Understanding 13F | Crazy buying Alphabet-C, Microsoft, Amazon, clearing PDD! "Tech stock hunter" also bought Nvidia.

Buying Alphabet-C at a low price, increasing holdings in JD.com, Tiger Global Management Fund even bought Apple for the first time in four years, and newly established positions in semiconductor leaders such as TSMC and Nvidia. What signal does this send?

Retail investors, the "investment barometer", disclosed the 13F quarterly report of top Wall Street institutions!

Tiger Global Management Fund, founded by hedge fund legend Julian Robertson and led by star fund manager Chase Coleman, went on a buying spree in the first quarter, snapping up Alphabet-C, Microsoft, and Amazon, and newly building positions in Apple, TSMC, and Nvidia, while clearing out PDD and Roblox!

During the quarter, Tiger Global went crazy buying tech stocks, spending $445 million to bottom out Alphabet-C, and buying Apple for the first time in four years since clearing out in the fourth quarter of 2018.

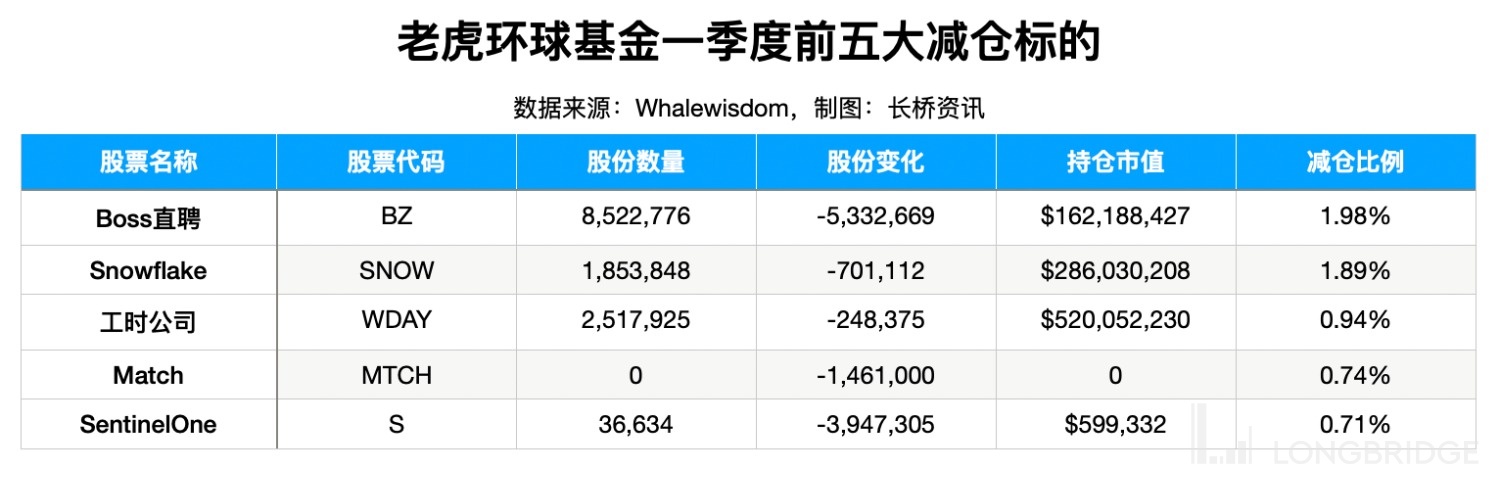

As for Chinese concept stocks, Tiger Global had a mixed attitude: adding to JD.com, reducing its holdings in Boss Zhipin, and clearing out PDD; among them, JD.com was the fund's third-largest heavy stock.

It is worth noting that Tiger Global built positions in four semiconductor stocks during the quarter, namely TSMC, Nvidia, Lam Research, and Applied Materials, with a total purchase of over $110 million.