Reviewing the ups and downs experienced by the U.S. stock market over the past decade [Fu Peng Says 12]

本文回顧了過去十年美股的走勢與波動,強調了 2012 年以來的重要節點和市場變化。2015、2016 年美國及全球格局的轉變,低利率和居民部門出清推動了市場發展。疫情成為催化劑,2018 至 2019 年間市場波動加劇,直至疫情前才穩定。文章還提到未來將以英偉達為例進行具體覆盤。

“ 交易桌前看天下,付鵬説來評財經 ”

《付鵬説·第五季》重磅來襲!立即訂閲

—

本期內容

>>本文僅限作者觀點,點擊上方視頻收看!

交易桌前看天下,付鵬説來評財經。

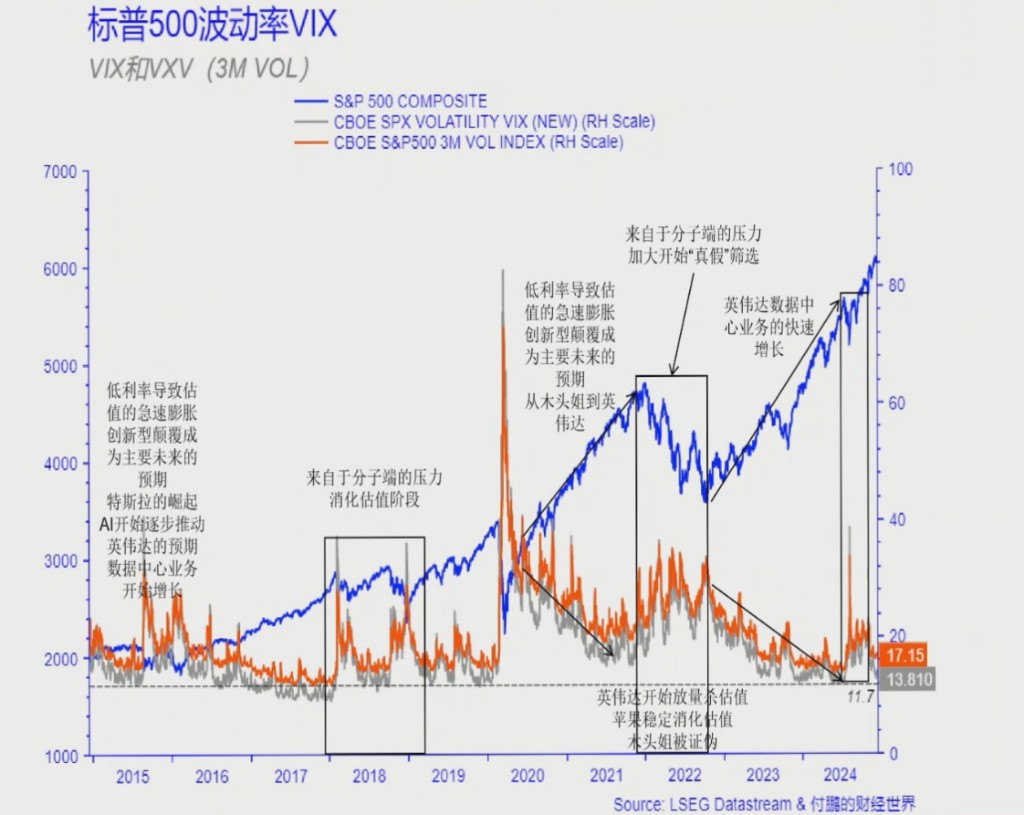

本期付鵬説接上一期的內容繼續聊美股近 10 年的覆盤,一起回顧一下過去十年美股的走勢和波動率的情況。

早在 2012 年,我就開始與中國機構的朋友們進行記錄性的溝通交流,期間經歷了很多重要的節點,這些都成為了我們共同的回憶。同時,我也一直在社交媒體上持續分享相關內容,所以很多回憶的節點在過往的歷史中都是可以追溯的。

從 2015、2016 年開始,美國以及全球的世界格局都在發生巨大的轉變,而美國的這種變化並非一蹴而就。隨着從上到下的整體變革,以及 2008 年金融危機後美國居民部門的有效出清,其潛力逐漸在市場中顯現。

2020 年疫情的爆發,成為了一場重大共振性的催化劑。而在這之前,市場是相對比較温和緩慢的。在 2015 年、2016 年時,美國的低利率以及居民部門出清後的債務和槓桿,已經在推動早期的市場出清。當然,在技術的這條線上,在之前【美股大師課】上已經和大傢俱體講過產業週期和技術迭代下的美股分析方法,之後也會以英偉達為例具體覆盤。

我們看到,在 2015、2016 年,市場經歷了特朗普上台以及中國的衝擊,之後市場平穩延續至 2018 年。在此期間,單純從利率角度看,美國從耶倫任期末期開始小幅加息。這一階段,從經濟、利率、出清到技術早期,都已初具雛形。

然而我們從下圖上能看到:市場在 2018 年至 2019 年時波動率較高,美股呈現擴散性形態,直至疫情前才真正穩定下來。大家可能會認為這是疫情帶來的衝擊,因此可以忽略。但實際上,在 2018 年至 2019 年這將近兩年的時間裏,美股一直停滯不前,從 2019 年後市場才開始逐漸推動發展。

當時我們曾討論過這個問題,我認為美股可能看似創新高後又大幅下跌,你以為要崩盤了,它卻又慢慢創新高。但它是否會就此結束?並沒有,它又開始下跌,呈現出擴散性狀態,市場波動率隨之放大。

當時,鮑威爾先是加息,隨後又開始降息,這一階段正好對應美國降息時期——那時美國經濟的韌性尚未充分展現。無論是技術推動,還是特朗普上台後政治右翼化帶來的變化,包括關税、貿易戰等,都還未直接產生結果,所以經濟韌性表現不強。那麼,利率抬升的可持續性就會比較差。

但美國經濟的基礎其實已經奠定,包括技術早期發展、政治的積極變化,以及 2008 年金融危機至 2014、2015 年對美國相關運營部門的出清——基礎是有的,只是韌性還未顯現。

疫情後,雖然很多人從微觀角度認為美國經濟是靠財政政策推動,但有時因既是果,果既是因。若自身基礎不牢,即使吃再多補藥或亢奮藥也無濟於事;而若底子修復過來了,遇特殊事件時,潛能便可能被激發。

疫情爆發後,爆發式的低利率狀態從 2020 年延續至 2021 年,大約有一年半時間。這期間,技術從早期走向裂變。其實我認為:到 2020、2021 年,技術裂變已初現端倪,英偉達的例子可加以佐證。低利率環境對技術裂變起促進作用,同時在財政補償和利率影響下,居民部門和政策韌性再次被激發出來了。從那時起,美股真正意義上的長牛趨勢才開始展開——這就是疫情後的重要性。

到了 2021 年底,波動率上升,美股下跌。這一期間,我多了很多炒幣的粉絲,幣圈很多朋友從這時開始關注我。在 2021 年底,我們討論木頭姐和比特幣時,我曾表示:木頭姐採用的是二級市場中的一級投資策略。而比特幣到底是什麼,至今我們仍未完全理解其本質,但從我的觀察來看,它與利率存在一定關聯。

如果説疫情之後,美國逐步進入常態化階段,那麼利率抬升在裂變節點中勢必引發一波殺估值現象——這種狀態可能會推動某種轉化,即技術從早期的估值狀態向價值狀態切換,後續我們可以深入探討這一點。

當時,英偉達、比特幣、木頭姐都經歷了一波暴跌,比特幣更是跌至 2 萬多美元。然而,在利率抬升、殺估值結束後,市場進入價值階段,波動率持續下降,木頭姐表現低迷,而英偉達和比特幣卻重新創下新高,大幅上漲,市場整體波動率也隨之下降。這種上漲與之前的上漲有着本質區別,完成了一次重要的轉換。

綜合過去十年來看,從早期解決問題,到從底層居民部門、中間內政外交以及技術維度這三個方向着手,可視為全要素的準備階段。在第一階段,美國的經濟韌性不足;隨着疫情爆發,促使韌性開始展現;經歷殺估值後,最終展現出韌性和價值——這一系列路徑符合完整的邏輯和路徑。

風險提示及免責條款

市場有風險,投資需謹慎。本文不構成個人投資建議,也未考慮到個別用户特殊的投資目標、財務狀況或需要。用户應考慮本文中的任何意見、觀點或結論是否符合其特定狀況。據此投資,責任自負。