高盛、小摩齐警告:若美国 12 月 CPI 不及预期 美股将震荡

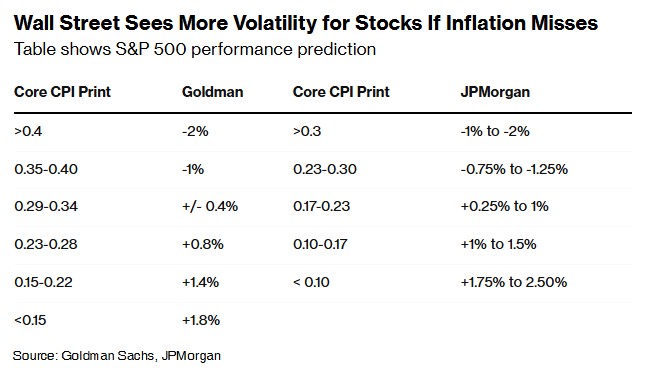

高盛和摩根大通警告稱,如果美國 12 月 CPI 數據不及預期,美股可能會面臨震盪。市場預計 CPI 同比增速將從 2.7% 升至 2.9%。高盛預測,若核心 CPI 環比增速超過 0.4%,標普 500 指數將下跌 2%;摩根大通則預計若環比增速超過 0.3%,指數將下跌 1%-2%。兩家機構均認為,疲軟的 CPI 數據可能引發 1%-2% 的反彈。

智通財經 APP 獲悉,華爾街大行高盛和摩根大通預計,如果週三公佈的美國 12 月 CPI 數據不盡如人意,美股將迎來又一個震盪的日子。

市場目前預計,美國 12 月 CPI 同比增速將由前值 2.7% 上升至 2.9%,環比增速將維持在 0.3%;剔除能源和食品等波動較大因素的核心 CPI 通脹同比增長預計仍將維持在 3.3%,環比增速將放緩至 0.2%。

高盛預計,如果美國 12 月核心 CPI 環比增速大於 0.4%,標普 500 指數將跌 2%。摩根大通預計,如果美國 12 月核心 CPI 環比增速大於 0.3%,標普 500 指數將跌 1%-2%。

與此同時,高盛和摩根大通都預計,如果美國 12 月核心 CPI 環比增速較為疲軟,則可能引發標普 500 指數 1%-2% 的反彈。

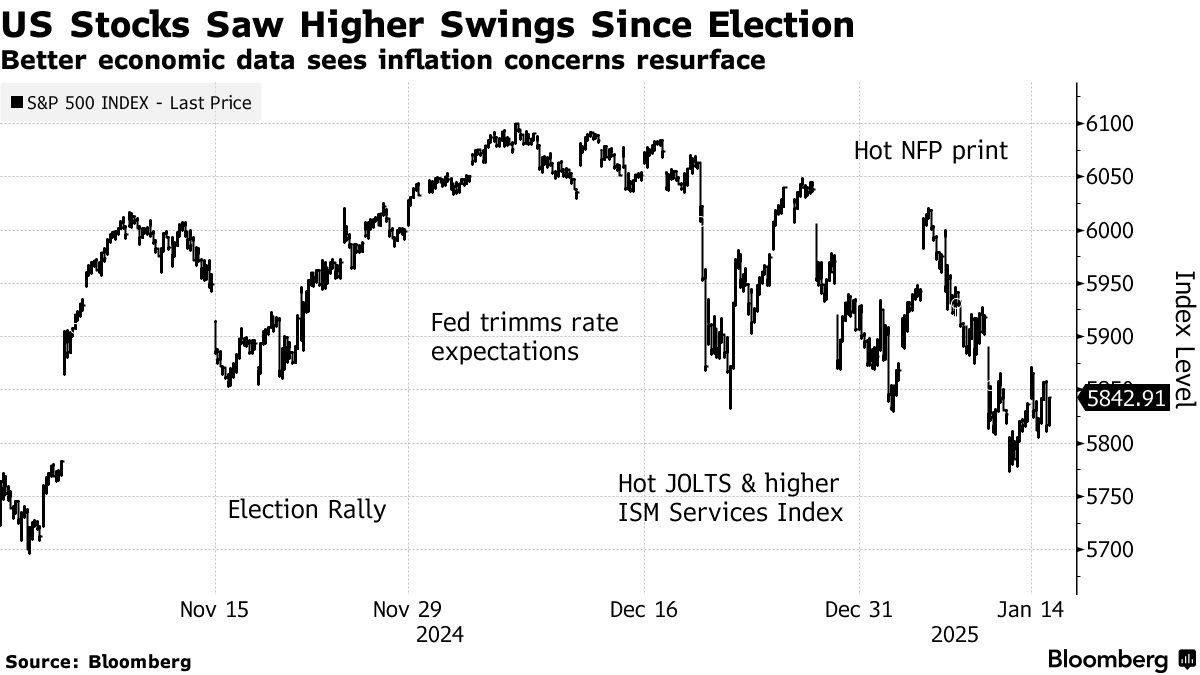

此前一系列穩健的經濟數據導致市場對美聯儲降息的預期有所降温,標普 500 指數今年迄今為止下跌了 0.7%,同時引發了美債收益率的上升和美股盤中的波動加劇。

高盛策略師 Dom Wilson 表示:“美股現在可能需要美聯儲鷹派立場的明顯緩解,才能持續走高。”“我們認為,在我們扭轉美聯儲看跌期權走低的看法之前,股市可能會更加脆弱。”

摩根大通市場情報團隊指出,週三的通脹數據是一個 “關鍵數據點”,基於標普 500 指數期權的波動率指數 VIX 已處於去年 10 月 CPI 公佈以來的最高水平。該團隊表示:“温和的通脹數據可能會重新點燃股市反彈,而強勁的業績期可能會提振反彈。” 不過,該團隊補充稱:“強勁的通脹數據可能是使十年期美債收益率升至 5%,增加所有資產類別的波動性,並繼續給股市帶來壓力。”