Investment opportunities in "China Concept Stocks" in Hong Kong

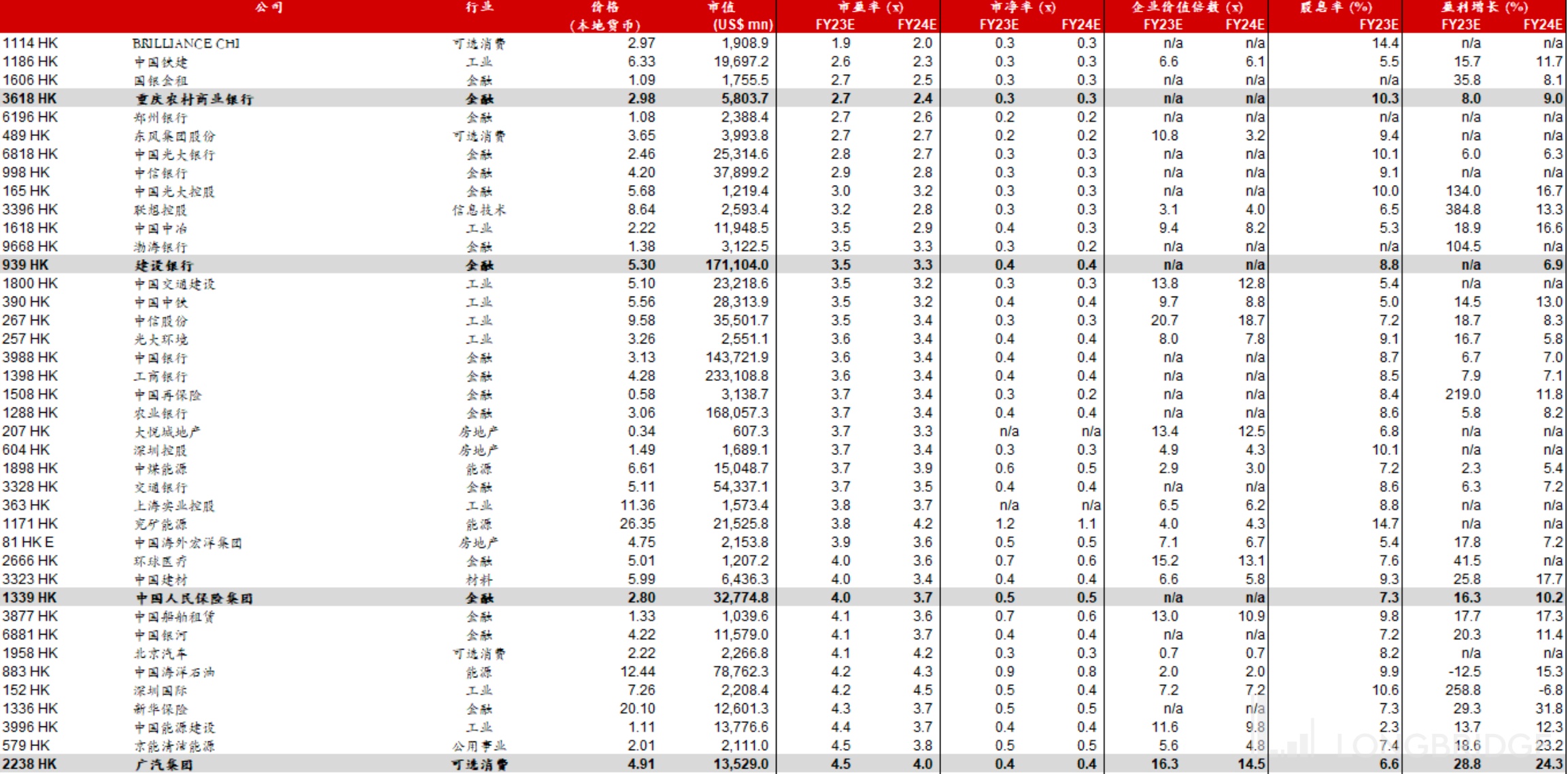

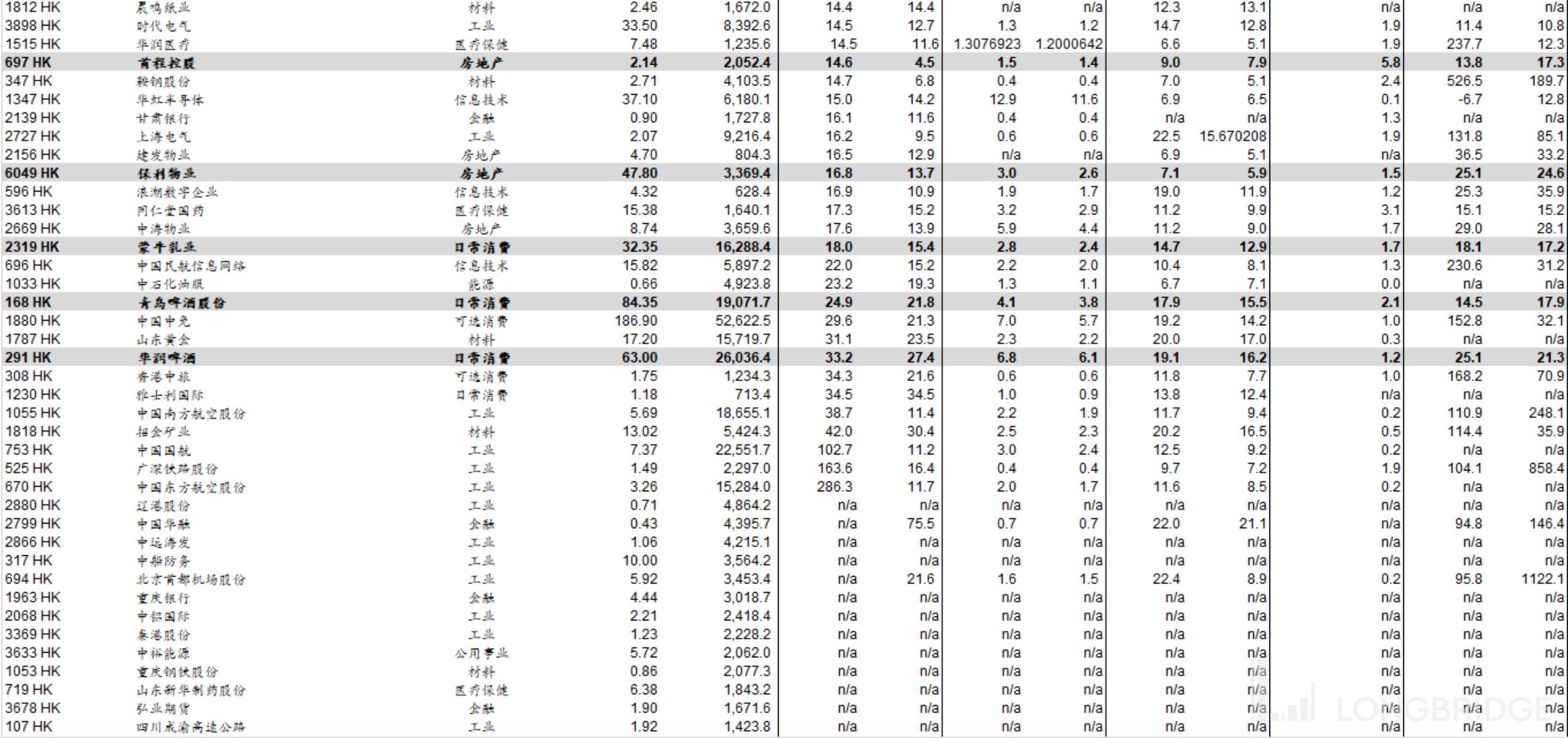

Among the 206 central state-owned enterprises listed on the Hong Kong stock market (excluding those with a market value of less than USD 500 million), a total of 28 central state-owned enterprises are expected to have a price-to-earnings ratio of less than 4 times in 2023, with the majority being in the financial and industrial (mainly infrastructure) sectors.

Source: He Saiyi, Feng Jianrong, Ye Bingnan from CMB International

Analysis shows that over the past 16 years, the correlation between the revenue of central state-owned enterprises and China's GDP has been close to 60%, indicating that central state-owned enterprises have played an important role in supporting the development of the Chinese economy.

With the construction of China's unique valuation system, it is expected that central state-owned enterprises will undergo a valuation reassessment. This article focuses on investment opportunities in central state-owned enterprises in the Hong Kong stock market.

The following industries can be focused on under the optimization of central enterprise assessment indicators: the valuation reassessment of central state-owned enterprises is one of the key paths to realizing China's unique valuation system, which can be achieved from three major directions: 1) improving productivity; 2) improving cash flow; 3) asset injection and spin-off.

Investment Theme Opportunities

With the launch of a new round of optimization of central enterprise evaluation and assessment indicators, it is expected to further enhance the core competitiveness of central state-owned enterprises in technology and overall operational efficiency, and enhance their core functions through enterprise architecture optimization.

The energy and power, communication services, and military industries are expected to benefit from this.

We are also optimistic about central state-owned enterprises that meet policy paths and have investment theme opportunities:

- (1) Digital economy + central state-owned enterprises: technology and telecommunications service central state-owned enterprises with high R&D investment;

- (2) National security + central state-owned enterprises: energy, software and hardware state-owned enterprises that play a key role in national energy and information security;

- (3) "Belt and Road" + central state-owned enterprises: energy, transportation, construction and other central state-owned enterprises participating in the construction of the "Belt and Road".

Valuation of Central State-Owned Enterprises Listed in Hong Kong

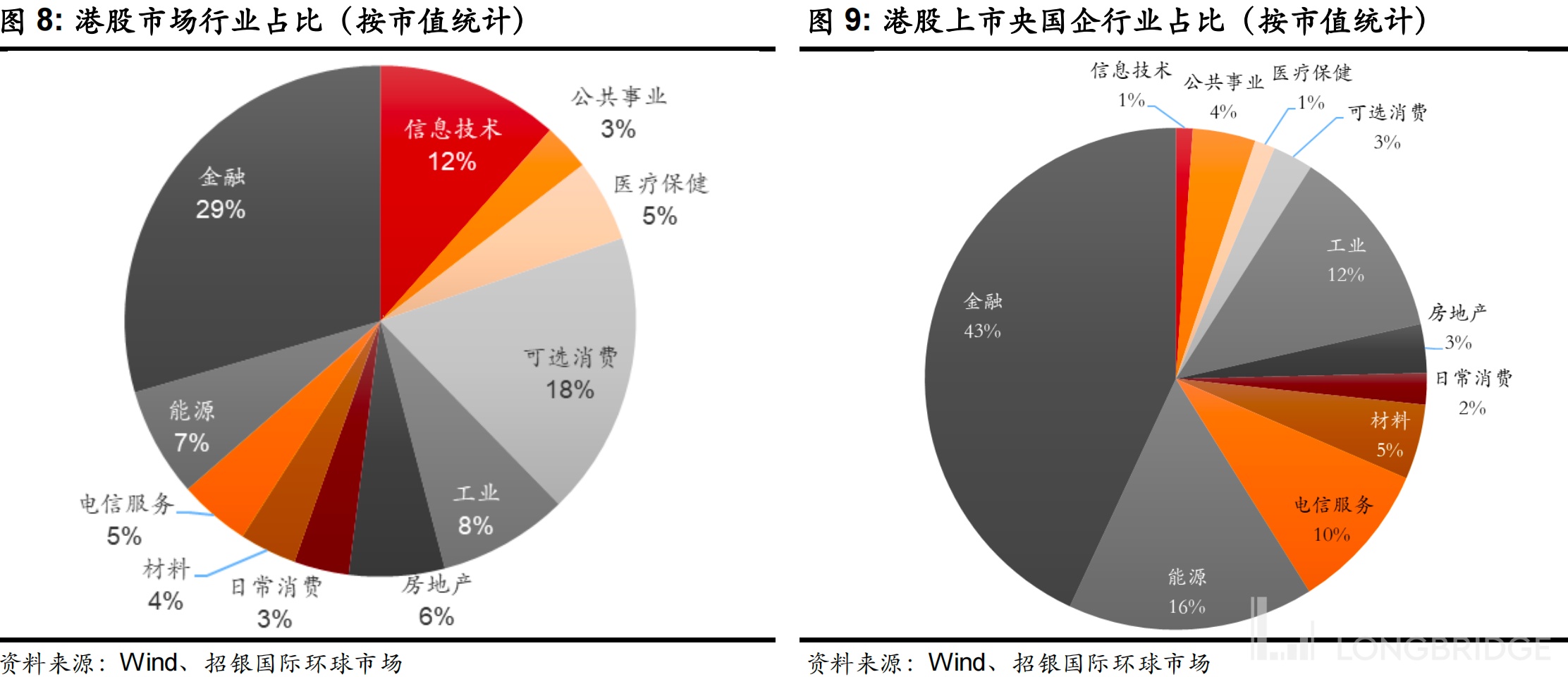

According to statistics, a total of 324 central state-owned enterprises (including central and local state-owned enterprises) are listed in Hong Kong, with the financial/energy/communication industries accounting for 43%/16%/10% of the total market value of state-owned enterprises listed in Hong Kong.

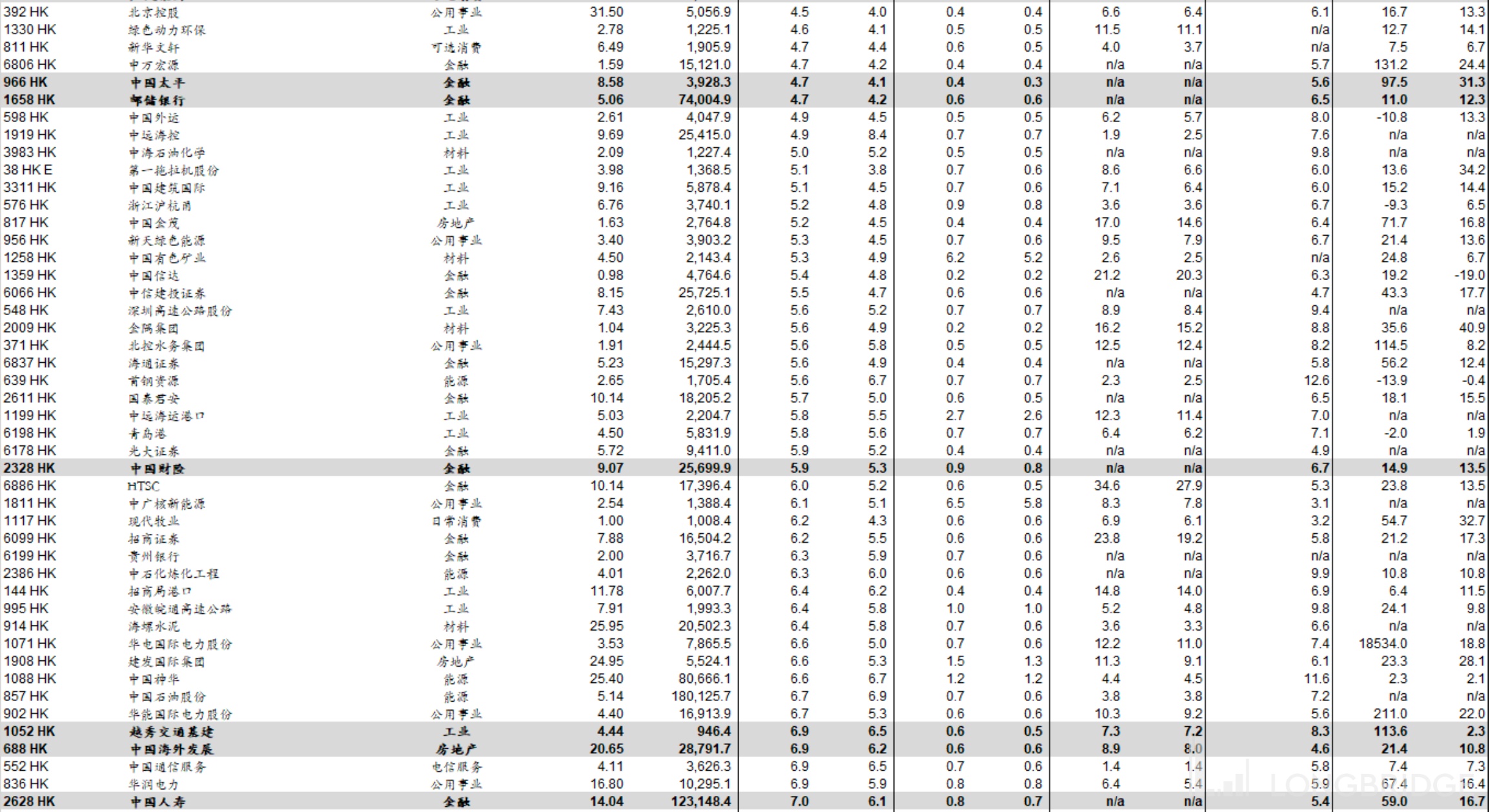

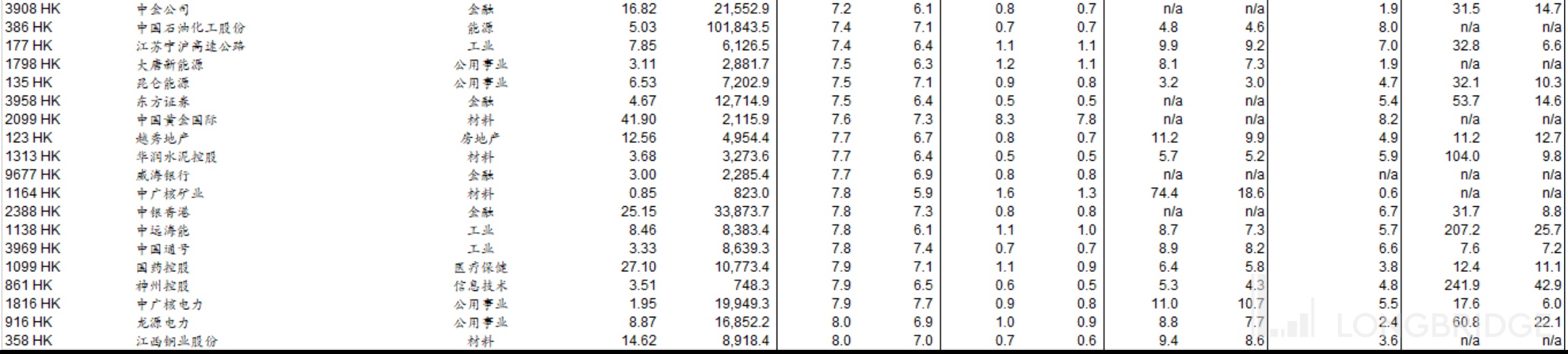

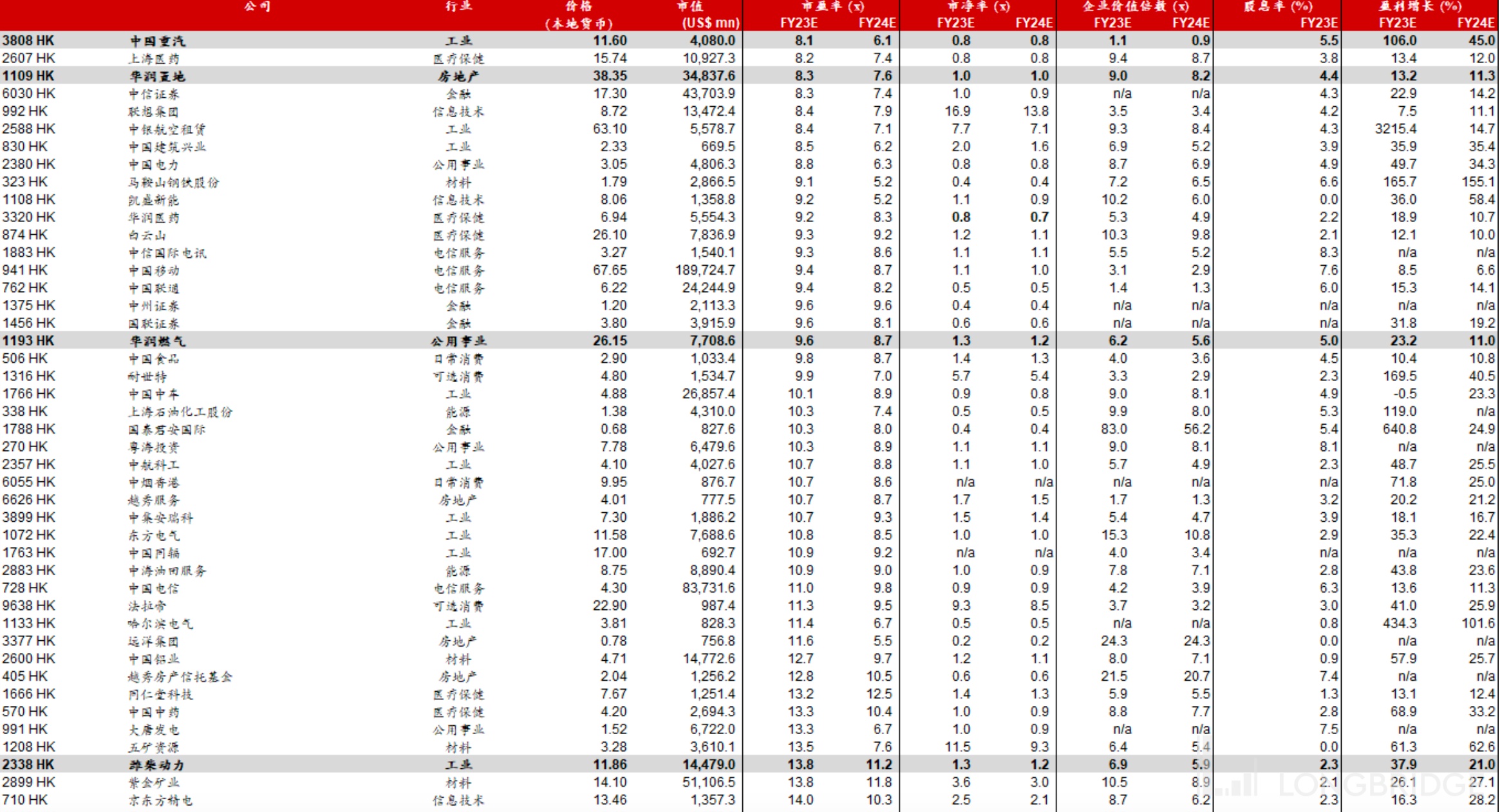

In terms of P/E ratio, among the 206 central state-owned enterprises listed in Hong Kong (excluding those with a market value of less than USD 500 million), a total of 28 central state-owned enterprises have a forecast P/E ratio for 2023 of less than 4 times, with the financial and industrial (mainly infrastructure) industries accounting for the majority.

In terms of dividend yield, there are a total of 19 companies whose stock prices are traded at a dividend yield greater than 9%.

Investment Recommendations

- Financial and insurance industry:

(i) PICC P&C (2328 HK): Looking ahead to 2023, the company is expected to further release its value potential in the new assessment indicators under the China unique valuation system; (ii) China Life (2628 HK): optimistic about the stabilization and rebound of China Life's new business value, which will form a positive support for the company's stock price.

- Infrastructure stocks: With the continuous improvement of China's relations with the Middle East, infrastructure companies will benefit from the strong growth of China's infrastructure spending and overseas business opportunities. The relevant stocks in the infrastructure industry are currently trading at 2-4 times the 2023 P/E ratio.

- Coal stocks: stable income (currently dividend yield 11-14%), defensive.