CPI 持续反弹但核心 CPI 却下降了 市场很高兴但高兴得有点太早了

我是 PortAI,我可以总结文章信息。

美國 12 月 CPI 同比上漲 2.9%,核心 CPI 同比上漲 3.2%,低於預期。市場對美聯儲降息的預期加大,6 月降息概率上升至 70% 以上,導致美債收益率下滑,美股期貨上漲。然而,分析 CPI 數據的細分和趨勢顯示,市場的樂觀情緒可能過早。

美國 12 月通脹加速但符合預期,同時核心 CPI 下降,市場預計美聯儲將繼續降息步伐。

具體而言,12 月 CPI 同比上漲 2.9%,預期值 2.9%,前值 2.7%,創 2024 年 7 月以來的最高水平;同時 12 月核心 CPI 同比上漲 3.2%,低於預期 3.3%,前值 3.3%。

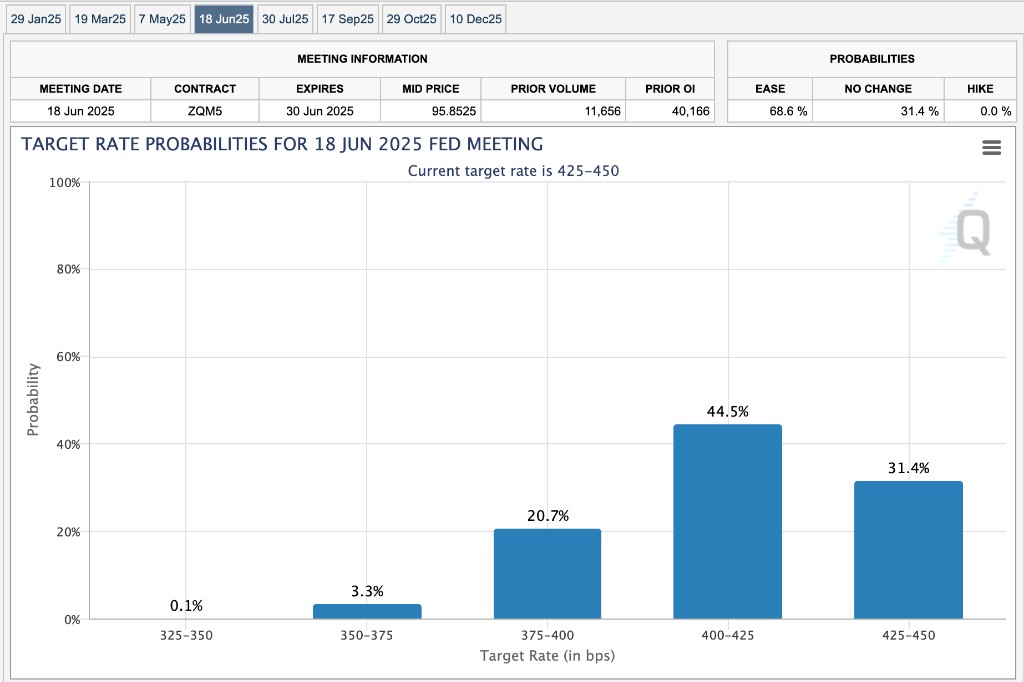

從理論上來講,核心 CPI 對於未來通脹更具有指導意義,所以這次市場看到這個數據非常 “高興”:市場加大了對 6 月降息的押注。

圖:2025 年 6 月再降息的概率上升至 70% 以上

受此影響,美債收益率下滑,美股期貨開盤前跳漲:納斯達克 100 指數期貨暴漲 2%,標普 500 漲 1.55%。

然而,如果細看 CPI 數據的細分和趨勢會發現,市場高興得有點太早了。