TSMC: Q2 indicators will continue to deteriorate, but will improve in the second half of the year, with incremental demand from AI products.

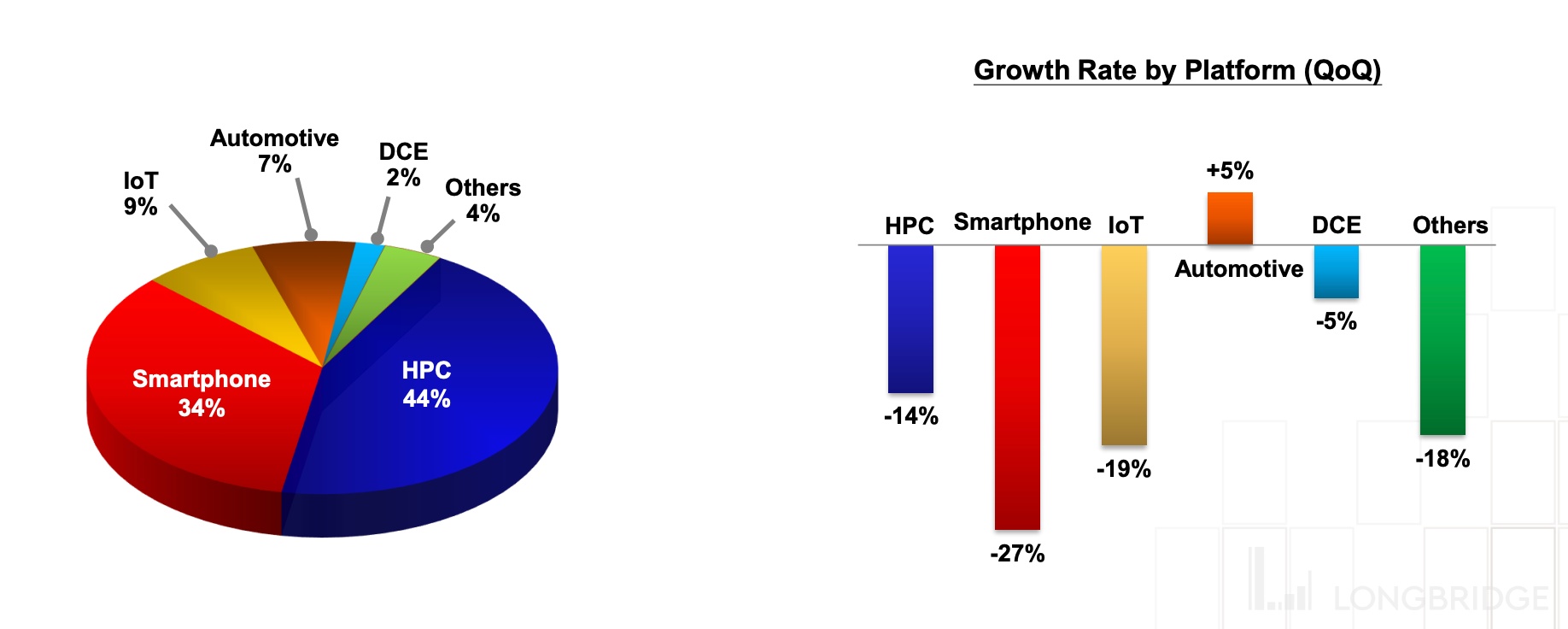

In the first quarter, except for the automotive business, other areas experienced varying degrees of decline. Among them, smartphone sales fell by 27%, IoT fell by 19%, and HPC fell by 14%.

Taiwan Semiconductor released its Q1 2023 financial report.

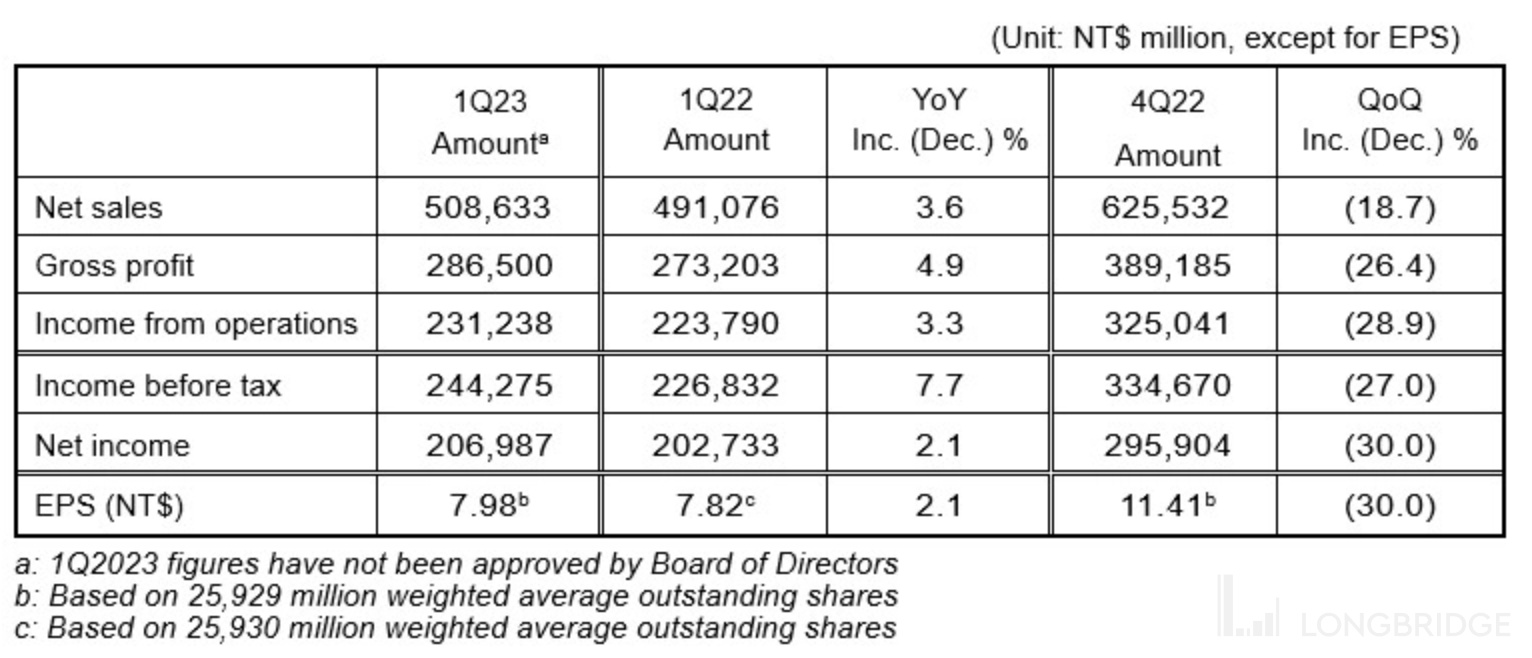

In Q1 2023, Taiwan Semiconductor's revenue was NT$508.63 billion, with a net profit of NT$206.99 billion and a diluted earnings per share of NT$7.98. The overall performance was poor, and the guidance for Q2 continued to deteriorate.

Q1 2023 Financial Report of Taiwan Semiconductor

Taiwan Semiconductor

Net profit was NT$206.99 billion,

Diluted earnings per share were NT$7.98, up 2.1% YoY but down 30% QoQ.

Compared with the same period last year, Q1 revenue increased by 3.6%, and net income and diluted earnings per share both increased by 2.1%.

The gross margin for this quarter was 56.3%, the operating profit margin was 45.5%, and the net profit margin was 40.7%.

Observation of Subsidiary Business

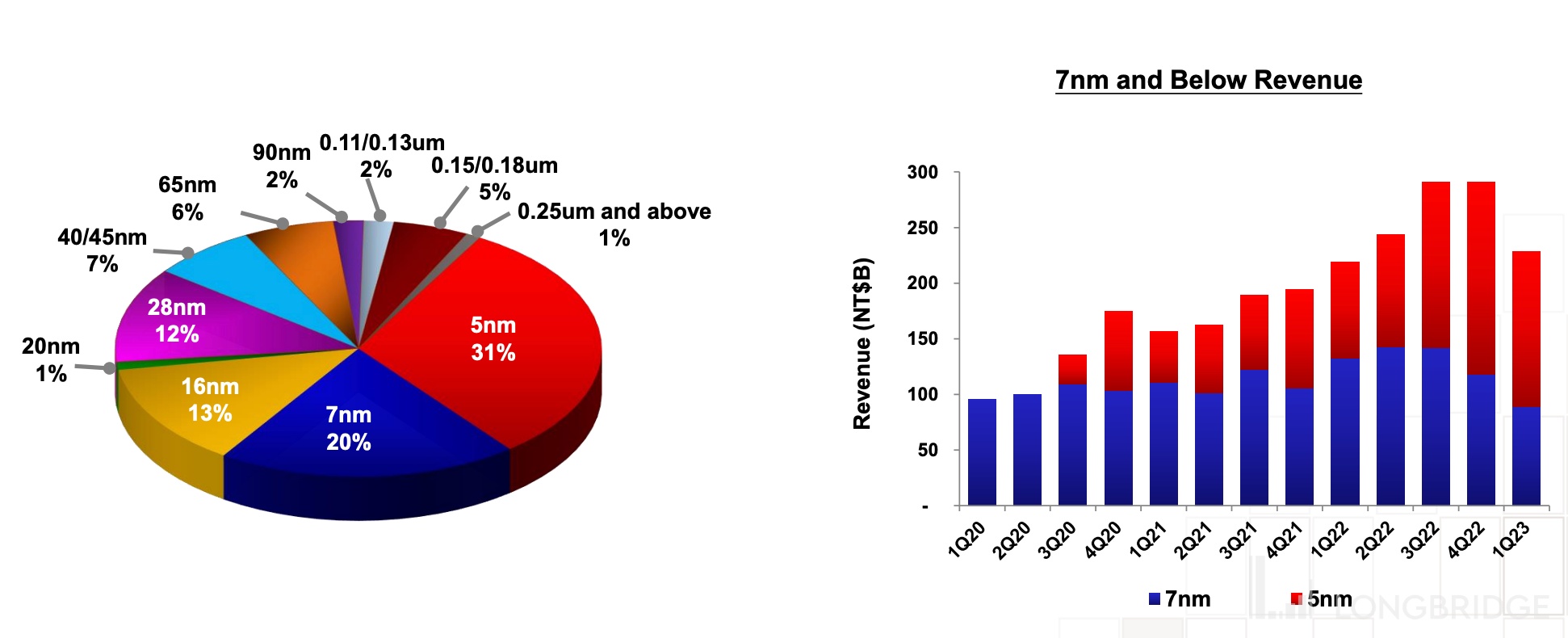

In Q1 2023, the shipment volume of 5nm chips accounted for 31% of the total wafer revenue, and 7nm chips accounted for 20%, totaling 51%.

In Q1 2023, except for the automotive business, other fields showed varying degrees of decline. Among them, smartphone sales fell by 27%, IoT fell by 19%, and HPC fell by 14%.

Q2 2023 Guidance

Wendell Huang, Vice President and CFO of Taiwan Semiconductor, said: "The business in Q1 was affected by the weak macroeconomic situation and weak demand in the terminal market, which led to corresponding adjustments in customer demand."

Based on the assumption of a USD/NTD exchange rate of 1:30.4, management expects the overall performance of Q2 2023 to be as follows:

- Revenue is expected to be between USD 15.2 billion and USD 16 billion;

- Gross margin is expected to be between 52% and 54%;

- Operating profit margin is expected to be between 39.5% and 41.5%.

AI Products Bring Incremental Growth

Taiwan Semiconductor stated that it expects business in the second half of the year to be stronger than in the first half. The business will be affected by inventory adjustments and will take longer than expected to recover.

It sees strong demand for N3 chips in the coming years. N2 chips are expected to be mass-produced in 2025.

CEO Wei Zhejia said that the personal computer and smartphone markets are still weak, and AI products will bring incremental growth.

Taiwan Semiconductor stated that it is confident in maintaining a high market share and sees a gradual increase in demand related to AI. Taiwan Semiconductor Manufacturing Company (TSMC) said it is expanding its 28nm production capacity at its Nanjing plant, but still faces a shortage of advanced nodes. The company believes that long-term demand exists and will continue to invest.

This year's capital expenditure expectations are cautious but still effective; it is too early to discuss next year's capital expenditure. TSMC has the flexibility to increase or tighten capital expenditures, but believes that its business will continue to grow.

The cost of overseas factories is relatively high in the first few years. TSMC is evaluating the possibility of building a factory in Europe and is expected to employ more than 6,000 employees in Taiwan by 2023.