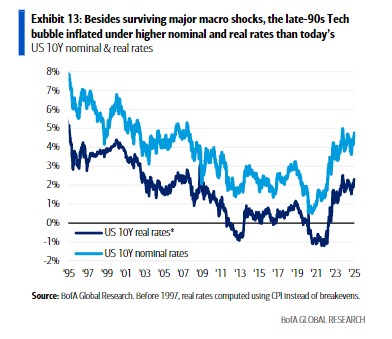

美銀在報告中表示,科網泡沫期間,科技股不僅抵禦了巨大的宏觀面衝擊,還在 10 年期美債收益率高於當前水平的情況下實現了 80% 的年度回報。

短期風險 VS 長期機會

美銀在報告中表示,當 10 年期美債收益率高於 4% 時,該收益率與標普 500 指數之間的相關性由正轉負,進而使股市上行承壓。

報告數據顯示,在標普歷史上規模最大的四次拋售中,有三次都伴隨着 10 年期美債收益率升至 4.5% 及以上的情況。

然而,美銀認為,如果這種由債券收益率驅動的股市衝擊能幫助投資者提前排除 AI 泡沫風險,那麼它可能會成為一個重大的買入機會。

首先,報告表示,從 20 世紀 90 年代的科網泡沫來看,這類股票其對宏觀面衝擊的抵抗力極強,抗住了當時的亞洲金融風暴和美聯儲大幅加息,並在 1998 年實現了超過 80% 的回報。

其次,在整個 1995-1999 年的科網泡沫期間,10 年期美債收益率名義利率和實際利率都是高於現在的。報告表示,只要美國仍然是全球增長的主要推動力,其債務問題就還不至於全面爆發。

最後,報告提及,科技股上次陷入困境是在 2022 年,但當時更多是受到企業盈利而非債市的拖累,因此,只要企業盈利保持強勁,科技股尤其是 AI 股抵禦債市衝擊的能力仍會較強。