全球矿业头号并购交易要来了?媒体称力拓和嘉能可商谈合并

嘉能可美股一度漲超 8%。若交易達成,合併後公司市值將超越礦業龍頭必和必拓。交易能否達成可能取決於持股嘉能可的該司前 CEO Ivan Glasenberg、卡塔爾以及中鋁。

全球礦業可能誕生一個新的巨無霸。

美東時間 1 月 16 日週四美股午盤,彭博社報道援引知情者的消息稱,力拓(Rio Tinto Group)和嘉能可(Glencore Plc)之前一直在討論兩家公司合併,最近就交易進行了初步的磋商,目前尚不清楚談判是否仍在進行中。

另外據路透社援引知情人士報道,嘉能可去年年底曾與力拓接洽,希望進行潛在合併,但談判很短暫,沒有取得任何進展,目前談判已經不再活躍。

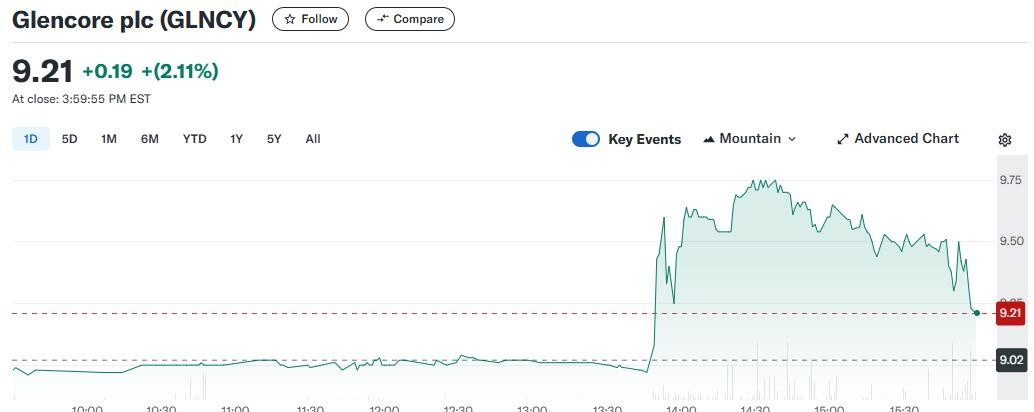

消息傳出後,嘉能可在美股粉單市場的交易價迅速跳漲,盤中漲幅一度超過 8%,最終收漲逾 2%。力拓美股收跌 1.1%。

嘉能可的發言人此後表示,公司不對市場傳言或猜測發表評論。力拓拒絕置評。

若消息屬實,將可能出現採礦行業有史以來最大的交易,因為合併後的公司市值將超越長期以來一直處於行業領先地位的必和必拓集團(BHP Group)。

力拓是全球第二大礦業公司,截至本週四收盤,以倫敦上市的力拓和嘉能可各自歐股收盤價計算,力拓的市值約合 1030 億美元,嘉能可的市值約合 550 億美元。以週四美股收盤價,必和必拓的市值不到 1250 億美元。

嘉能可和力拓都擁有一些優質銅礦。不過,和必和必拓一樣,力拓作為全球最大的鐵礦石生產商還嚴重依賴鐵礦石推動其利潤增長。力拓去年同意以 67 億美元收購美國上市的鋰生產商 Arcadium,體現出力拓正尋求提升在電池礦物供應領域的影響力。

與嘉能可併購將讓力拓得到智利 Collahuasi 銅礦的股份。Collahuasi 是全球最大的銅礦之一,位於智利北部,由嘉能可和英美資源集團(Anglo American Plc)控股。報道稱力拓已經覬覦了 Collahuasi 銅礦十多年。

同時,與力拓合併會讓人懷疑,作為全球大宗商品交易巨頭的嘉能可是否要延續煤炭開採業務。

力拓早在 2013 年就開始掛牌出售煤炭資產,此後持續五六年逐步退出煤炭業務。而嘉能可是全球最大的動力煤運輸商和最大的焦煤生產商。

去年 8 月嘉能可公佈,在與股東討論過後,公司決定放棄剝離煤炭業務的計劃。在公開信中,嘉能可直言,這是因為超過 95% 的股東 “向錢低頭”,認為保留該業務能增強現金生成能力。

有評論稱,力拓與嘉能可的併購能否達成可能取決於前嘉能可 CEO Ivan Glasenberg 會不會支持。Glasenberg 於 2021 年卸下 CEO 一職,但仍持有嘉能可將近 10% 的股份。執掌嘉能可帥印期間,Glasenberg 曾在 2014 年牽頭與力拓合併,但最終未果。

此外,對力拓與嘉能可的併購來説,卡塔爾和中國的支持也至關重要。卡塔爾是嘉能可最大的股東之一,持有公司 8.5% 的股份,中國鋁業股份有限公司則是力拓的最大投資者。

2008 年,中鋁聯合美國鋁業收購了力拓 12% 的股份,交易總對價略超過 140 億美元。2009 年,中鋁還試圖繼續注資 195 億美元、讓所持的力拓股份佔比接近翻倍至 18%,並獲得兩名董事席位,直接擁有部分鋁、銅和鐵礦石資產的權益,以及與這些業務建立結盟關係。但隨着那一年的原材料商品價格的復甦,力拓財務狀況有所改善,中鋁的注資計劃沒能實現。