Hong Kong stocks are showing a 2019 market trend again? The key opportunities still lie in technology stocks!

The dark days for growth sectors such as the internet and technology may be over! In the short term, the overall market may still lack a clear trend, but market valuations are already too low and there is still ample downside protection. If there is a significant pullback, it may be a better time to reposition.

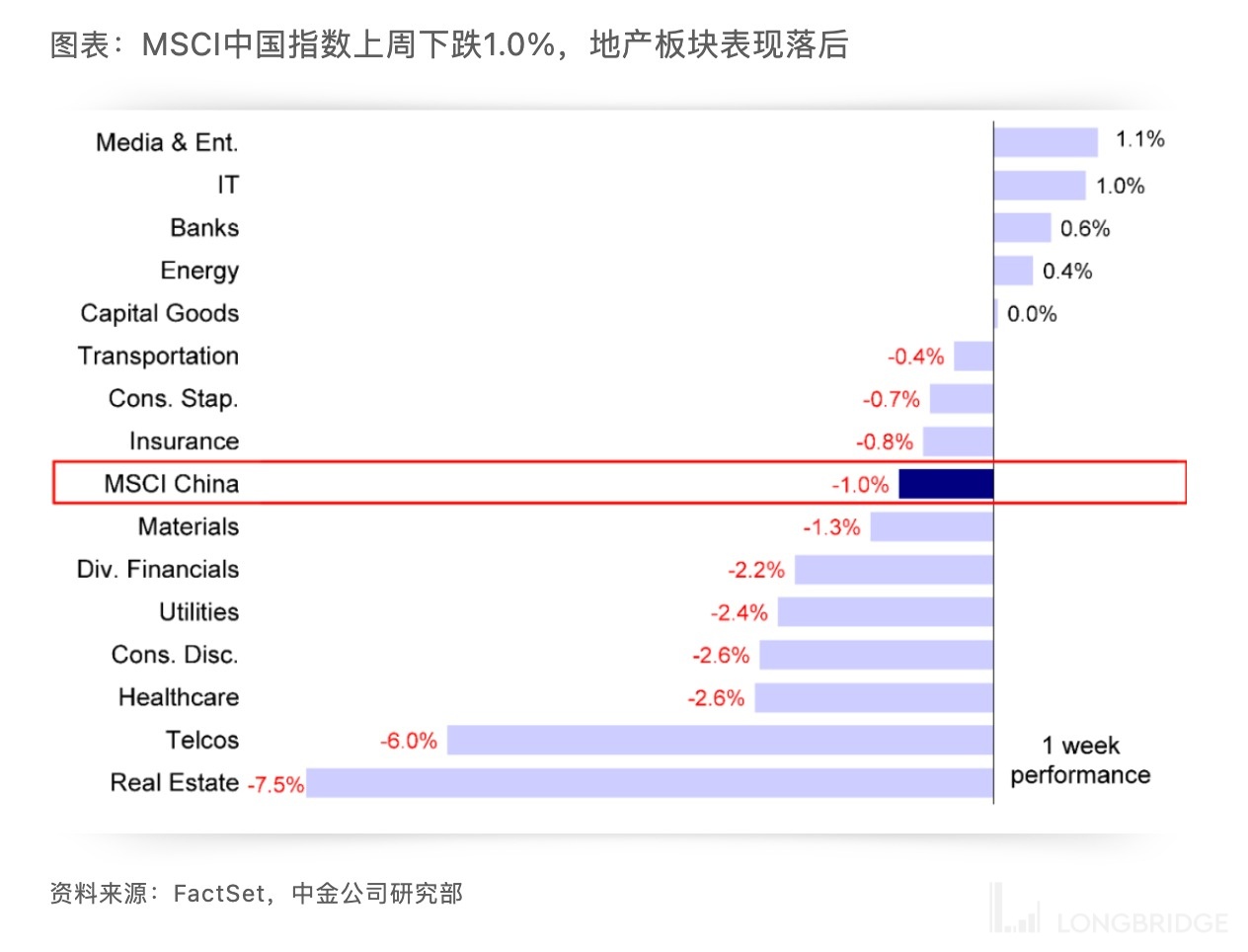

Recently, the Chinese market, including the Hong Kong stock market, has continued the consolidation trend since the end of April, reflecting the overall weak sentiment of investors, mainly due to concerns about the future economic growth prospects of China.

We reiterate our previous view that, considering the relatively weak pattern of China's economic recovery, the overall market may still lack a clear trend in the short term, or maintain a volatile pattern. However, we are not overly concerned about the significant downside risk. If there is a significant correction in the short term, it will provide better allocation opportunities.

We believe that many factors at the macro and micro levels are similar to those in 2019: 1) China's economy is moderately recovering, and the Federal Reserve is gradually exiting the policy tightening cycle; 2) After a strong recovery in the first three months of 2019, the market continued to lack direction, but A-shares and overseas Chinese stocks markets are both full of structural opportunities; 3) The RMB exchange rate against the US dollar has also experienced significant depreciation.

Compared with the possibility of a lack of overall market trend, we still believe that there are structural opportunities and we still recommend that investors pay attention to the "dumbbell-shaped" allocation strategy that we have been recommending recently (state-owned enterprises with the potential to increase dividend ratios + growth sectors such as the Internet and technology; the healthcare sector may benefit from the greater flexibility after the Federal Reserve's easing turn).

On the one hand, we believe that the recent consolidation performance of some high-dividend state-owned enterprise targets does not mean the end of the overall high-dividend state-owned enterprise investment theme, because the core logic behind it (dividend cash flow) is particularly important for investors in the current market uncertainty, especially against the backdrop of the continuous increase in market volatility.

At the same time, most of the state-owned enterprise targets screened out from our CICC Hong Kong stock high dividend state-owned enterprise portfolio still have a price-to-book ratio significantly lower than 1.0 times, and we believe that there is still sufficient room for recovery.

In addition, we would like to reiterate that the key to the high-dividend state-owned enterprise investment theme is to focus on both the dividend potential and dividend ability dimensions, rather than simply the high dividend yield, and we recommend that investors refer to the above suggestions to screen targets.

On the other hand, some technology giants' first-quarter revenue growth exceeded expectations, and the expected policy measures at the policy level may indicate that the relevant sectors may have passed the darkest moment.

On the domestic front, many economic data show that although the overall recovery is still continuing, the overall momentum is not very strong, and more policy stimulus measures are needed to restore upward momentum.

After the rapid weakening of financial and economic data announced in the previous week, a series of latest data released last week were weaker than expected, which is in sharp contrast to the strong recovery in the first quarter of this year. We believe that, as mentioned by the People's Bank of China in the first quarter monetary policy execution report, it is still necessary to take further stimulus measures to boost market confidence and promote economic recovery.

Externally, the 10-year US Treasury bond yield and the US dollar exchange rate have risen sharply, and the debate over the US debt ceiling issue may also cause disturbances in the market in the short term. However, considering the low valuation level of the Hong Kong stock market, we still believe that there is ample downside protection space, and potential significant pullbacks may be better opportunities for repositioning.