Earnings Preview | Google Cloud is expected to have its slowest growth in seven years, with revenue expected to increase slightly year-on-year.

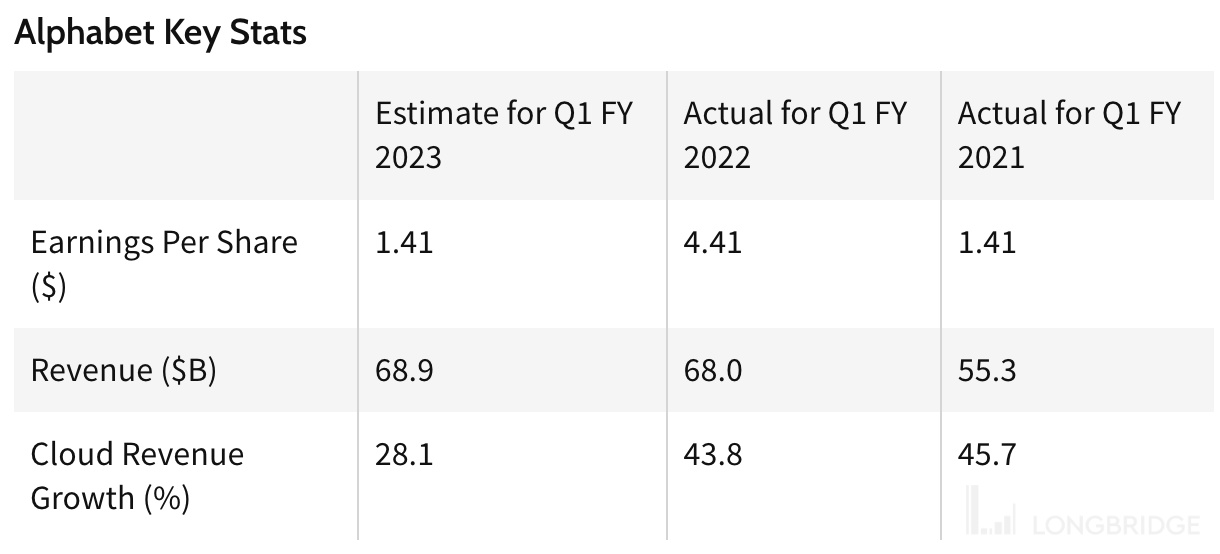

Alphabet-C is set to release its Q1 financial report after the US stock market closes on Tuesday. According to Visible Alpha, Alphabet's revenue may increase by 1% to $68.9 billion, with an expected net profit of $13.8 billion, a 16% YoY decrease. The estimated earnings per share (EPS) is $1.41, compared to $4.41 in Q1 2022.

Alphabet-C will release its Q1 financial report after the US stock market closes on Tuesday.

Analysts predict that Alphabet-C's revenue may improve slightly, while Q1 net profit may decline due to the possibility of cloud computing revenue growth falling to its lowest level since 2016, and customers across the industry hoping to reduce the cost of cloud computing services.

Alphabet-C cloud business will slow down

Analysts' forecasts compiled by Visible Alpha show that Alphabet-C's revenue may grow by 1% to $68.9 billion, and net profit is expected to be $13.8 billion, a 16% decrease from $16.4 billion in the same period last year. Earnings per share (EPS) are expected to be $1.41, while Q1 2022 is $4.41.

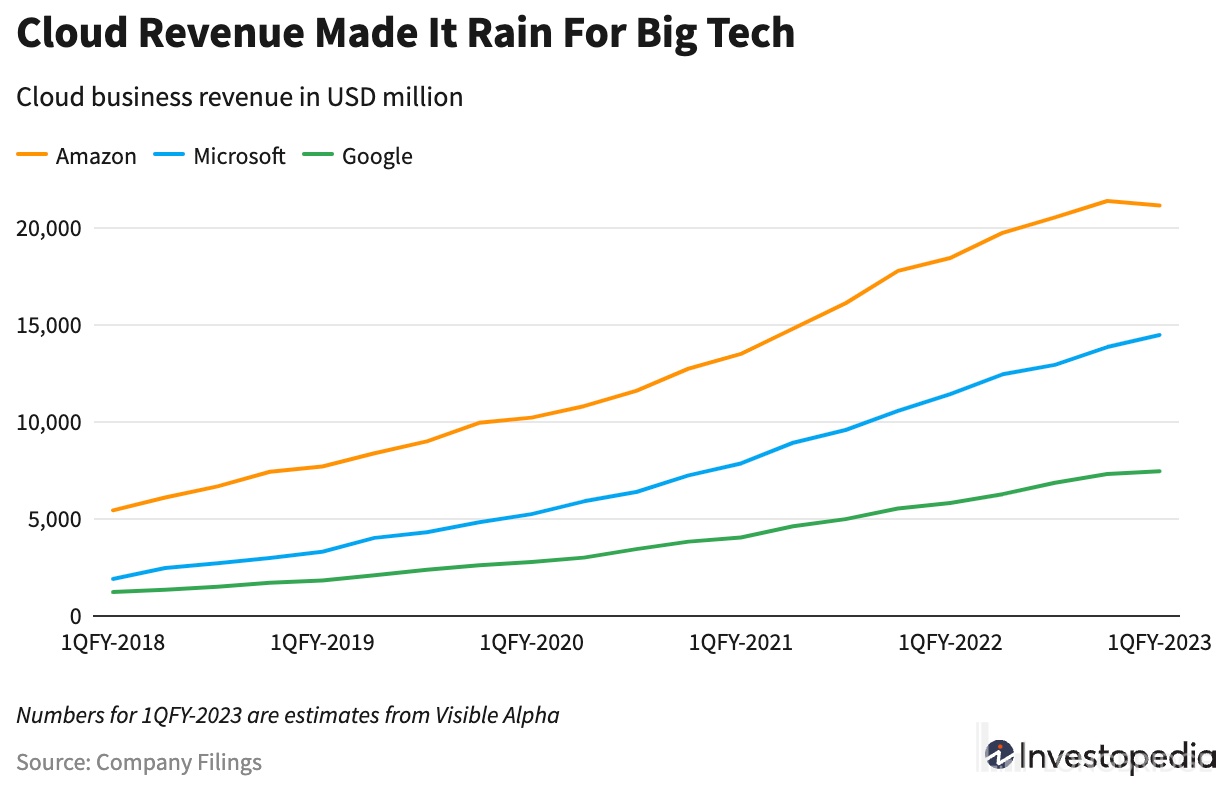

The pandemic and the shift to remote work have driven explosive growth for Alphabet-C and its cloud computing competitors Microsoft and Amazon.

However, inflation and rising interest rates have prompted many customers to cut spending on expensive cloud infrastructure and services. The growth of all three major cloud service providers slowed in the last quarter of 2022.

Alphabet-C's Q1 cloud business revenue is expected to grow by 28%, the slowest growth rate in seven years, lower than the 43.8% in the same period last year.

In addition, analysts predict that Alphabet-C's largest source of revenue, advertising revenue, will decline for the second consecutive quarter.

Cost cutting will be reflected in Q2 financial report

Like other large technology companies, Alphabet-C has launched a cost-cutting campaign, ending the recruitment frenzy during the pandemic.

The company began massive layoffs in January, cutting 12,000 employees, or 6% of its global workforce.

It also reduced office space. Alphabet-C expects one-time costs related to Q1 to reach $2.4 billion to $2.8 billion.

US Bank analysts predict that cost cutting will have a positive impact on revenue in the second quarter.

Some optimistic points

Despite this, they believe that Alphabet's cloud computing division will approach breakeven in the first quarter, and concerns that Alphabet is losing market share to Microsoft's AI-enhanced Bing are somewhat exaggerated.

According to Bank of America analyst Justin Post, Alphabet's downloads have remained stable since the end of 2022, indicating that "users may be trying Bing, but they are not changing their Alphabet download activity."

Post said: "We expect to see a constructive tone from Alphabet in terms of integrating artificial intelligence into the search field, and consider Alphabet to be a more defensive stock in the internet sector in 2023, given its cost flexibility, healthy profit margins, and opportunities to support its stock through buybacks, Alphabet's returns are relatively stable."