How does the market respond to Trump's tariffs of "small amounts and multiple times"?

特朗普的關税政策未如預期迅速實施,可能採取 “少量多次” 的方式施壓貿易伙伴。這種猶豫導致市場對美國通脹的預期面臨下行風險,同時可能使美元匯率走弱。美股因利率下行和盈利向好而反彈,但市場仍對特朗普的政策不確定性感到擔憂。通脹問題成為市場關注焦點,特朗普的目標之一是遏制通脹,增加油氣供給以降低汽油價格。市場在重要數據發佈前難以找到方向。

特朗普就任美國總統,市場翹首以盼的關税政策卻沒有像想象中那樣 “爽快” 落地,反而對於內政着墨較多。多方消息顯示,特朗普大概率會使用關税作為談判手段,並採用 “少量多次” 的方式來向貿易伙伴施壓。

對於金融市場而言,特朗普在關税政策上的 “猶豫”,卻帶來了兩個新的宏觀變量。首先,關税如果加徵時間推後,那麼市場對於美國通脹的展望就可能面臨 downside risk;其次,關税大棒落下較慢以及分量比預想中輕,相應貿易對手的匯率就可能出現反彈,換言之,美元匯率可能會走弱。

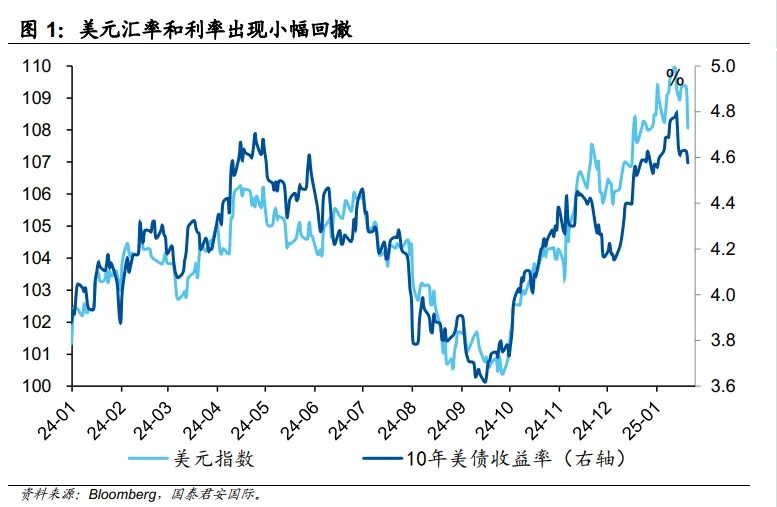

正是由於這樣的變化,美元利率和匯率均在特朗普就任後出現了一定回撤,但由於市場仍擔心特朗普的 “不按常理”,因此也不敢在反向頭寸上加倉,因此也只能等待特朗普的下一步,以及 2 月前兩週的美國數據再做判斷。

美股邏輯則顯得較為流暢,利率下行,股債蹺蹺板的作用下,美股出現反彈;與此同時,特朗普的 “重商主義” 以及盈利向好,也推動了美股的持續表現。大體上,我們也會發現,當 10 年美債利率接近 4.8% 甚至靠近 5% 時,市場對通脹的擔憂會顯著升温,並會影響整體市場的風險偏好。但當美債利率出現下行時,市場的風險偏好會伴隨着美元走弱而出現上升。

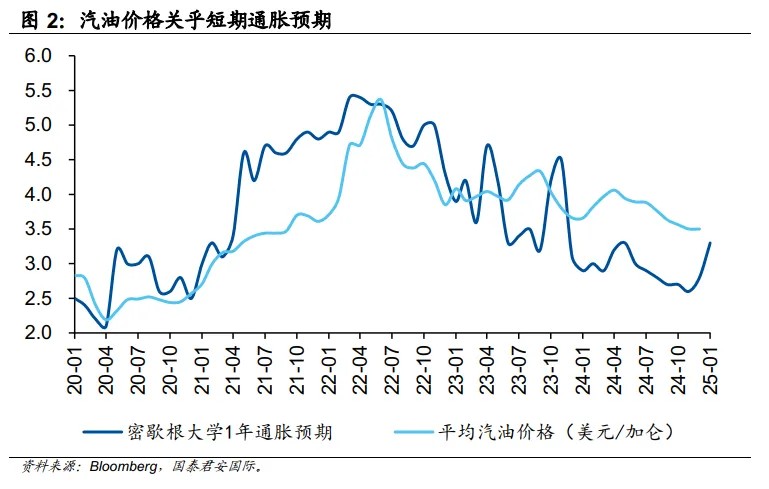

從這些方面而言,通脹仍然是市場博弈和關心的焦點,遏制通脹似乎也是特朗普目前的頭號目標之一。上任首日,特朗普就退出巴黎氣候協定,並宣稱要增加油氣開採和供應。考慮到汽油價格對於普通美國居民的重要性,增加油氣供給來遏制通脹的意圖也十分明顯。

當然,這一切的重要性,都會讓位於 2 月初的非農就業數據以及 CPI 報告,這也意味着市場在數據發佈前很難找到方向,只能以 carry 作為最可靠的交易邏輯。與此同時,債券市場可能需要以匯率作為先行指標,即美元匯率走強,那麼利率大概率上行;反之亦然。

正文

特朗普就任美國總統,市場翹首以盼的關税政策卻沒有像想象中那樣 “爽快” 落地,反而對於內政着墨較多。多方消息顯示,特朗普大概率會使用關税作為談判手段,並採用 “少量多次” 的方式來向貿易伙伴施壓。這似乎又讓我們想起了特朗普 1.0 時代的各種極限施壓,相信未來的各種拉扯仍然難以避免。

但對於金融市場而言,特朗普在關税政策上的 “猶豫”,卻帶來了兩個新的宏觀變量。首先,關税如果加徵時間推後,那麼市場對於美國通脹的展望就可能面臨 downside risk;其次,關税大棒落下較慢以及分量比預想中輕,相應貿易對手的匯率就可能出現反彈,換言之,美元匯率可能會走弱。與此同時,需要考慮的是,美元匯率走強,會對關税效應形成一定的對沖,即加徵關税和美元購買力增強,這兩者之間會出現一定的抵消效應,而理論上來説,這兩者之間可能會有一個微妙的平衡點。

正是由於這樣的變化,美元利率和匯率均在特朗普就任後出現了一定的回撤,但由於市場仍然擔心特朗普的 “不按常理”,因此也不敢在反向頭寸上加倉,因此也只能等待特朗普的下一步,以及 2 月前兩週的美國數據再做判斷。這樣的情況在 2017 年似乎也出現過,當時美債利率在特朗普就任前就開始掉頭向下,但到了 2 月初又開始反彈,直至 3 月才出現明顯的向下趨勢。市場不會踏入同一條河流,但往往又會踏入同一條河流,簡單的類比只能説明市場本身存在類似的交易慣性,但最終仍然要考慮經濟的基本面。

相比而言,美股邏輯則顯得較為流暢,利率下行,股債蹺蹺板的作用下,美股出現反彈;與此同時,特朗普的 “重商主義” 以及盈利向好,也推動了美股的持續表現。大體上,我們也會發現,當 10 年美債利率接近 4.8% 甚至靠近 5% 時,市場對通脹的擔憂會顯著升温,並會影響整體市場的風險偏好。但當美債利率出現下行時,市場的風險偏好會伴隨着美元走弱而出現上升。

從這些方面而言,通脹仍然是市場博弈和關心的焦點,遏制通脹似乎也是特朗普目前的頭號目標之一。上任首日,特朗普就退出巴黎氣候協定,並宣稱要增加油氣開採和供應。考慮到汽油價格對於普通美國居民的重要性,增加油氣供給來遏制通脹的意圖也十分明顯。與此同時,1 月底美國財政部也會公佈新的債券融資計劃,這也是新任財長貝森特面臨的第一次實際考驗,面臨高昂的利息成本,如何安排未來的再融資計劃,將成為貝森特與市場的第一次關鍵博弈。

當然,這一切的重要性,都會讓位於 2 月初的非農就業數據以及 CPI 報告,這也意味着市場在數據發佈前很難找到方向,只能以 carry 作為最可靠的交易邏輯。與此同時,債券市場可能需要以匯率作為先行指標,即美元匯率走強,那麼利率大概率上行;反之亦然。

本文作者:周浩、孫英超,文章來源:國君海外宏觀研究,原文標題:《【國君國際宏觀】特朗普關税 “少量多次”,市場如何反應?》