The five key "mismatches" in the current global market

Expectations of the Federal Reserve's interest rate cuts VS the reality of stubborn inflation, moderate tariff policy expectations VS Trump's tough statements, expensive U.S. stocks VS a weak U.S. economy

The market is not always rational, and this irrationality is manifested as "dislocation."

On the 21st local time, Deutsche Bank's macro strategist Henry Allen released a report stating that the current global financial market is facing five key "dislocation" phenomena, which may indicate the direction of future adjustments.

The market believes that the Federal Reserve will continue to cut interest rates this year, despite inflation still being above the central bank's target;

The market does not believe that Trump will take aggressive measures on tariffs, despite Trump himself warning multiple times;

U.S. stock valuations have never reached such high levels amid such weak economic growth;

UK government bonds and the pound have performed poorly, but the investment-grade spread of the pound is at its tightest level since the global financial crisis;

The Bank of Japan is in a rate hike cycle, but the 5-year Japanese government bond yield is only 0.84%, far from adequately reflecting actual inflationary pressures.

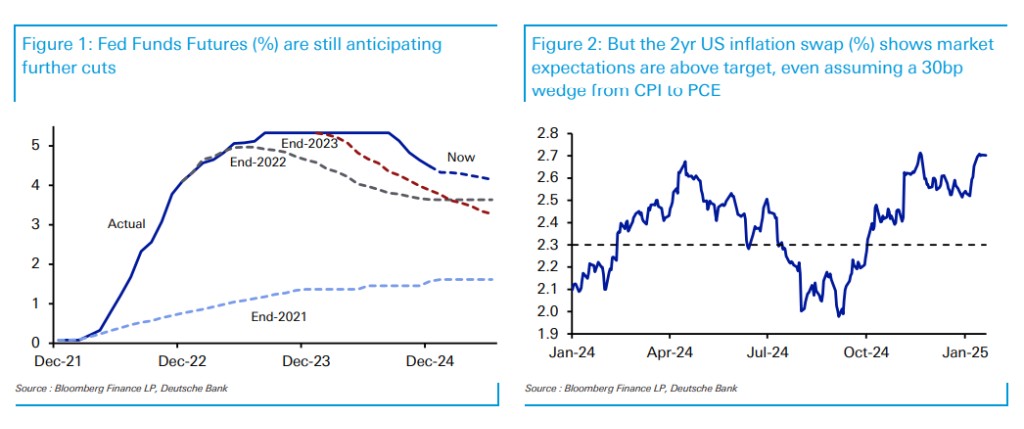

Mismatch One: The Contradiction Between Federal Reserve Rate Cut Expectations and High Inflation Pressure

The report first points out that the market currently expects the Federal Reserve to cut interest rates in 2025, while simultaneously expecting inflation to remain above the Federal Reserve's target, which leaves market analysts puzzled.

According to data from Federal Reserve fund futures, the market expects the Federal Reserve to cut rates by 43 basis points by December 2025. However, inflation expectations remain high, with the 1-year inflation swap rate at 2.77%, the 2-year at 2.70%, and the 5-year at 2.58%. Even considering the 20-40 basis point difference between inflation swap rates and the Federal Reserve's target inflation rate (PCE), inflation expectations are still well above the Federal Reserve's target range.

Behind this contradictory expectation, the market seems to overlook the more cautious policy path that the Federal Reserve may take due to inflation remaining persistently above target. Deutsche Bank believes that although the Federal Reserve may hint at future rate cuts, the persistence of inflation may limit its rate-cutting space, and the market's underestimation of this risk could lead to market volatility during future policy adjustments. Allen wrote:

Given the record of inflation being persistently above target since 2021, it is hard to imagine the Federal Reserve would risk being overly aggressive in loosening policy.

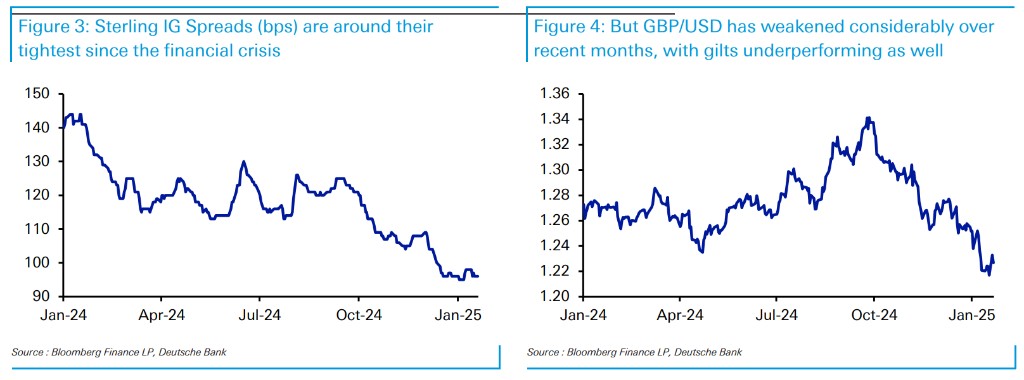

Mismatch Two: Asset Performance Divergence in the UK Market

The UK market has also recently seen significant asset performance divergence.

Since December 2024, the pound has fallen 3.9% against the dollar and 1.3% against the euro, while the total return on UK government bonds has decreased by 2.9%, underperforming eurozone sovereign bonds and U.S. government bonds.

However, against this backdrop, the investment-grade (IG) credit spread of the pound has tightened by 12 basis points to 96 basis points, approaching its tightest level since the global financial crisis. In contrast, the U.S. IG credit spread has only tightened by 2 basis points, and the euro IG credit spread has tightened by 11 basis points, still above the mid-2021 low

Deutsche Bank believes that this divergence may reflect the market's excessive optimism regarding the UK credit market while ignoring the weak performance of the pound and government bonds. The report points out that the IG credit spread of the pound may widen in the coming months, especially compared to the IG spread of the euro, which could pose a challenge to the stability of the UK market.

Mismatch Three: Underestimation of Trump's Tariff Policy by the Market

In the United States, there is also a significant mismatch in the market's expectations regarding Trump's tariff policy.

Although Trump proposed a series of radical tariff policies during his campaign, the market seems not to believe that he will fully implement these policies. Deutsche Bank's recent global market survey shows that over 80% of investors believe Trump will be more moderate than his campaign promises.

However, Trump himself has repeatedly denied this expectation, emphasizing that his tariff policy will remain tough. On the 21st local time, Trump signed an executive order announcing a 25% tariff on Mexico and Canada starting February 1, putting pressure on the Mexican peso and Canadian dollar.

The report points out that the market's underestimation of Trump's tariff policy may overlook its potential impact on global trade and US inflation. Deutsche Bank found that the current market pricing only reflects a 5% general tariff. If Trump implements his tariff threats, it could significantly boost US inflation, thereby affecting the Federal Reserve's policy path.

Based on the experience of his first term, Trump's more aggressive trade policies are usually implemented in the second or third year. Looking ahead, Deutsche Bank believes:

April 1 will be a key date, as several reports will return to him that day according to Trump's "America First Trade Policy" memorandum.

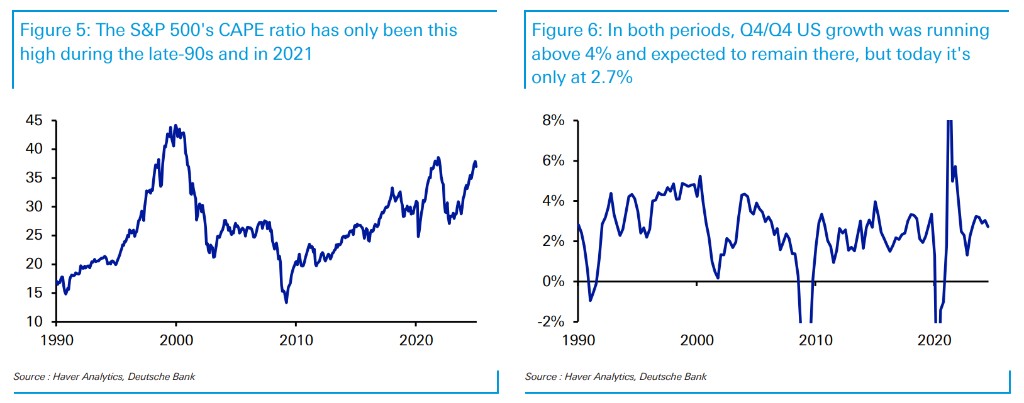

Mismatch Four: Divergence Between US Stock Valuation and Economic Growth

The divergence between US stock valuations and economic growth is also a key mismatch phenomenon in the current market.

The report shows that the CAPE ratio (Cyclically Adjusted Price-to-Earnings ratio) of the S&P 500 index is currently at a historical high, only seen in the late 1990s and 2021. However, unlike the economic growth rate of over 4% at that time, the current US economic growth is only 2.7%, and it is expected to remain at a low level in the future.

This divergence indicates that the market may be overly optimistic, ignoring the risks of slowing economic growth. Deutsche Bank states that although stock market valuations are high, the slowdown in economic growth may limit corporate profit growth, thereby putting pressure on the continued rise of the stock market.

Mismatch Five: Japanese Bond Yields vs. Inflation

In Japan, the divergence between inflation and bond yields is also worth notingThe report points out that since April 2022, Japan's inflation rate has been above the target level, and the CPI data expected to be released this week is projected to rise further to 3.4%. However, the yield on Japan's 5-year bonds is only 0.84%, and the 5-year inflation expectation is just 1.68%.

Deutsche Bank believes that the market may be underestimating the risk of Japan's inflation remaining persistently above target, leading to bond yields not fully reflecting actual inflation pressures.

This divergence may suggest that the Japanese market has a bias in its long-term inflation expectations, and the persistence of future inflation may force the Bank of Japan to adopt a more tightening policy, which could impact the bond market