Alibaba is reported to have laid off a large number of employees! Just because of the "removal of the middle platform" spin-off? No, the blame is on e-commerce!

Partnering with JD.com has become a quagmire, Alibaba's core e-commerce business may no longer be "core"! Traditional e-commerce is falling, while live-streaming e-commerce is thriving? The battle between ByteDance and KUAISHOU-W may have already been decided.

After the dust settled on the financial report and the split was confirmed, behind Alibaba's determination to continue reducing costs and increasing efficiency may be the downfall of traditional e-commerce.

Since yesterday, there have been rumors circulating on social media that Alibaba Cloud and Taobao Tmall are both undergoing large-scale layoffs.

Alibaba Cloud has responded that the company conducts normal organizational job and personnel optimization every year, and this personnel adjustment began in May after the year-end bonus was issued at the end of April. The overall optimization ratio is about 7%, and the compensation standard is N+1+1.

Other business groups have not yet responded to the layoff rumors.

It is worth noting that what the market did not expect seems to be only the extent of the layoffs in the rumors, not the layoffs themselves.

After all, under the background of Alibaba's split and the implementation of "1+6+N", Alibaba is "going to the middle platform", which means that the original large and medium-sized platforms are "thinning out". This move will inevitably be accompanied by "optimization" of labor costs.

However, in addition to the annual personnel adjustments and job changes brought about by the split, is there no other reason for Alibaba's large-scale layoffs?

Combining the rumors of a 25% layoff in Taobao Tmall's production and research department with the basic situation exposed by Alibaba's financial report, perhaps this is related to Alibaba and its core e-commerce business no longer being "core"!

Looking at Alibaba's financial reports in recent quarters, the core e-commerce profits and profit margins, including those in China and overseas, have generally shown a consistent downward trend. Looking at the year as a whole, the GMV (total merchandise transaction volume) of China's retail industry in the 2023 fiscal year has also declined compared to the previous two years.

Although the net profit is not bad, the decline in revenue from Alibaba's e-commerce business, especially its domestic e-commerce business in China, is an undeniable fact that drags down overall revenue.

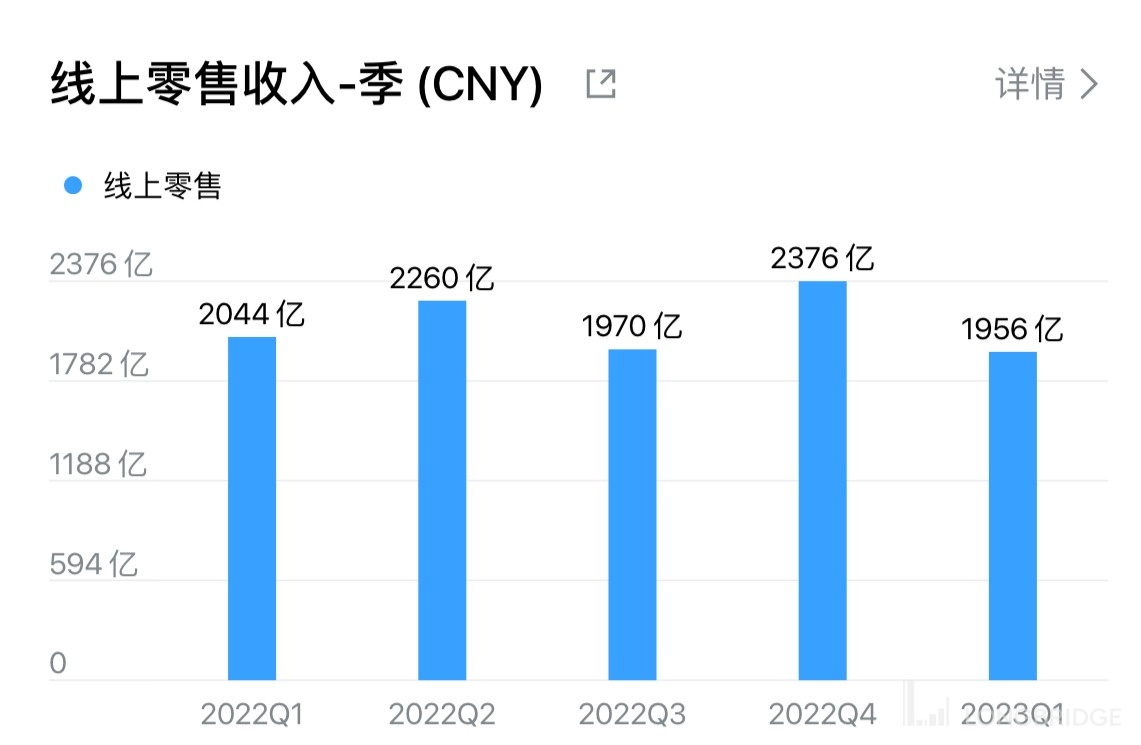

However, it should also be noted that traditional e-commerce companies that were once core businesses are not just Alibaba. JD.com is also in the same situation, with online retail revenue in the first quarter hitting a near-five-quarter low.

Traditional e-commerce falls, does it mean that live-streaming e-commerce is full?

Not necessarily. KUAISHOU-W e-commerce GMV also declined after high growth in the fourth quarter.

According to previous data from NetEase, the scale of China's live-streaming e-commerce market reached 3.5 trillion yuan in 2022, a year-on-year increase of 48.21%. Compared with the growth rates of 227.7% and 136.61% in 2019 and 2020, the growth rate has obviously declined significantly.

In this race, perhaps only ByteDance, the old rival of KUAISHOU-W, which has not yet gone public, still maintains explosive growth.

Wei Wenwen, the e-commerce president of ByteDance, revealed the latest data, showing that the year-on-year growth rate of GMV in the past year reached 80%. In contrast, KUAISHOU-W's e-commerce GMV only increased by 32.5% year-on-year in 2022.