Zhang Yidong: Short-term negative factors in Hong Kong stocks have been exhausted! "Bottom tug-of-war" may usher in a turning point for stage rebound.

Zhang Yidong also said that when the valuation returned to its historical low, the Hong Kong stock market was like a "wounded reed" and needed to find the stocks with the strongest vitality when rebounding against the wind. Among them, after the end of the G7 summit, the strongest headwind factor of Hong Kong's internet stocks has dissipated, and it is expected to usher in a rebound driven by short cover.

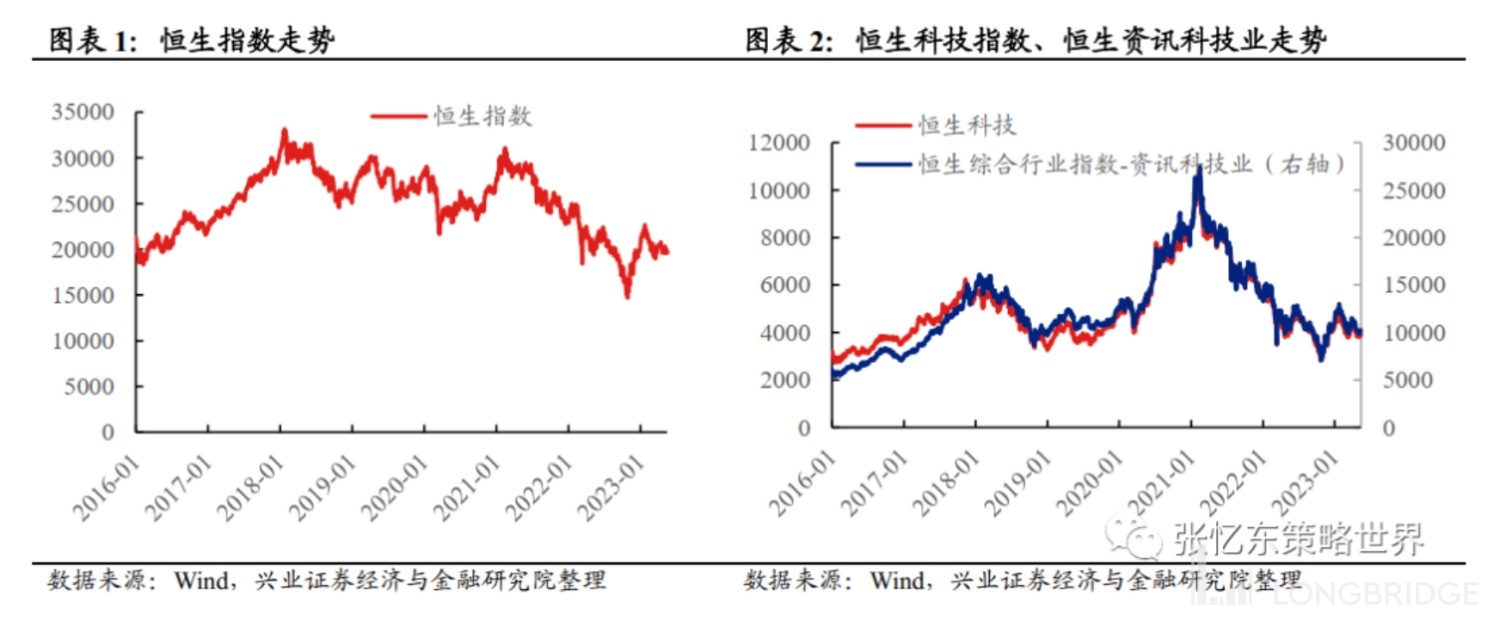

In February, there were geopolitical risks, in March, there were banking crises in Europe and America, and in April, heavyweight stocks such as TENCENT and Alibaba in Hong Kong stocks reduced their holdings... As of last Friday, compared with the end of January, the Hang Seng Index fell by 14.3%, and the Hang Seng TECH Index fell by 20.6%.

However, Zhang Yidong, the most accurate analyst of Hong Kong stocks and the global chief strategist of CICC, pointed out that the short-term bearishness of Hong Kong stocks has been exhausted, and the "bottom tug-of-war" may usher in a turning point of phased rebound. The reasons are:

Geopolitical aspect: Sino-US relations are expected to stabilize;

Hong Kong stock funds: The pressure of double impact of exchange rate and interest rate is expected to usher in marginal improvement;

Fundamental: The market is overly pessimistic about the recovery and underestimates the "economic transformation";

Other factors at the level of risk preference: The US debt ceiling X day (early June) is approaching, and the potential default risk of US bonds is approaching the end of the impact on the foreign exchange market and capital market.

Zhang Yidong believes that when the valuation returns to historical lows again, Hong Kong stocks, like "beaten reeds," need to find the stocks with the strongest vitality when they rebound against the wind.

Theme 1: Prepare for the rebound driven by short cover and focus on high-quality Internet leaders

Pay attention to the end of the G7 meeting, and the geopolitical risks may usher in a phased easing. The strongest counterwind factor of the heavyweight sector of Hong Kong stocks-the Internet market-is eliminated, and it is expected to usher in a rebound driven by short cover.

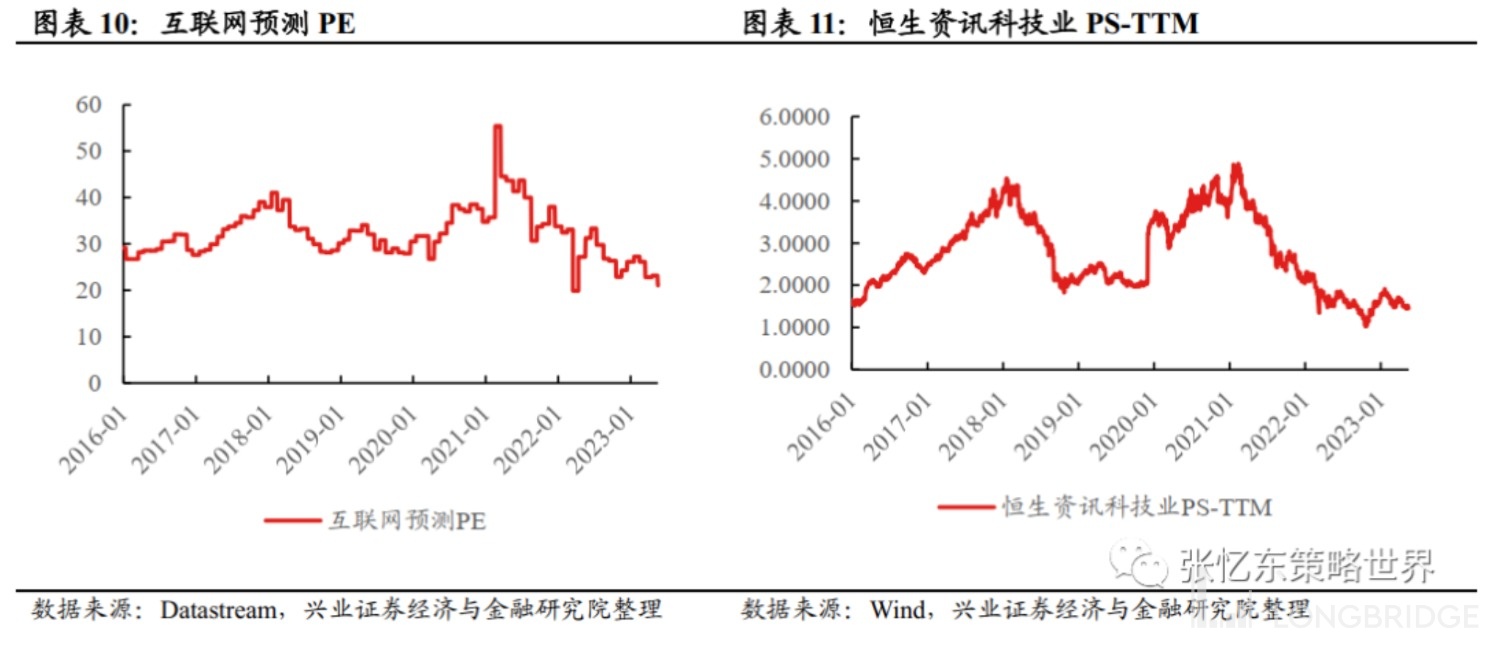

As the largest heavyweight sector representative index of Hong Kong stocks, the Internet sector's macro beta attribute continues to increase, and it can operate in waves based on variables that affect risk premiums. The current valuation has returned to a low point.

The potential pressure of major shareholders' reduction has been reduced. The overall growth expectation of the Internet sector is stable, and the continuous recovery of service consumption is expected to drive the improvement of the fundamentals. With the development of regulatory normalization, e-commerce off-platform, data security, and artificial intelligence, platforms are also actively adopting changes to adapt to the environment and business direction.

Theme 2: "Zhongtegu", but not all central SOEs are called "Zhongtegu"

Zhang Yidong pointed out that only high-quality companies that can sustain high dividends can continue to be revalued, and those with global competitiveness will inevitably be "rare and expensive".

The ability to sustain high dividends in Hong Kong stocks is the only truth, and it is recommended to lay out high-dividend value stocks with "convertible bonds" strategy. It is recommended to select high-quality central SOE leaders in the fields of telecommunications operators, energy (petroleum and petrochemicals, coal, etc.), real estate, utilities, finance, etc.

Main Line 3: Waiting for Policies to Expand Domestic Demand, Focusing on Consumer Recovery and New Infrastructure

Explore alpha opportunities in fields such as catering and tourism, food and beverage, medicine, and new energy, and adhere to long-term value.