Big Moves | Alibaba Target Price Cut! JD.com, BYD Both Have at Least Doubled Potential?

However, Bank of America also expects that Alibaba's mainland retail GMV will recover to a year-on-year growth trajectory in this fiscal quarter, and revenue from managing Chinese retail business customers will also grow at a similar pace.

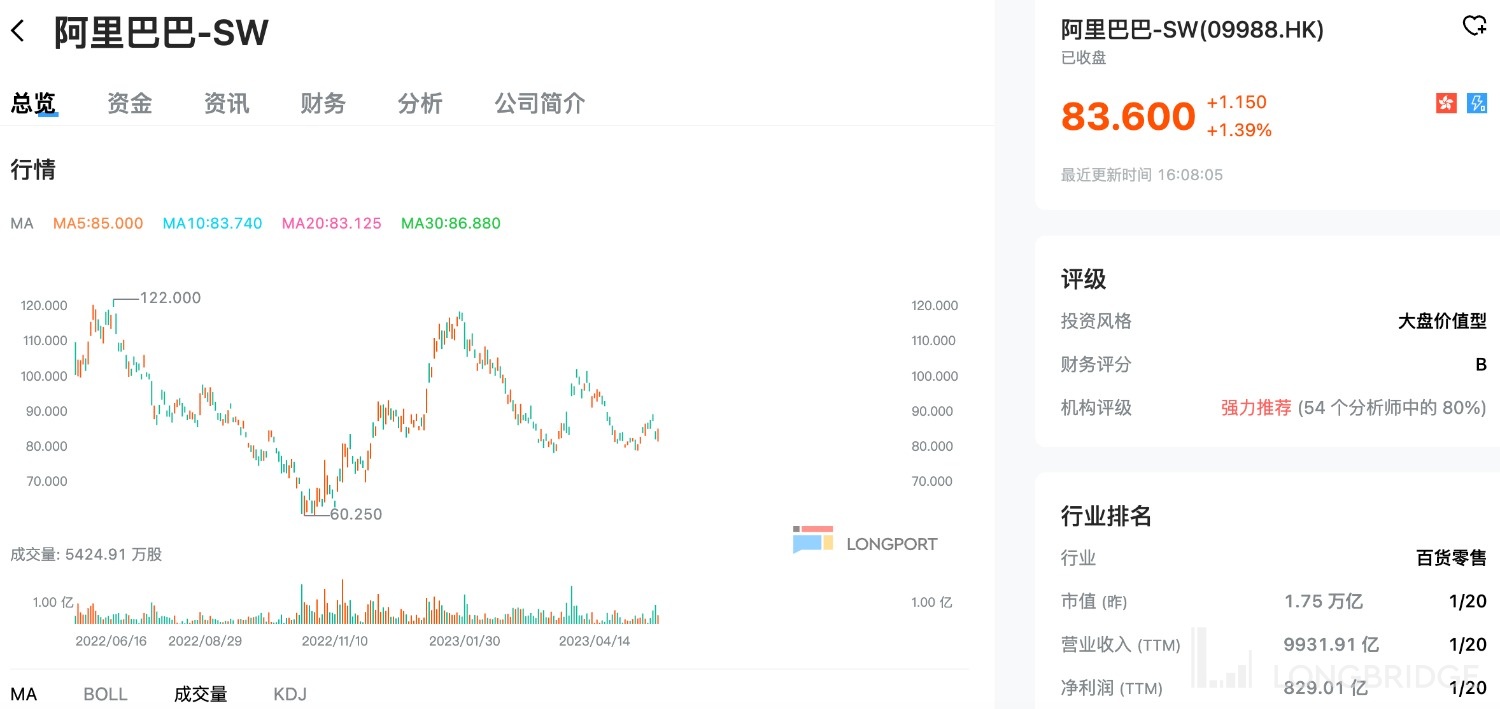

Bank of America: Reiterates "Buy" rating for BABA-SW, target price lowered by 8.5% to HKD 129 from HKD 141

If calculated based on the latest closing price of HKD 83.6, this price implies a 54% upside potential!

The bank has lowered its revenue forecast for Alibaba's fiscal year 2024-25 by 5%-6% to reflect a slight slowdown in consumer recovery and the trade-off made for better profit margins for non-core business units after restructuring.

According to the report, Alibaba's management remains positive about user and order growth in the first quarter ending in June. The bank expects Alibaba's mainland retail gross merchandise volume (GMV) to recover to a year-on-year positive growth trajectory in the current quarter, and China's retail commercial customer management (CMR) revenue to grow at a similar pace.

Credit Suisse: Initiates "Buy" rating for JD.com, target price HKD 379

If calculated based on the latest closing price of HKD 140.1, this price implies a 171% upside potential!

JD.com-SW management stated that the company's overall strategy, including the 3P ecosystem, penetration into lower-tier cities, product category expansion, and user base expansion, remains unchanged after organizational adjustments and changes in management.

The bank believes that the long-term trend of the company's online shopping is intact, and JD.com stands out in online shopping with its excellent consumer experience. The penetration rate of online shopping has continued to rise after the epidemic.

Citigroup: Initiates "Buy" rating for BYD, target price HKD 602

If calculated based on the latest closing price of HKD 252.2, this price implies a 139% upside potential!

The bank stated that considering that Longbridge Dolphin and Korean models under BYD accounted for 10% of the total sales volume in the first four months of this year, assuming that BYD's total sales volume for the next quarter is 630,000 vehicles, and the sales volume of Longbridge Dolphin and Korean models is 63,000 vehicles, and the average selling price of Longbridge Dolphin and Korean models is reduced by RMB 25,000, which will reduce the company's profit by RMB 1.575 billion.

The bank also pointed out that due to the decline in lithium battery costs, the net profit per vehicle will increase by RMB 6,000, which will bring a profit increase of RMB 3.78 billion. The comprehensive impact of the two is expected to increase the profit by RMB 2.205 billion, equivalent to an increase of RMB 3,500 in net profit per vehicle in the second quarter.

Credit Suisse: Maintains "Outperform" rating for KE Holdings, target price raised by HKD 9.5 to HKD 69 from HKD 63

If calculated based on the latest closing price of HKD 39.95, this price implies a 73% upside potential!

The bank stated that KE Holdings' guidance for the second quarter is RMB 1.85 billion to RMB 1.9 billion, higher than investors' expectations, mainly due to the stable number of existing home transactions in the first half of May, showing steady growth. The bank predicts that the transaction volume of existing and new houses will increase by 21% and 32% respectively.

The recent weak stock performance is mainly due to investors' concerns about the company's prospects in the second half of the year. The bank believes that the group is still in the early stage of the upward cycle, and the company will benefit from its market share increase and outperform the industry, and believes that the recovery trend is clear. The bank expects the company's adjusted net profit to reach RMB 8 billion this year, and believes that it can be sustained under stable market conditions after cost optimization.