Earnings Report is Out | Alibaba's Performance is Mixed, Cloud Business Revenue Declines, Accelerating Push for Spin-off Listing

In the fourth quarter, revenue was RMB 208.2 billion, lower than market expectations, with adjusted net profit of RMB 27.38 billion, a YoY increase of 38%. Cloud business revenue was RMB 18.58 billion, estimated at RMB 20.19 billion, a YoY decrease of 2.1%. The Alibaba board of directors has approved the distribution of dividends to shareholders to achieve the spin-off of Alibaba Cloud Intelligence Group and seek to become an independent listed company. The board has also approved Alibaba International Digital Business to seek external financing, Cainiao to explore the listing process, and Hema to implement its listing plan.

On Thursday, Alibaba released its Q1 2023 (Q4 FY2023) financial report.

Alibaba's Q4 revenue was RMB 208.2 billion, lower than market expectations.

Alibaba's Efficient Reform: Multiple Businesses Launch Financing and Listing Plans

Alibaba announced that the reform plan launched at the end of March is being rapidly and efficiently promoted:

- Alibaba Cloud Intelligence Group will be completely spun off from Alibaba and independently listed;

- Cainiao and Hema have launched listing plans;

- Alibaba International Digital Business Group has launched external financing, and the six major business groups have officially established a board of directors.

Alibaba stated that this is an active reform made by Alibaba for future development and has received full support from the board of directors.

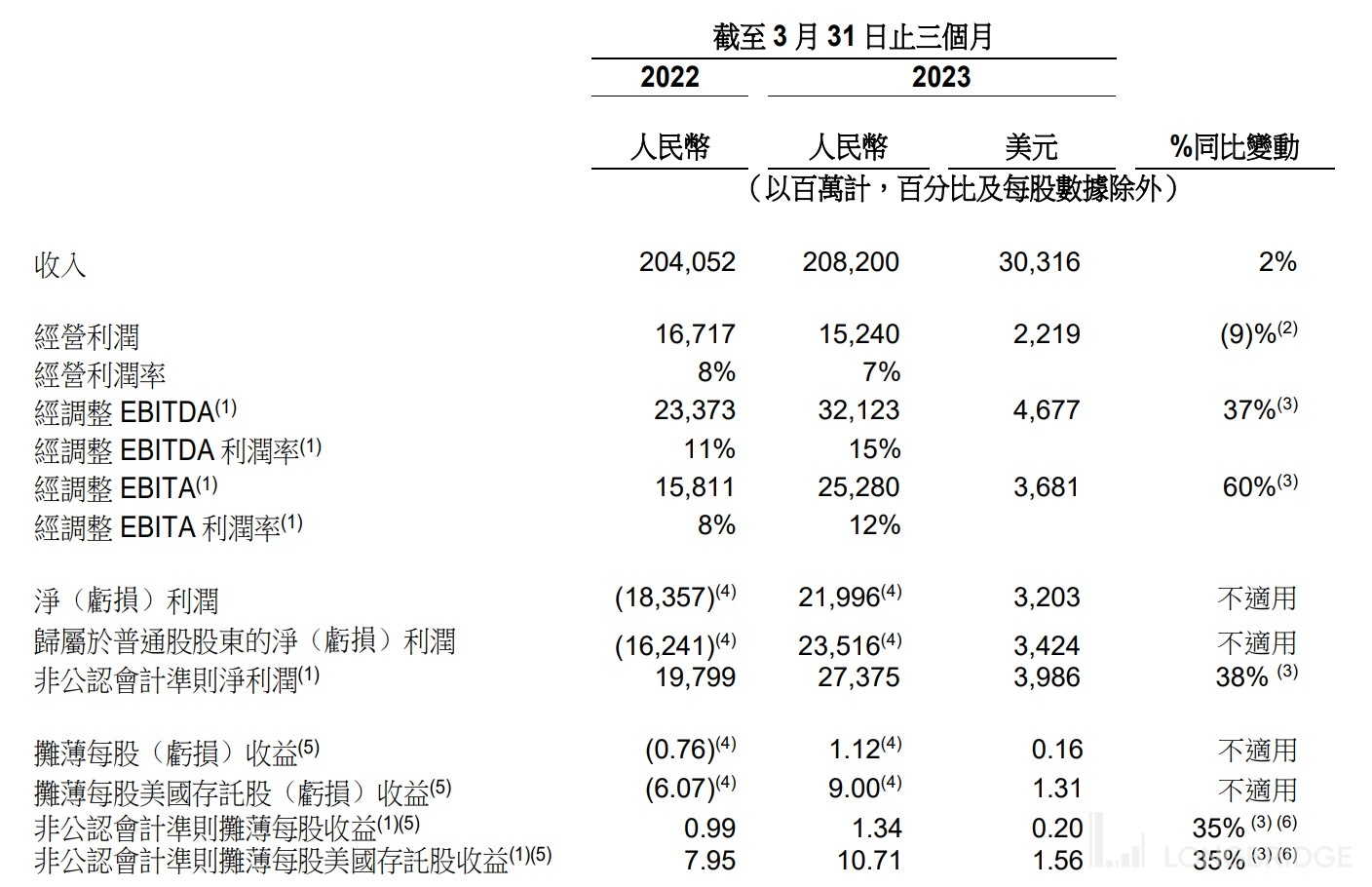

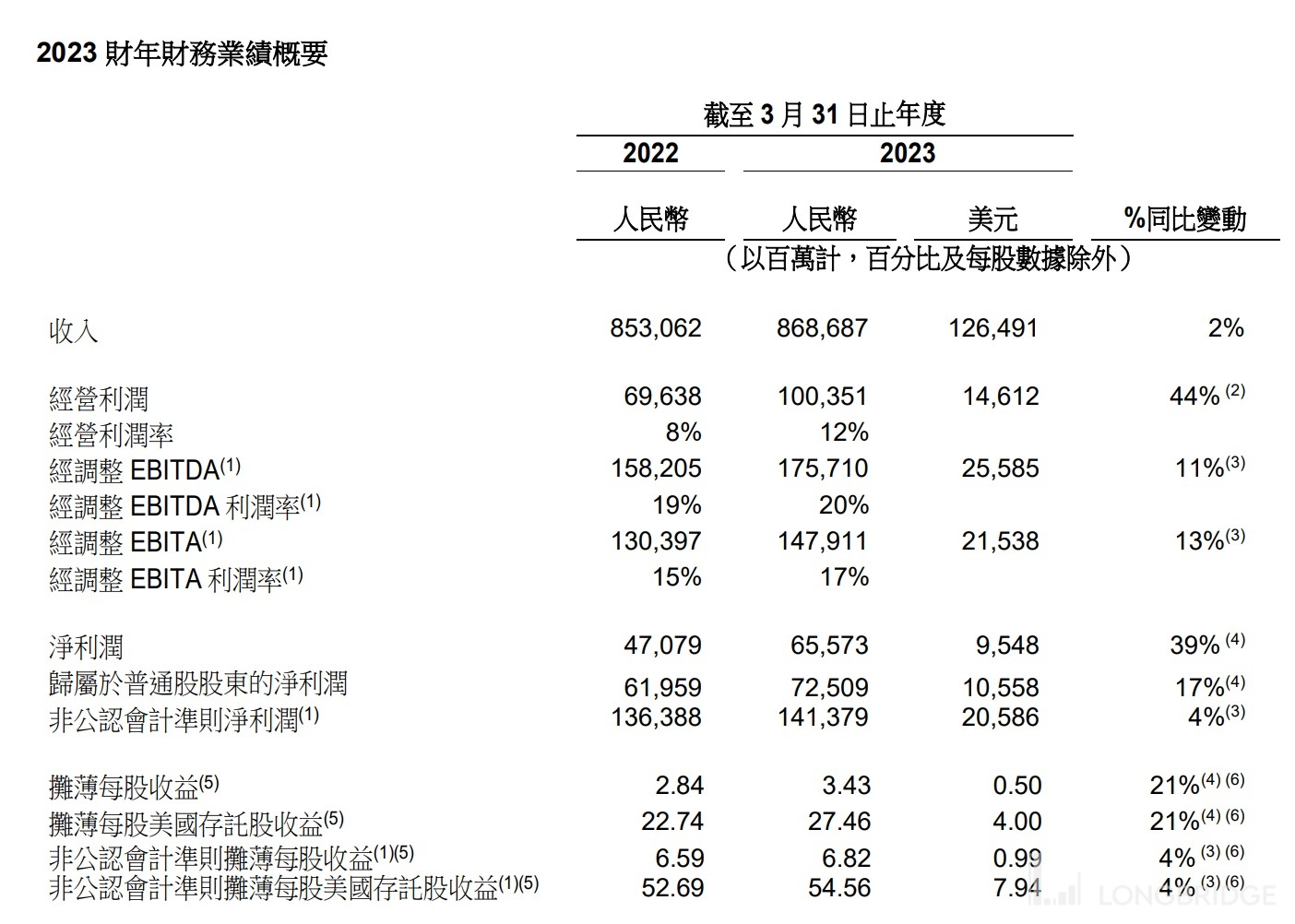

Q4 and Full-Year Data

Alibaba's Q4 revenue was RMB 208.2 billion, estimated at RMB 209.19 billion.

Adjusted earnings per ADS in Q4 were RMB 10.71, compared to RMB 7.95 in the same period last year, and estimated at RMB 9.45.

Adjusted EBITDA in Q4 was RMB 32.12 billion, a year-on-year increase of 37%.

Adjusted EBITDA profit margin was 15%, compared to 11% in the same period last year, and estimated at 14.5%.

Adjusted net profit in Q4 was RMB 27.38 billion, a year-on-year increase of 38%.

Operating profit in Q4 was RMB 15.24 billion, a year-on-year decrease of 9%. Adjusted EBITA was RMB 25.28 billion, a year-on-year increase of 60%.

Alibaba's full-year revenue for FY2023 was RMB 868.687 billion, compared to RMB 853.062 billion in FY2022, a year-on-year increase of 2%. Net profit was RMB 72.509 billion, compared to RMB 61.959 billion in FY2022, a year-on-year increase of 17%.

Subsidiary Business

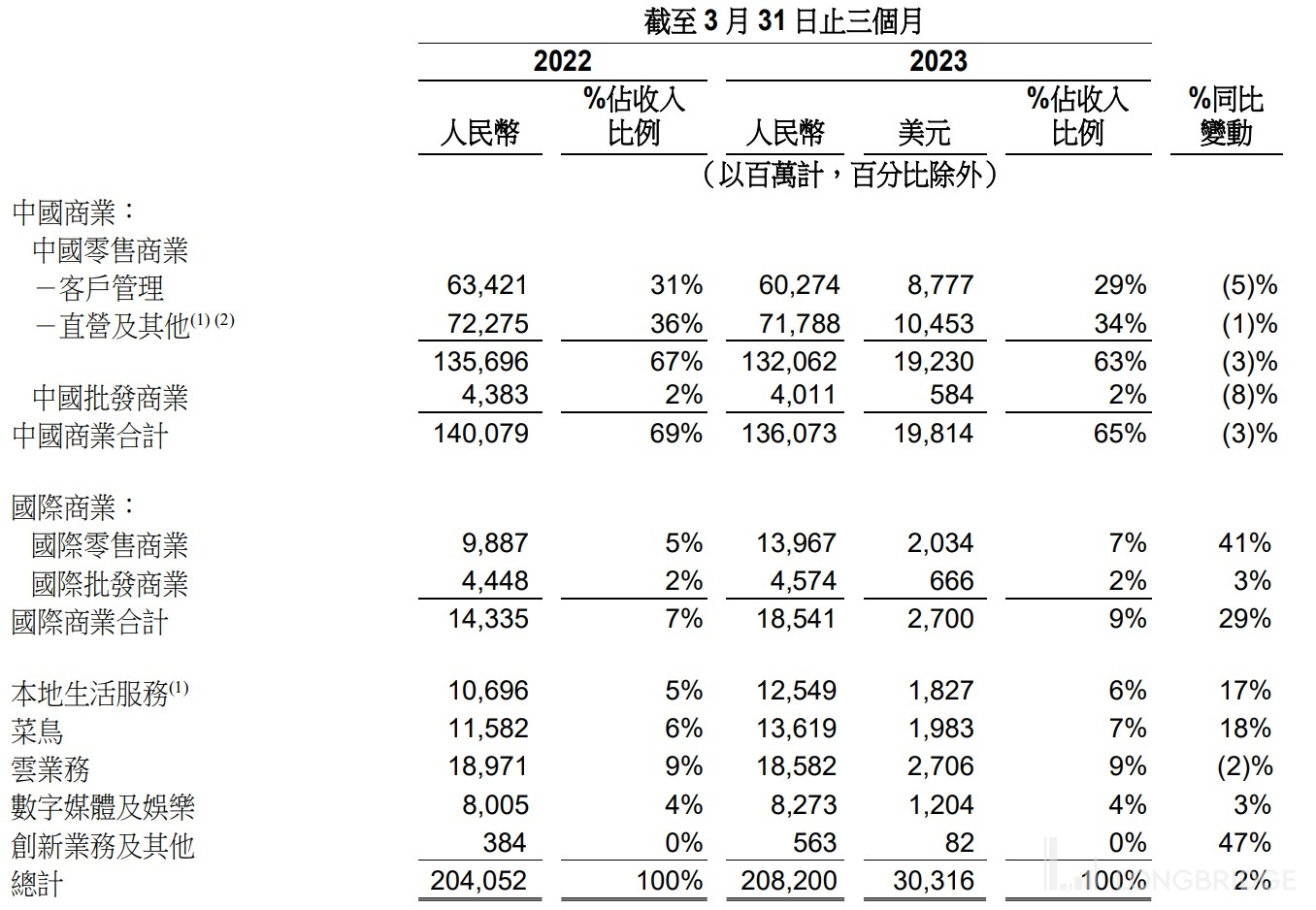

Revenue for Alibaba's China commerce segment was RMB 136.07 billion, a year-on-year decrease of 3%, estimated at RMB 142.24 billion.

Revenue for Alibaba's international commerce segment was RMB 18.54 billion, a year-on-year increase of 29%, estimated at RMB 16.94 billion. Local life service division revenue was RMB 12.55 billion, up 20% YoY, estimated at RMB 12.05 billion;

Cainiao revenue was RMB 13.62 billion, up 18% YoY, estimated at RMB 14.02 billion.

Digital media and entertainment revenue was RMB 8.27 billion, up 3.3% YoY, estimated at RMB 7.96 billion;

Innovative businesses and other revenue was RMB 0.563 billion, up 47% YoY, estimated at RMB 0.5195 billion.

Cloud computing revenue was RMB 18.58 billion, down 2.1% YoY, estimated at RMB 20.19 billion.

In the fourth quarter, the total online physical goods transaction volume (excluding unpaid orders) of Taobao and Tmall decreased by a single-digit percentage YoY. In March, the total online physical goods transaction volume (excluding unpaid orders) of Taobao and Tmall turned positive.

Alibaba continues to buy back shares

On the evening of May 18th, Alibaba announced its Q4 and full-year 2023 results, and continued to execute its share buyback plan this quarter.

As of the end of the quarter on March 31st, it had repurchased approximately 21.5 million American depositary shares (equivalent to approximately 172.4 million ordinary shares) for approximately US$1.9 billion.

As of March 31, 2023, Alibaba had approximately 20.5 billion outstanding ordinary shares (equivalent to approximately 2.6 billion American depositary shares).

Under the current authorization, there is approximately US$19.4 billion in repurchase authorization, which is valid until March 2025.