US Stock Options | Amazon and Uber options trading volume tripled, Lyft options trading volume surged fivefold.

Last Friday, the US stock market opened low and rose high, with obvious differentiation in technology stocks. Tesla rose more than 1%, Amazon rose more than 3%, AMD fell nearly 2%, Alibaba fell nearly 2%, Lyft rose more than 6%, and Uber fell more than 2%.

Last Friday (April 21), the US stock market rose slightly, and technology stocks showed obvious differentiation.

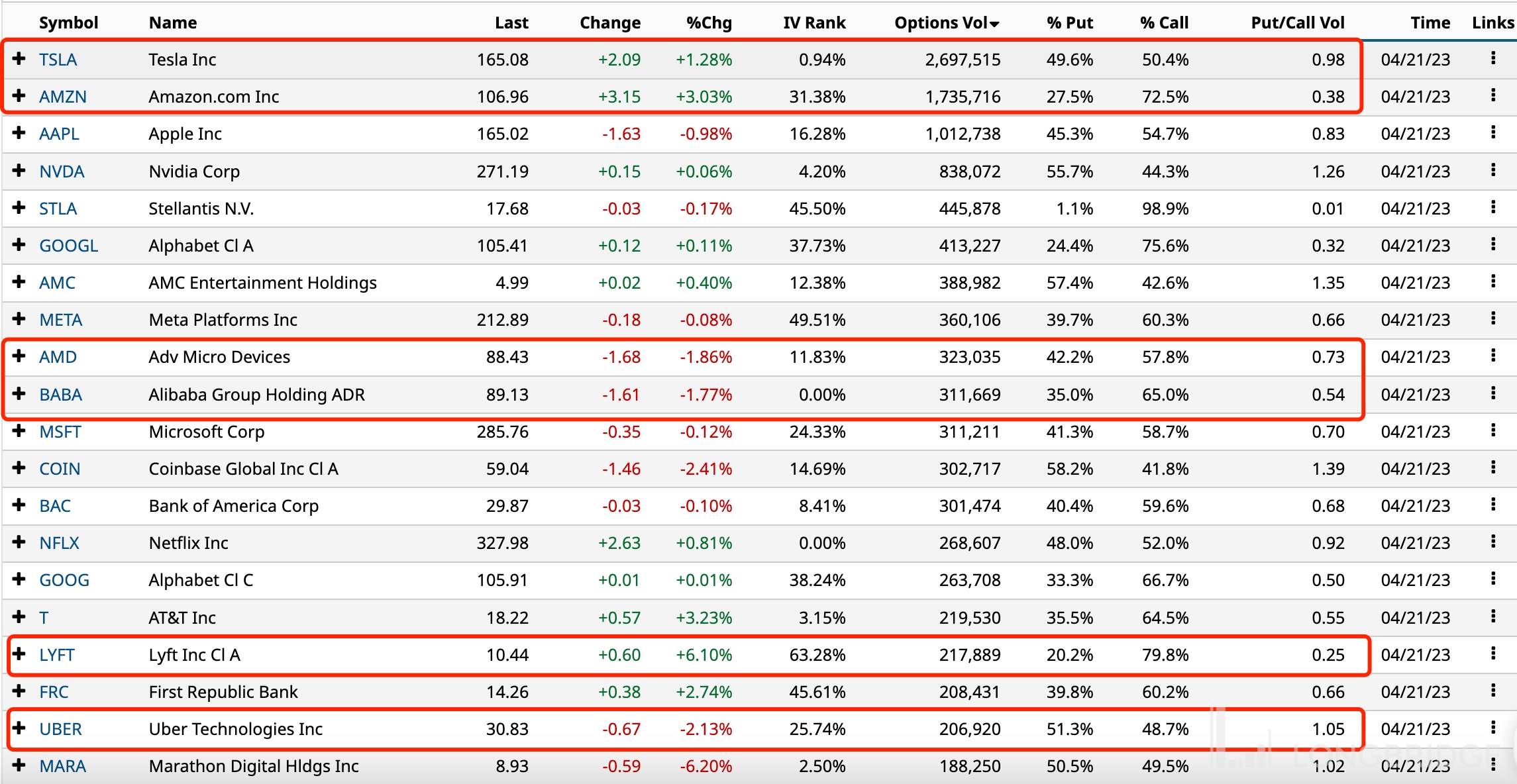

Top 10 US Stock Options

Last Friday, the US stock market opened low and went high, and the overall performance was relatively resilient.

The top 10 US stock options traded: Tesla, Amazon, Apple, Nvidia, Stellantis, Google A, AMC Theatres, Meta, AMD, Alibaba, Microsoft, Coinbase.

Tesla rose more than 1%, with options trading 2.7 million contracts, and the proportion of call options trading was 50.4%.

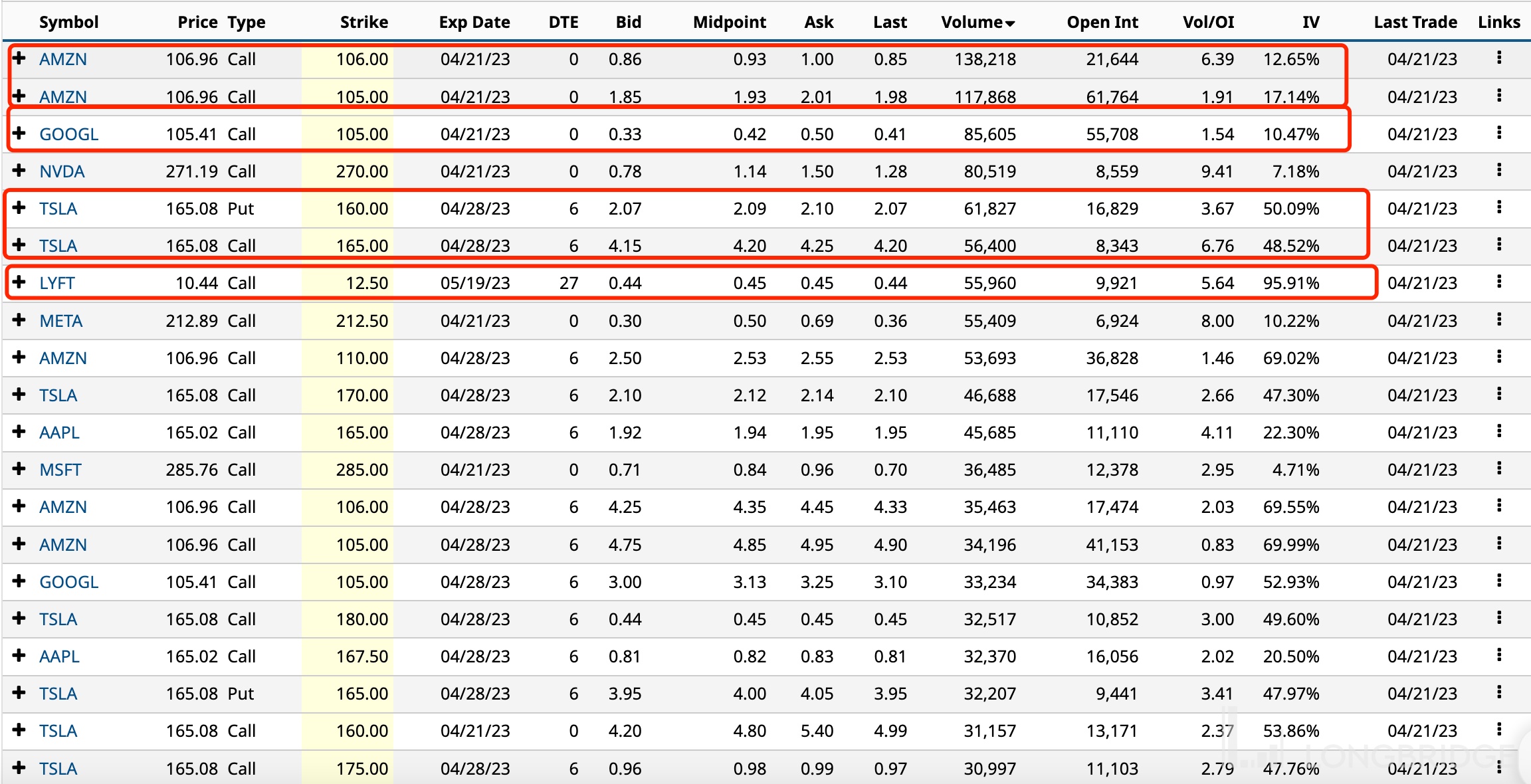

Amazon rose more than 3% against the trend, with options trading 1.74 million contracts, three times the average daily trading volume, and the proportion of call options trading was 72.5%. The call options with a strike price of $105/$106 were the most active.

Apple fell nearly 1%, with options trading 1.01 million contracts, and the proportion of call options trading was 54.7%.

Nvidia rose slightly, with options trading 840,000 contracts, and the proportion of put options trading was 55.7%.

Stellantis NV fell slightly, with options trading nearly 450,000 contracts, and the proportion of call options trading was 98.9%.

Google A fell slightly, with options trading 410,000 contracts, and the proportion of call options trading was 75.6%. The call options with a strike price of $105 were the most active.

AMC Theatres rose slightly, with options trading 390,000 contracts, and the proportion of put options trading was 57.4%.

Meta fell slightly, with options trading 360,000 contracts, and the proportion of call options trading was 60%.

AMD fell nearly 2%, with options trading 320,000 contracts, and the proportion of call options trading was 57.8%.

Alibaba fell nearly 2%, with options trading 310,000 contracts, and the proportion of call options trading was 65%.

Lyft rose more than 6%, with options trading 220,000 contracts, five times the average daily trading volume, and the proportion of call options trading was 80%. The call options with a strike price of $12.5 and expiring next month were the most active.

Uber fell more than 2%, with options trading 210,000 contracts, three times the average daily trading volume, and the proportion of put options trading was 51.3%.