U.S. Inflation "Douses Cold Water": A "Rehearsal" for the Turning Point?

美國 1 月通脹數據低於預期,導致市場反應積極,美元指數一度上升至 110,美債收益率接近 4.80%。儘管核心 CPI 降温,但能源價格上漲和核心商品企穩支撐了 CPI 整體表現。非美市場如英鎊和印度盧比出現反彈,市場對加息的擔憂暫時緩解。美債收益率大幅下跌,反映出市場對通脹的重新評估。

美國 1 月通脹這盆 “冷水”,終於讓市場喘了一口。1 月以來在特朗普政策的各種預期,以及美國就業等韌性數據連續 “轟炸” 下,美元指數一度站上 110,而美債收益率則衝着 4.80%“義無反顧”。受此影響非美市場承受了較大壓力,英國債匯雙殺,印度等新興市場則股匯雙殺。

美國核心 CPI 不及預期的這盆 “冷水”,雖然尚不足以扭轉趨勢,但卻讓我們看到了,如果特朗普政策的 “通脹屬性” 不及預期,誰的 “喘息之機” 會更大?

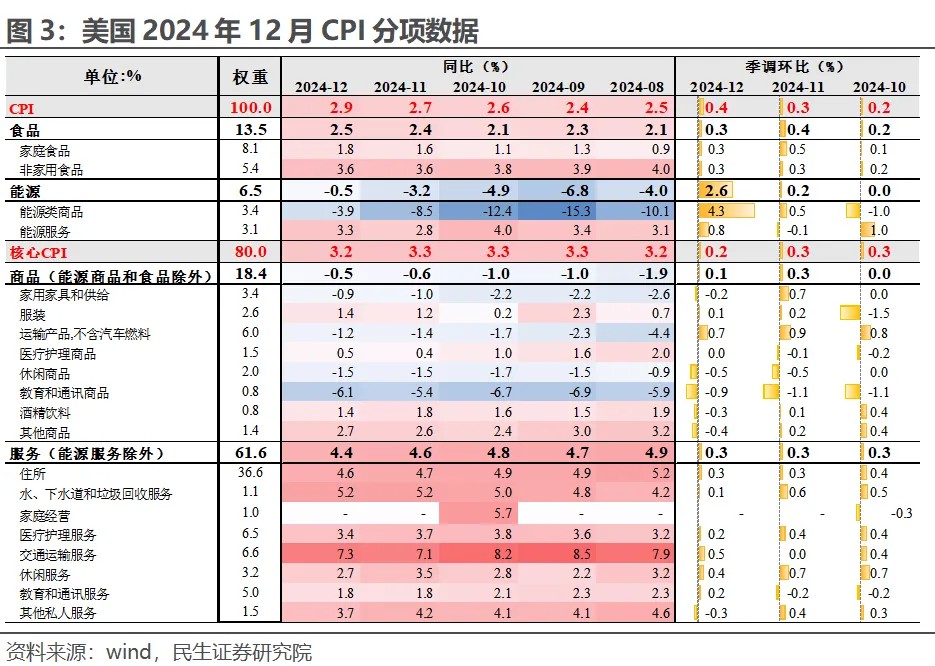

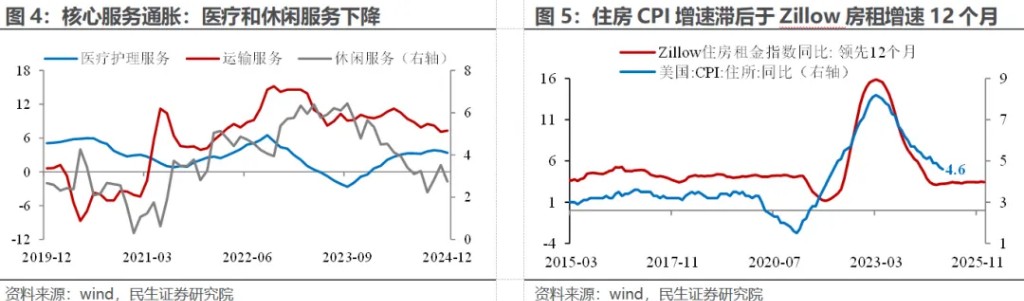

從數據本身來看,最大的驚喜是美聯儲關注的超級核心通脹(Supercore CPI)終於降温了,環比增速降至去年 7 月以來的最低。娛樂、醫療等服務價格下降是重要原因,其次是住所服務 “按部就班” 的回落,不過從環比上看降温主要來自於酒店價格。

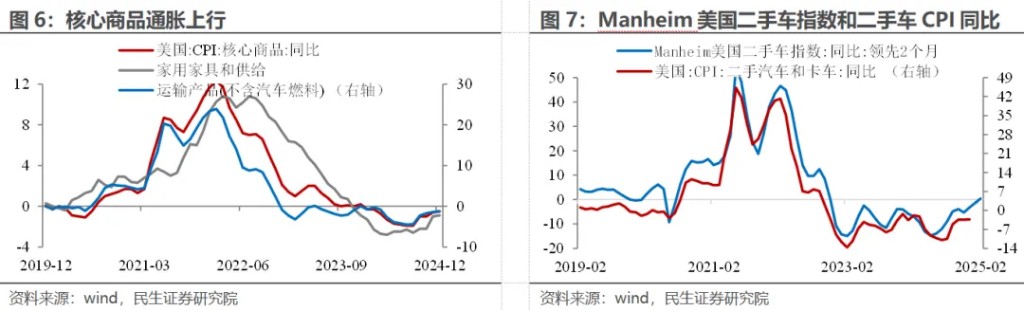

當然值得關注的、也是支撐 CPI 整體符合預期的最大因素是能源價格的上漲,以及核心商品的企穩。12 月美國天然氣價格相較 11 月上漲超過 4%,而近期原油價格的大漲也預示着 1 月能源價格會繼續顯著上漲。此外,像傢俱、汽車等耐用品消費價格在同比上的改善,背後對應的是美聯儲去年連續降息對耐用品消費的刺激在逐步釋放。

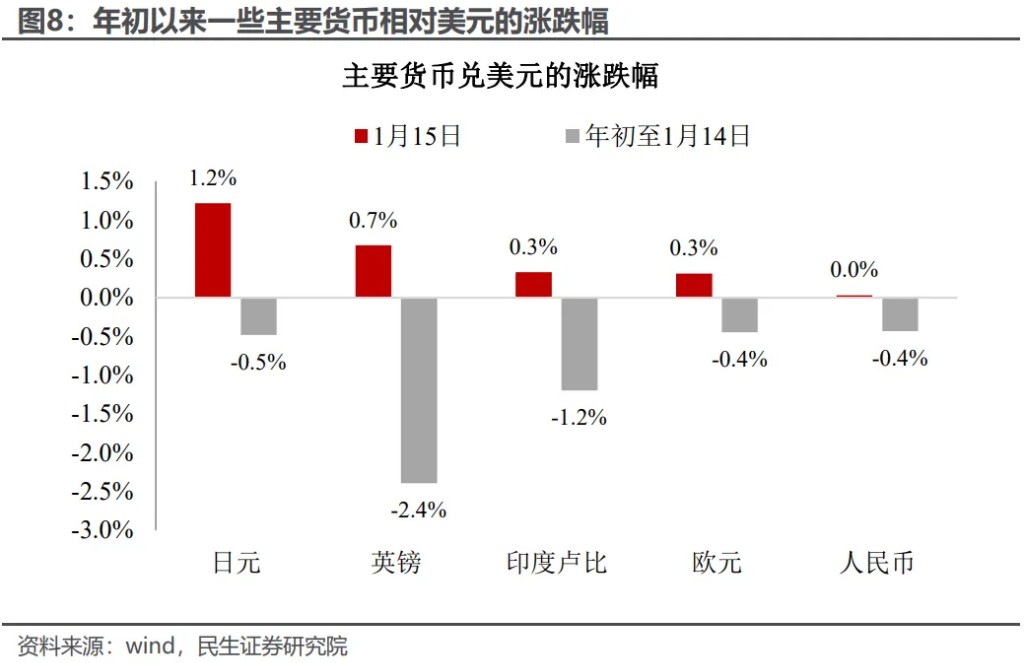

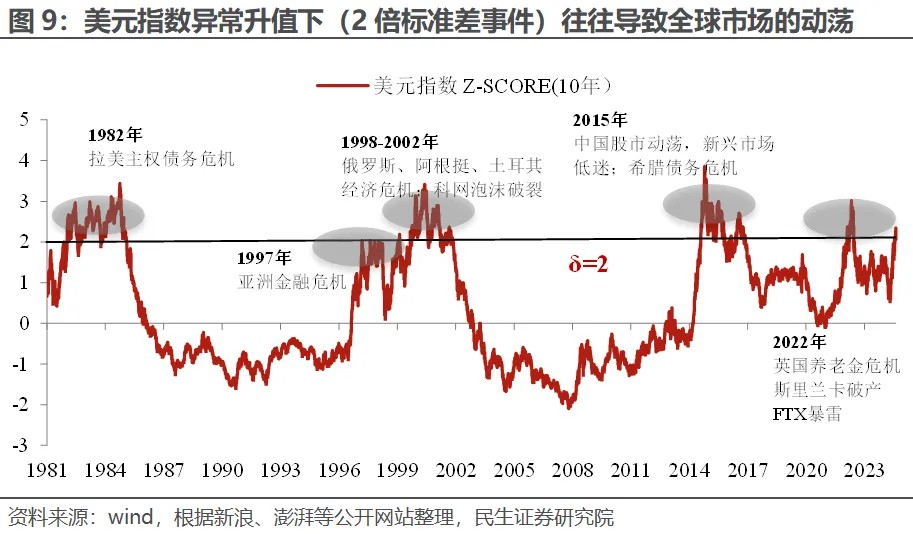

非美市場無疑是喘了一口大氣。年初以來貶值壓力比較大的英鎊、印度盧比都出現比較明顯的反彈。日元的強勢除了美元的原因外,還有其獨樹一幟的 “加息” 預期。從歷史上看,美元大幅異常升值往往導致非美經濟體或者市場出現危機性事件,美國通脹這盆 “恰到好處” 的冷水帶來美元走弱,讓警報暫時性解除,此前壓力大的市場,短期內可能有更好的反彈。

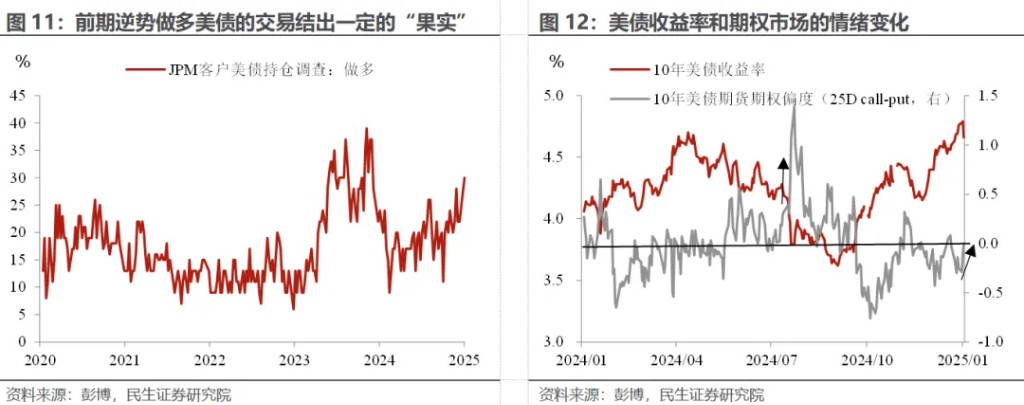

美債多頭也高興了。自 12 月底以來,美債收益率上漲背後的通脹 “含量” 不小,甚至開始定價再通脹擔憂下的加息風險。通脹數據的這盆冷水至少暫時可以打消市場對於加息的擔憂。

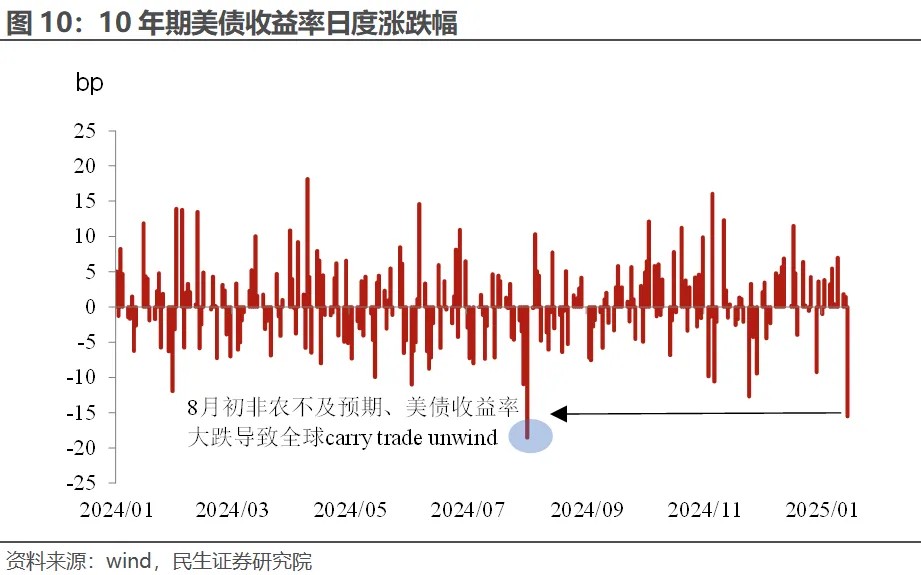

從微觀上,10 年美債收益率單日的跌幅非常誇張,幾乎和 2024 年 8 月初相當。而當時因為非農就業不及預期,帶來套息交易(carry trade)大規模爆倉,使得美股和以日股為代表的非美股市均出現大跌。

這一次可能更多是此前押注 10 年美債收益率漲破 5% 的期權期貨交易平倉(美債期貨看跌期權大量平倉)帶來的大幅波動。不過值得注意的是,美債期權市場的情緒是從看空變成中性,暫時還沒出現反轉。

美股也 “乘勝追擊”,單日就收復了今年所有的跌幅。這也側面反映出,今年美股的特點在於,對特朗普新政的 “親商” 特質是比較認可的,而主要的擔心是高估值下,高利率帶來的風險。而這個警報可能並沒有解除,因為單靠 1 個月的數據並不能改變美聯儲 12 月奠定的謹慎立場。

當然,美聯儲也該 “慶幸”,至少短期內加息的可能性下降。至少不用在去 9 月剛大幅開啓降息後,不到 1 年的時間就轉向加息,這在 1990s 美聯儲重回利率目標之後的歷史上是比較少見的。

不過,美元明顯是更有韌性的。美元的上漲趨勢還沒有被破壞,最終可能還是需要特朗普來 “一錘定音”。美元的底層邏輯除了自身的貨幣政策鬆緊之外,很重要的一點是即將到來的特朗普新政 “美國例外” 的預期,該預期最終的實現情況依賴於特朗普後續政策動向,而這至少需要等到 1 月 20 日之後,很可能會出現 “買預期、賣事實” 的時間窗口——控通脹可能是 “百日新政” 最重要的任務之一。

本文作者:邵翔 SAC 編號 S0100524080007,來源:川閲全球宏觀,原文標題:《美國通脹 “潑冷水”:拐點的 “預演”?》

風險提示及免責條款

市場有風險,投資需謹慎。本文不構成個人投資建議,也未考慮到個別用户特殊的投資目標、財務狀況或需要。用户應考慮本文中的任何意見、觀點或結論是否符合其特定狀況。據此投資,責任自負。