Bargain hunting or fleeing the market peak? How to trade Hong Kong stocks now? Keep an eye on this indicator!

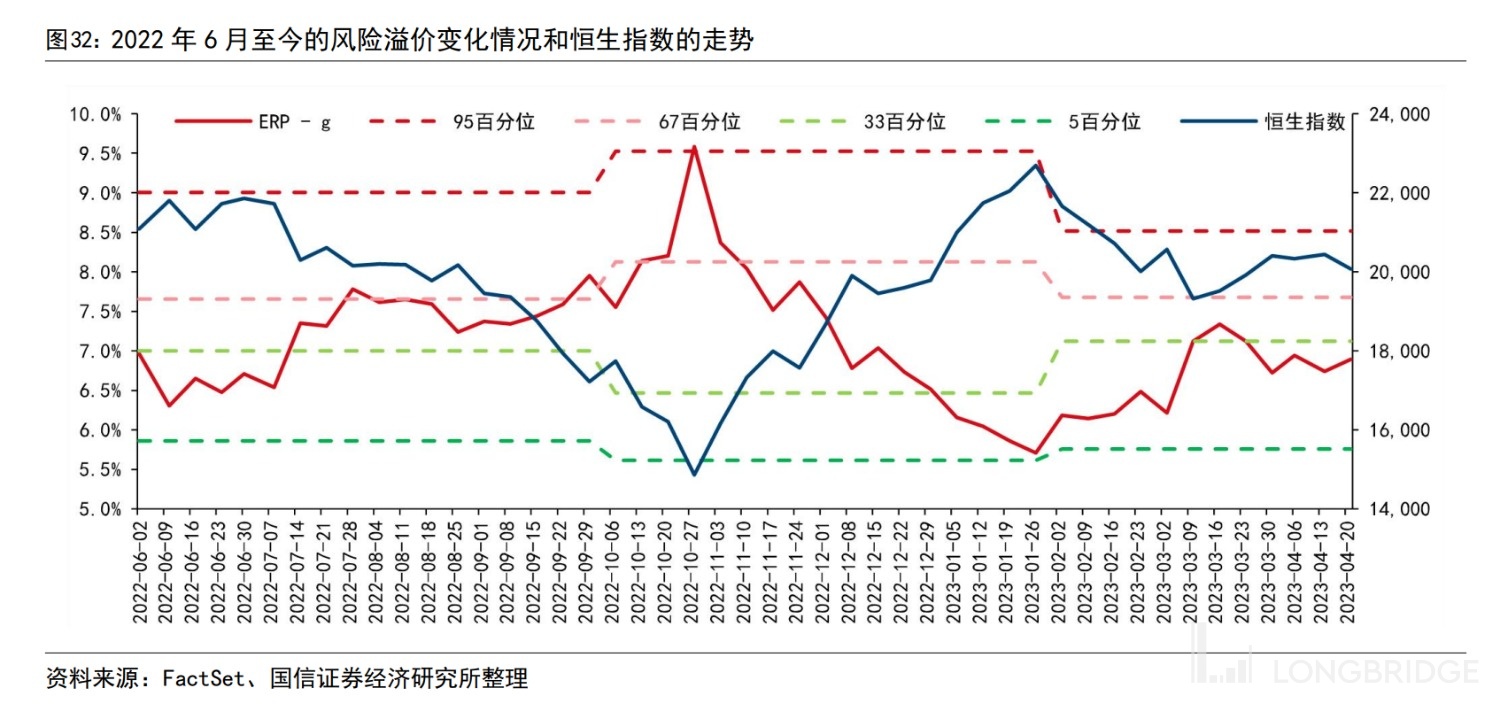

Currently, the risk premium of the Hang Seng Index is 7.3%, which is exactly in the middle level of the historical risk premium during the early stage of economic expansion. Therefore, there is not much room for Hong Kong stocks to rise or fall significantly based solely on emotions. Further market trends require improvement in fundamentals or a decrease in interest rates.

In the three valuation factors of fundamentals, funding costs, and risk premiums, the risk premium is the only subjective indicator and the only indicator without a long-term trend.

This indicator is the subjective pricing that investors give to the objective risk of the stock market and usually follows the law of "reversal": when the market is too optimistic or too pessimistic, the next emotional rebound is likely to occur.

Looking specifically at the Hong Kong stock market, Guosen Securities analysts Wang Xueheng and Zhang Xi noticed that the Hang Seng Index's risk premium has a distinct fluctuation range in history: 5%-9%. Therefore, using historical data, the "high" and "low" of the risk premium can be defined, forming a strategy for bottom-fishing/top-escaping and position adjustment:

Buy at the bottom when the risk premium reaches a high level, and sell at the top when it reaches a low level;

The higher the risk premium, the higher the position.

So, what is the current level of risk premium in the Hong Kong stock market? Should investors increase or decrease their positions?

The tepid Hong Kong stock market

The stock price and risk premium of Hong Kong stocks are negatively correlated. A risk premium of 5% means that market sentiment has already been excessively high, and the risk of market correction has surged; a risk premium of 9% means that market sentiment has already been excessively low, and the opportunity for market rebound is greater. This rule can provide suggestions for left-side operations.

The current risk premium of the Hang Seng Index is 7.3%, which is exactly in the middle level of the risk premium in the early stage of economic expansion in history. Therefore, the current sentiment of Hong Kong stocks is at a medium level, and the space for stock prices to rise or fall solely driven by sentiment is not significant. Further market trends in Hong Kong stocks require improvement in fundamentals or a drop in interest rates.

The most important question for estimating the future trend of Hong Kong stocks through the risk premium is whether this indicator will maintain the same fluctuation range in the future?

Guosen Securities believes that if there is no systemic change, there is a high probability that the risk premium of Hong Kong stocks will continue to maintain the fluctuation range in the current period. This is mainly because:

- The Hong Kong dollar is not a global reserve currency; 2) The listed companies in the Hong Kong stock market cannot represent the core assets of the world.

Of course, there are also factors that may cause the fluctuation range of the risk premium of Hong Kong stocks to drift:

-

The opening of China's capital account may transfer the pricing power of Hong Kong stocks to domestic investors;

-

The core component stocks of Hong Kong stocks undergo significant changes, such as the new industry companies introduced by the listing policy of special technology.