How to understand the valuation difference between China and the United States and its solution? Pay attention to this indicator - risk premium!

Is the difference in risk premium between the Chinese and American markets due to the mismatch of their economic cycles, especially in credit cycles? Does this imply a significant risk of convergence or the solidification of structural factors?

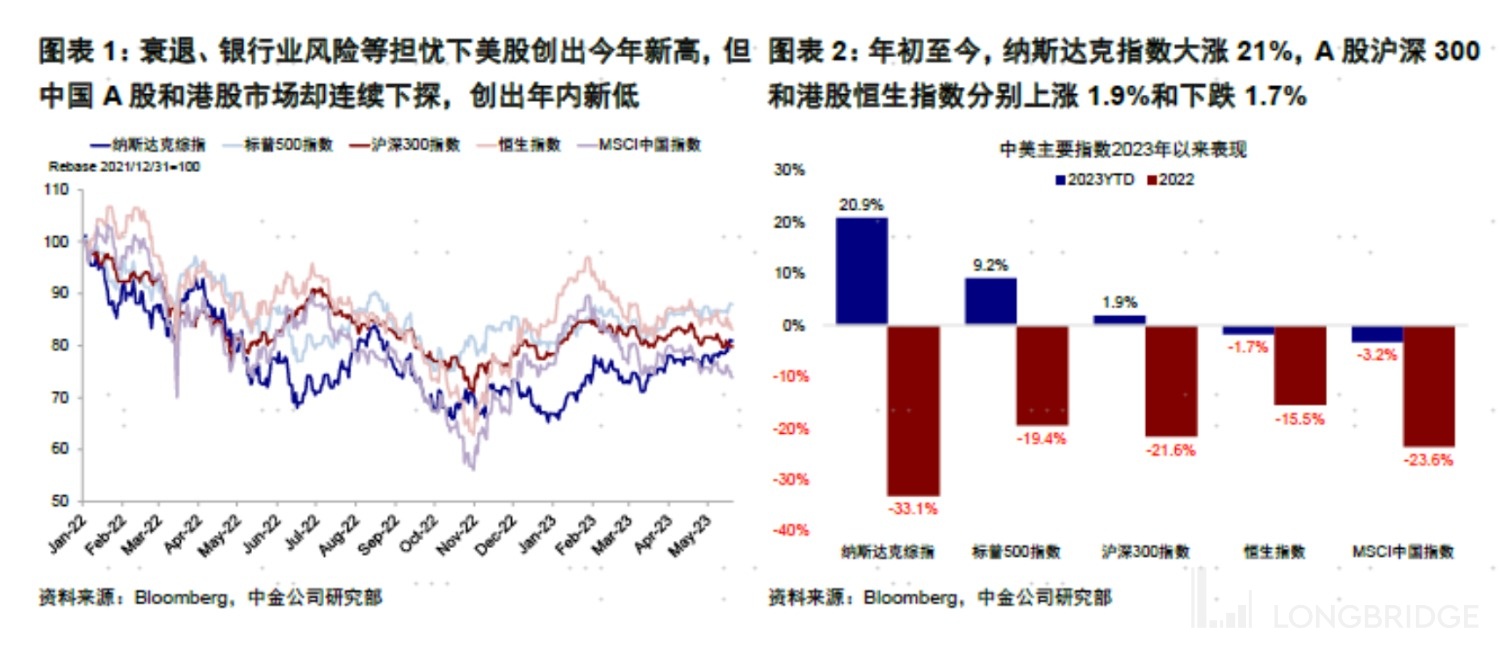

In the midst of concerns about interest rate hikes, recession, bank risks, and debt crises, the US stock market has recently hit a new high since August 2022, but China's A-shares and Hong Kong stocks have hit a new low for the year, which is probably a result that most people did not expect at the end of last year.

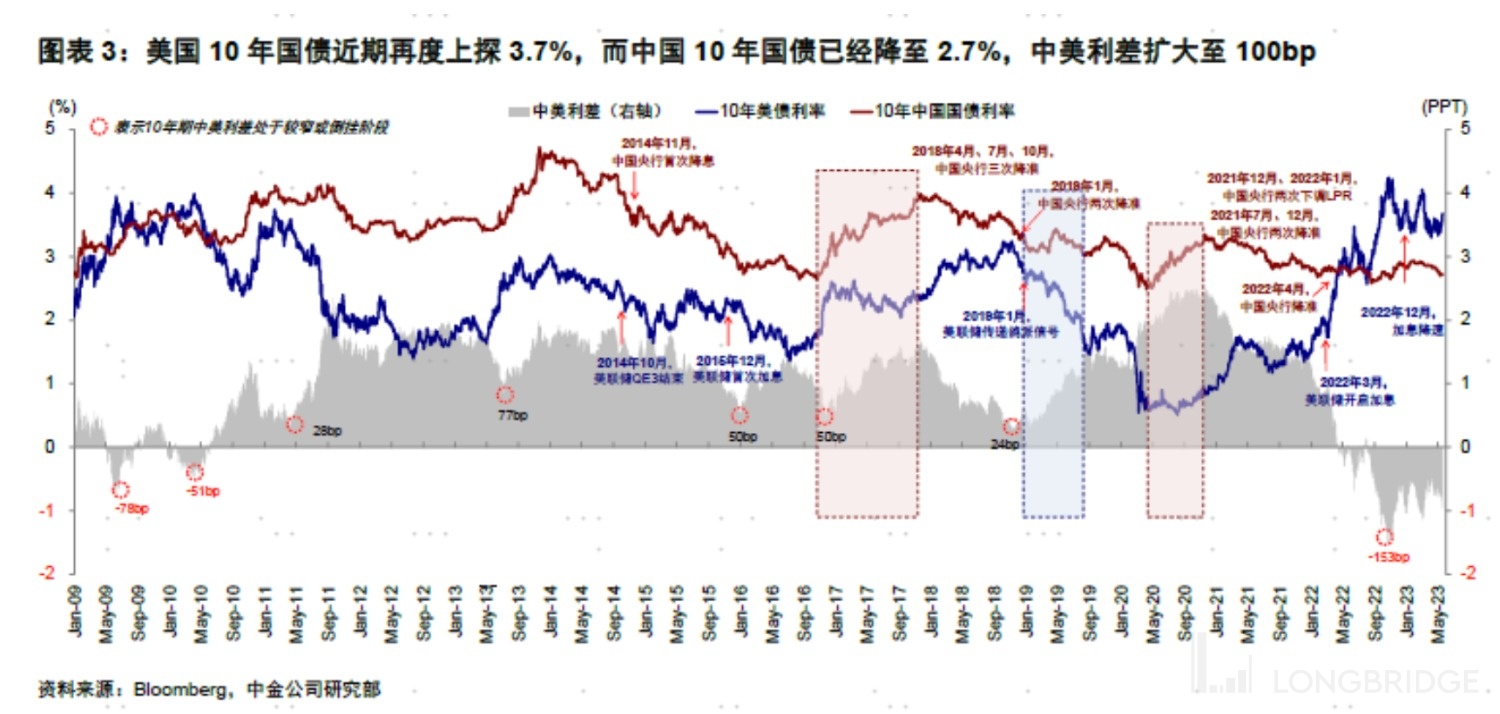

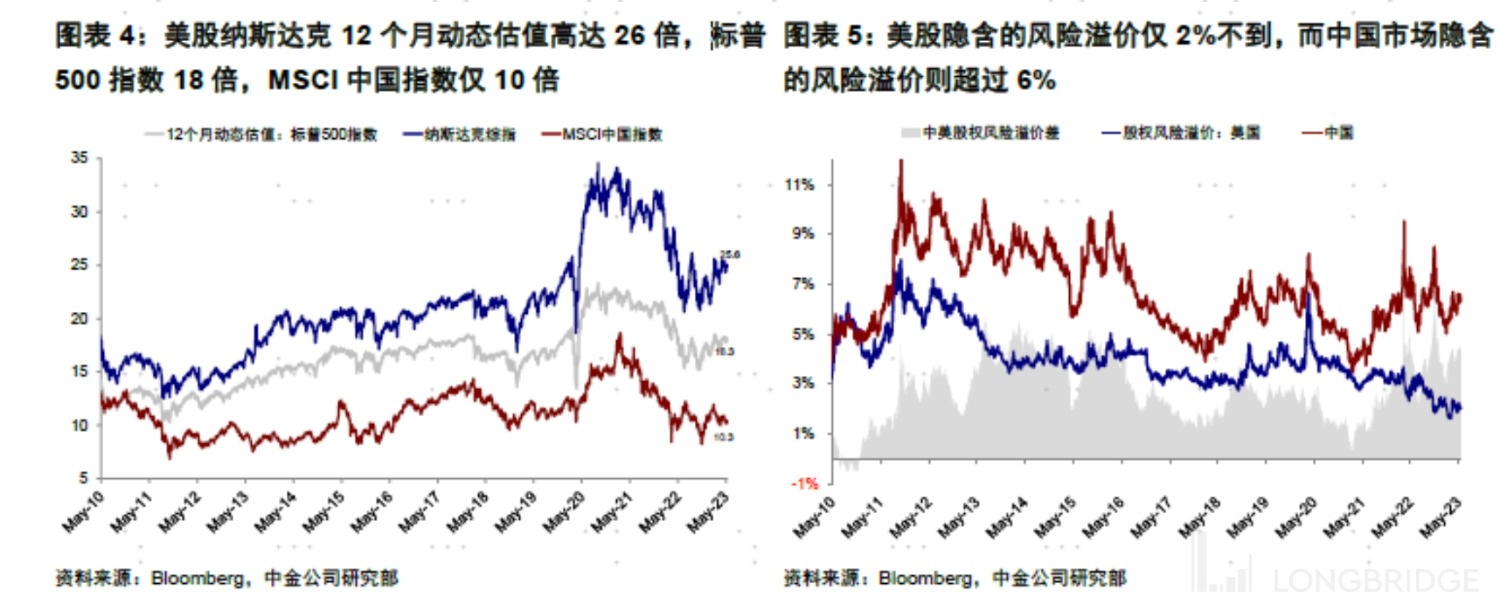

It should be noted that under higher financing costs (10-year US Treasury yields approaching 3.7%, Chinese government bond yields falling to 2.7%), US stock valuations are even higher (Nasdaq 25 times, S&P 500 18 times, MSCI China only 10 times), which means that the difference in market risk premiums between China and the US is huge (2% for US stocks, nearly 7% for China).

Does this mean there are greater risks and opportunities for convergence, or are some structural factors causing the gap to persist? If it is the latter, what solutions and opportunities can promote future change? We hope to find macro factors behind the differences in risk premiums between China and the US and provide possible solutions and ways out.

I. Understanding the difference in valuations between China and the US from the perspective of risk premiums: The deviation and continuous widening of risk premiums caused by the mismatch of the Chinese and US cycles and the geopolitical situation in 2021

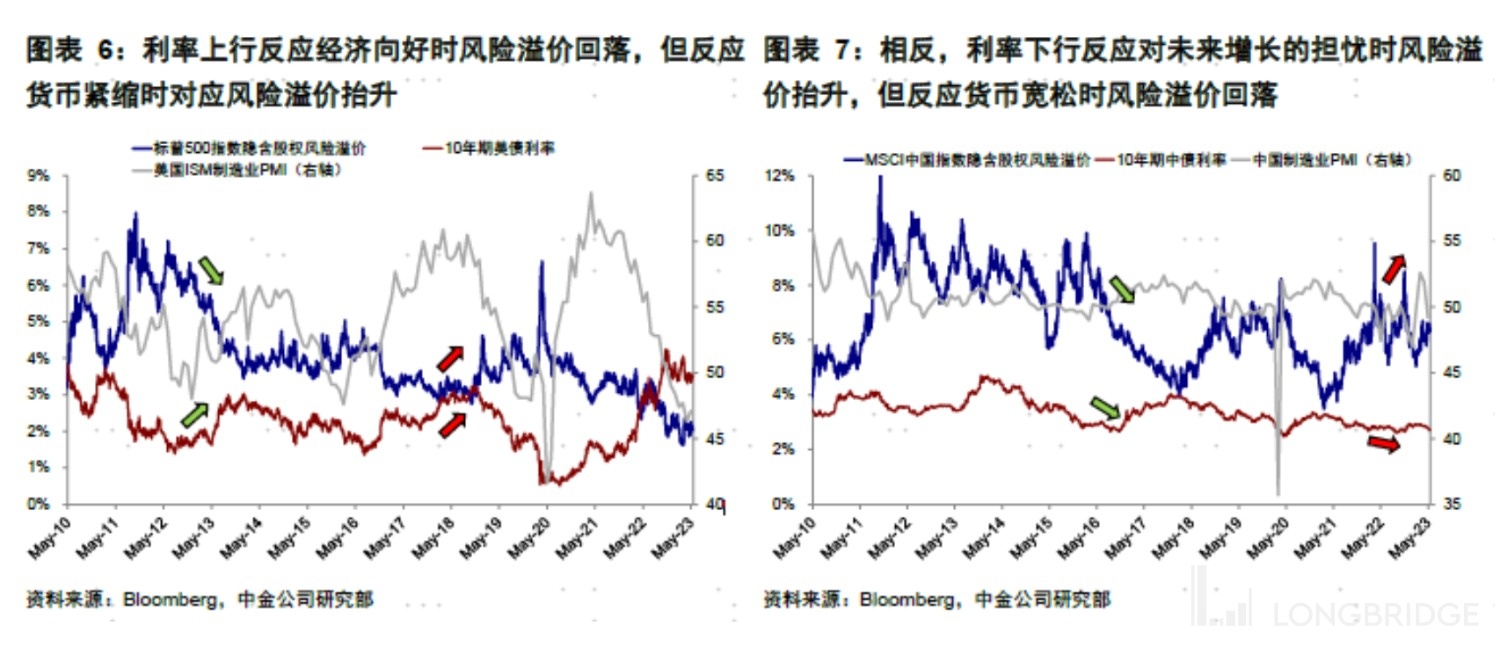

Market valuations can be divided into risk-free rates and risk premiums. For local markets, risk premiums are mainly composed of macro premiums (policies and fundamentals) and micro premiums (liquidity and sentiment), which are called local premiums. For offshore markets, country premiums applicable to foreign investors also need to be considered.

The trend of risk premiums in the Chinese and US stock markets is usually consistent, with China being slightly higher, and the difference between the two can be explained as the country risk premium required to hold Chinese stocks. However, since February 2021, due to the obvious trend differences in local premiums caused by the mismatch of the Chinese and US cycles and the country premiums caused by the geopolitical situation, the overall risk premium of the Chinese and US markets has continued to widen, with the US stock market falling and China rising.

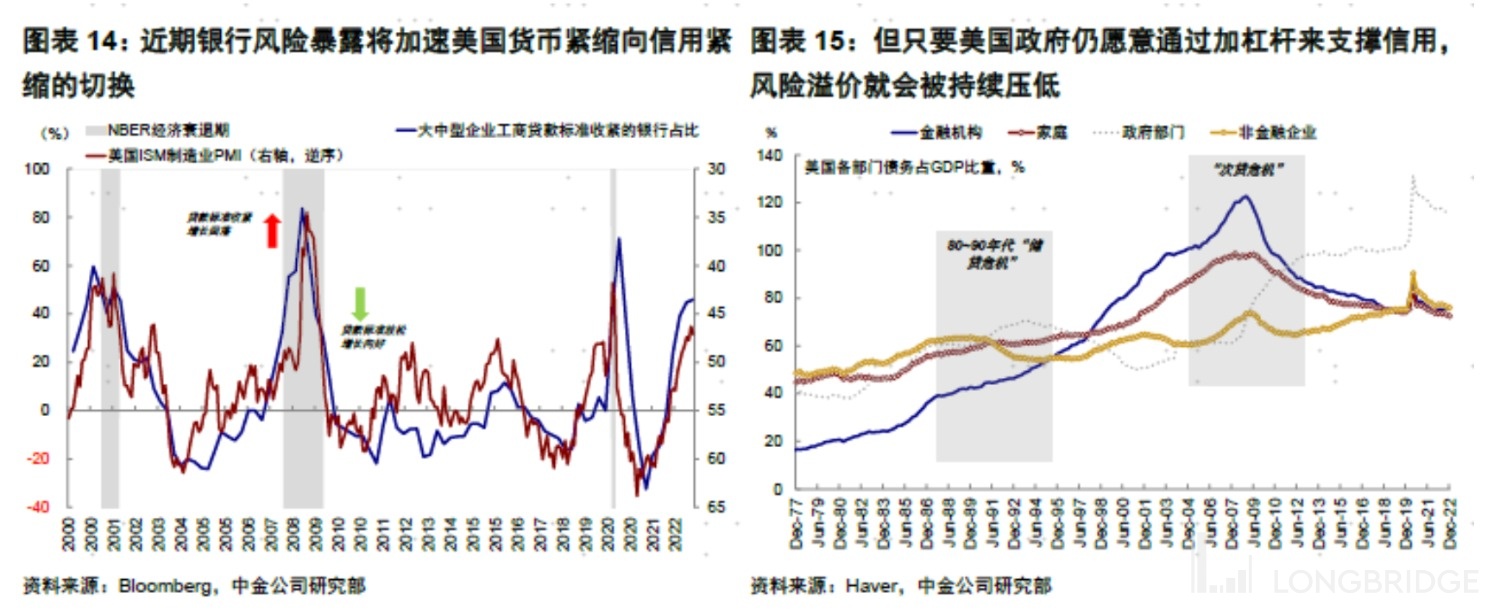

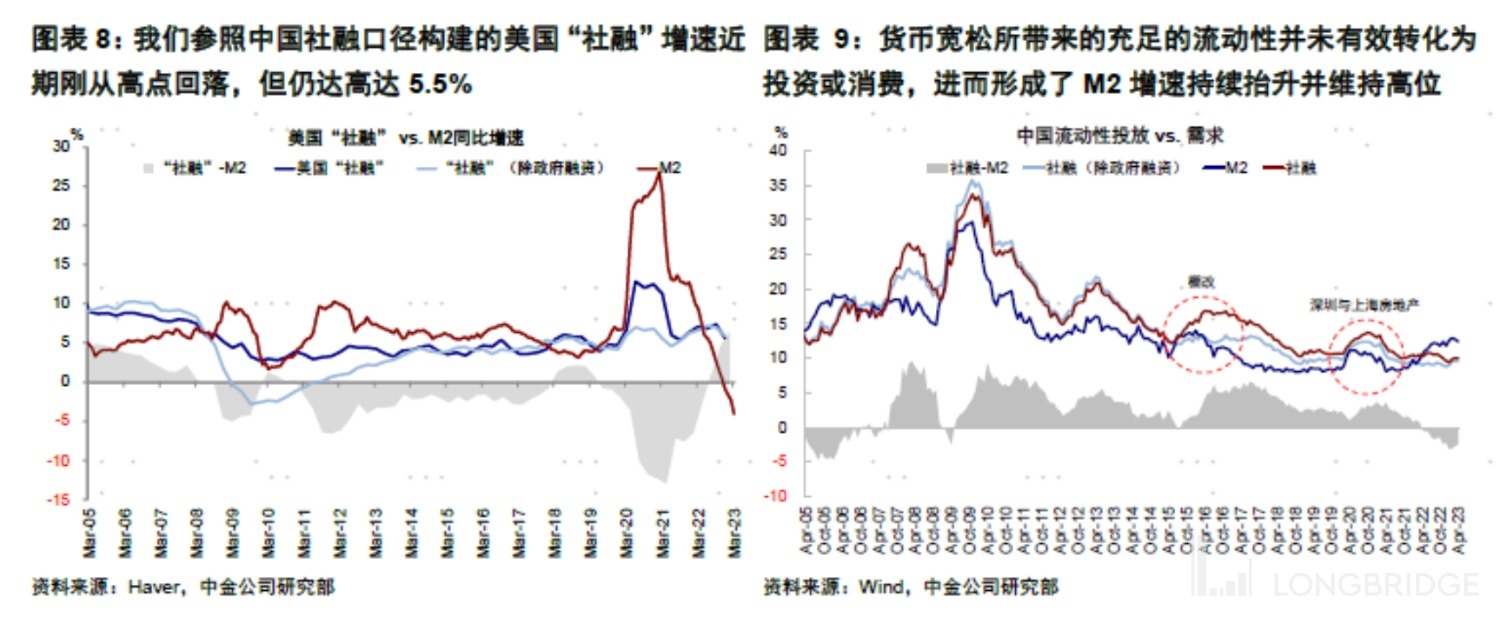

II. Understanding the difference in risk premiums between China and the US from the perspective of macro cycles: US credit expansion offsets the effect of monetary tightening, and the government "backs up" the private sector; China's private sector credit contraction offsets the effect of monetary easing

In addition to the normal growth environment, the difference in the mismatch of the Chinese and US cycles, especially the credit cycle, may be the main reason for explaining the deviation and continuous widening of the risk premium between China and the US since 2021. On the one hand, the expansion of credit in the United States partially offsets the suppression of risk premiums caused by monetary tightening. More importantly, the US government's continued "bottoming out" of the private sector is equivalent to extending US sovereign credit to the US stocks represented by the private sector, which may be the more important reason for the trend of lowering market risk premiums, even if interest rates rise sharply.

In contrast, the contraction of credit in China's private sector offsets the effect of monetary easing, and the abundant liquidity has not been effectively transformed into investment or consumption, which to some extent becomes the main constraint on economic recovery, thereby pushing up the market's risk premium.

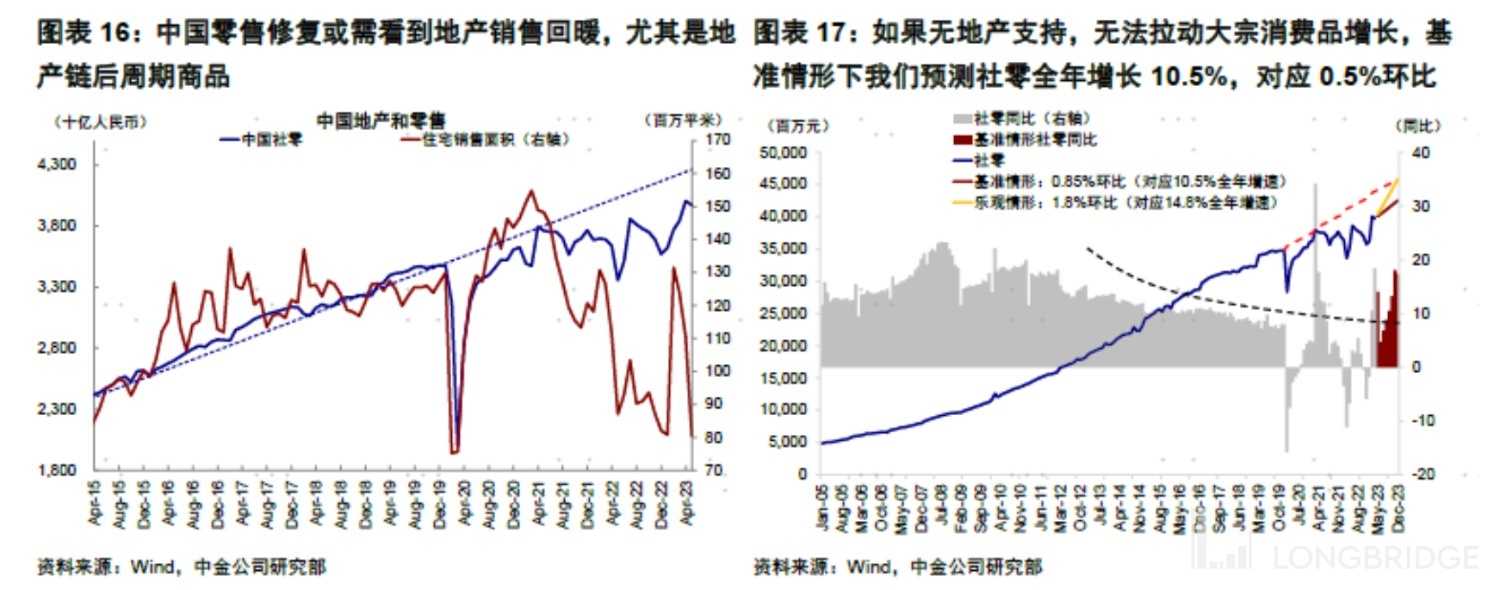

III. Macro Solutions and Ways Out for Risk Premiums in China and the United States: Credit Cycles, Monetary and Fiscal Policy Implications Differ

Subsequent tightening of credit in the United States will push up risk premiums, and government leverage will still help to partially suppress private sector premiums. However, this approach is still more beneficial to the US stock market itself, but if monetary easing is possible, it will be more beneficial to emerging markets including Hong Kong stocks.

In comparison, China's private sector credit cycle opening and direct government leverage will help to lower China's market risk premium. If it can happen, the current lower risk-free interest rates and higher risk premiums both mean that the market has greater room for rebound, otherwise 2019 will still be the benchmark scenario.